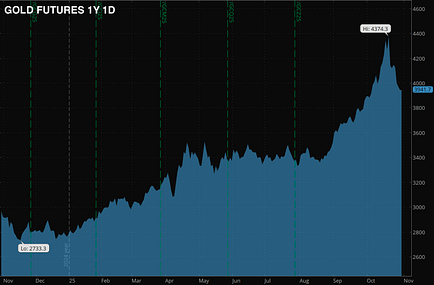

He Found $50K in Robinhood. I Down $56KSame gold trade, two different stories: One forgot he owned it, one can't forget he bought the topDown $56,000 on gold now. Gold’s at $3,960. Those calls everyone’s panicking about? Down to $46 from $83. And then I get this email from a subscriber over the weekend. Let’s call him Dave -- not his real name, obviously. I’m not putting anyone on blast here. Dave “found” $50,000 in his Robinhood account. Not like... found it on the street. Found it because he forgot he even bought those gold calls I recommended back in September 2024. Had 10 contracts at $5 each sitting there while he did his “real” trading in Think or Swim. Randomly checked Robinhood last week. Up fifty grand. Then -- here’s the part that kills me -- he “happened to look right before the dip and sold them.” At $83. The literal top. While eating lunch. Probably a sandwich. That’s when you know someone’s living right -- when they accidentally nail the perfect exit on positions they forgot existed. Meanwhile I’m watching every tick on gold like it’s going to change something. $3,952... $3,948... $3,955... As if my staring at the screen makes any difference. Here’s what actually matters though. Dave didn’t time that top because he’s some genius tracking every position in seventeen spreadsheets. He sold perfectly BECAUSE he forgot about it existed. Let it ride for months. Didn’t panic during the April Tariff Tantrum or the August chop. Just happened to check at exactly the right moment. Sometimes the best trading strategy is amnesia. Which I might need to implement ASAP because watching this thing tick by tick is making me insane. Speaking of insane -- the FT ran a story today where some executive literally called everyone who bought gold at $4,300 “lunatics.” Cool. Thanks for that. Now the World Gold Council thinks $3,500 would be “healthy” because it’s still “ridiculously high.” So I’ve got that to look forward to. Another $450 drop from here. But here’s the thing nobody’s talking about. Banks are still calling for $5,000 next year. HSBC, Bank of America, Société Générale -- all of them. The thesis hasn’t changed. U.S. debt’s still $35 trillion. Central banks are still buying. The dollar’s still a mess. What changed is everyone who bought at $4,300 is now puking their positions. Which means... what exactly? If you bought below $3,000, you’re still up huge. Hold it. If you bought at $4,398 like me, you’re learning an expensive lesson about chasing parabolic moves. If you’re thinking about buying now, maybe wait to see if we actually hit $3,500. Or do what Dave did. Buy it, forget about it, and accidentally sell the exact top because you happened to check your junk drawer account at the perfect moment. I’m not selling. Still holding my position. Still down $56,000. But I’m also not watching tick by tick anymore. That’s the new rule. Check it once a day. Maybe twice if something crazy happens. Because the only thing worse than losing $56,000 is losing your mind watching it happen in real-time. --Josh P.S. Those gold calls that were $83? Now $46. If you’re still holding, you’re up “only” 820% instead of 1,560%. I know it hurts watching profits evaporate, but you’re still up 8x. Dave’s completely out. You decide who’s smarter. P.P.S. The best part of Dave’s email? He mentioned he’s been crushing it on other trades too. Some people just have the magic touch. The rest of us stare at screens watching our losses compound. Disclaimer: Some of the links above are part of paid promotions. If you take action, we may earn a small commission. I only share stuff I believe is worth your attention. Josh Belanger's results are not typical and are not a guarantee of your success. Josh is an experienced investor and your results will vary depending on education, work experience, and background. Josh does not personally participate in every investment alert he provides. Due to sensitivity of financial information, we do not know or track the typical results of our students. Josh’ strategies may not always be accurate, and his investments may not always be profitable. They could result in a loss of an entire investment. We cannot guarantee that you will make money or that you will be successful if you employ his trading strategies specifically or generally. Consequently, your results may significantly vary from his. We do not give investment, tax, or other professional advice. Reference to specific securities should not be construed as a recommendation to buy, sell or hold that security. Specific securities are mentioned for informational purposes only. All investments involve risk, and the past performance of a security, industry, sector, market, financial product, investment strategy, or individual’s investment does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs. |

Rabu, 29 Oktober 2025

He Found $50K in Robinhood. I Down $56K

Langganan:

Posting Komentar (Atom)

Tidak ada komentar:

Posting Komentar