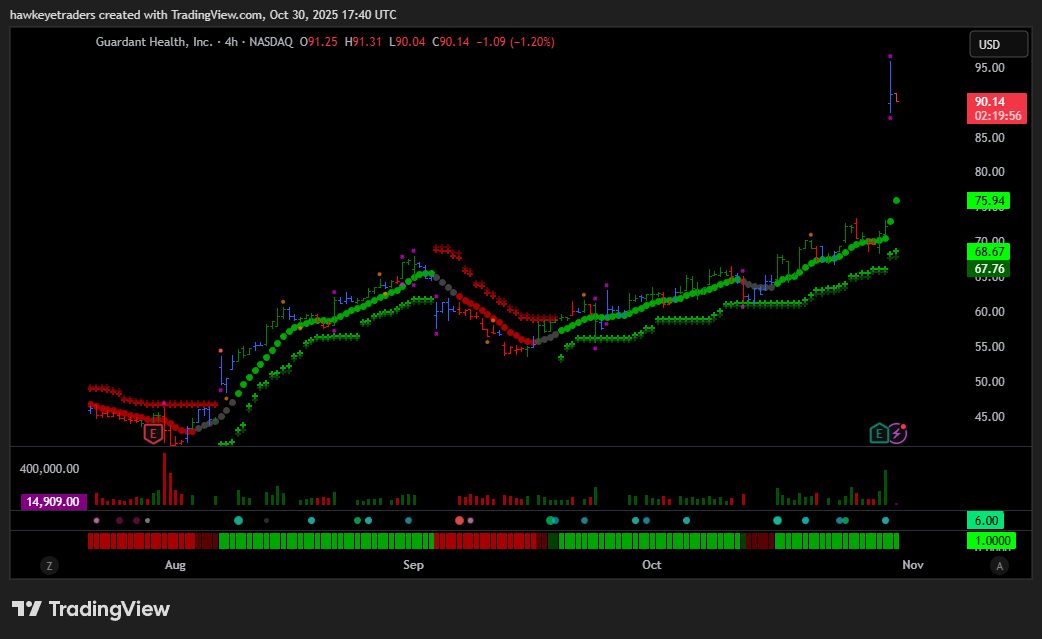

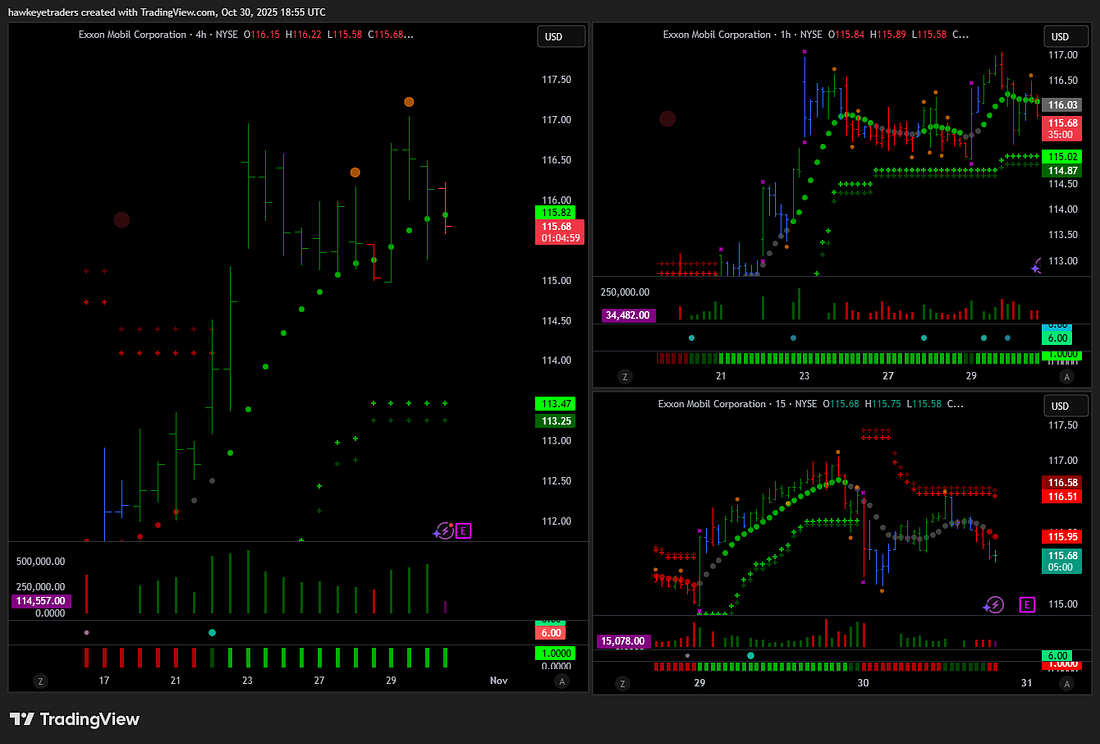

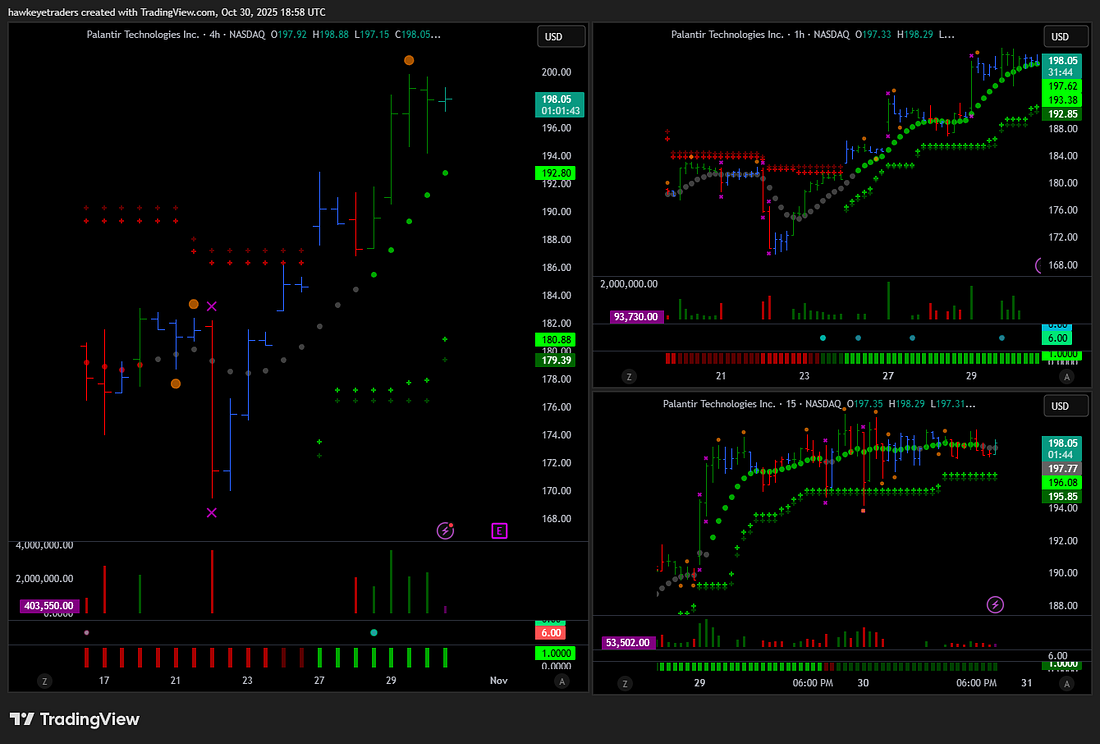

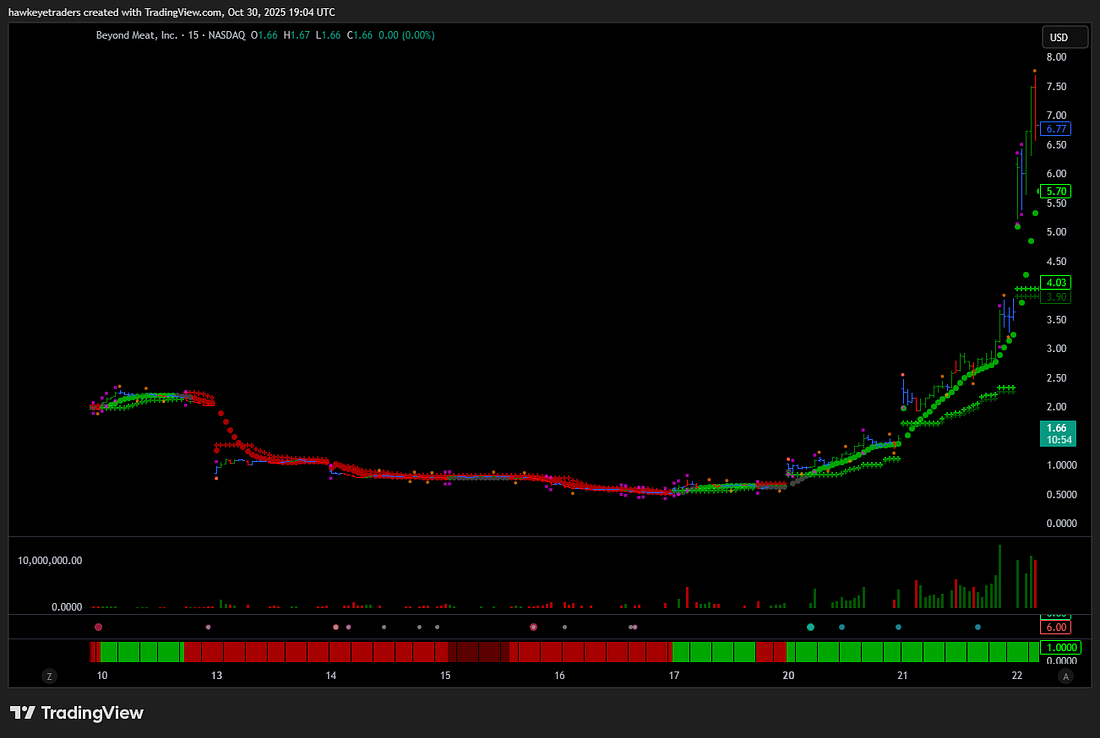

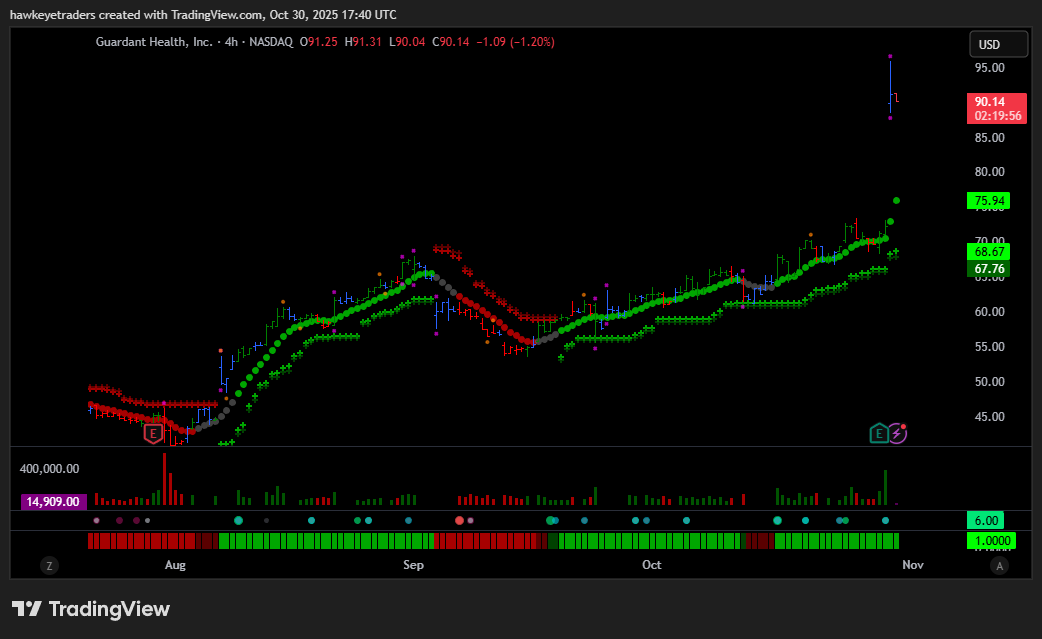

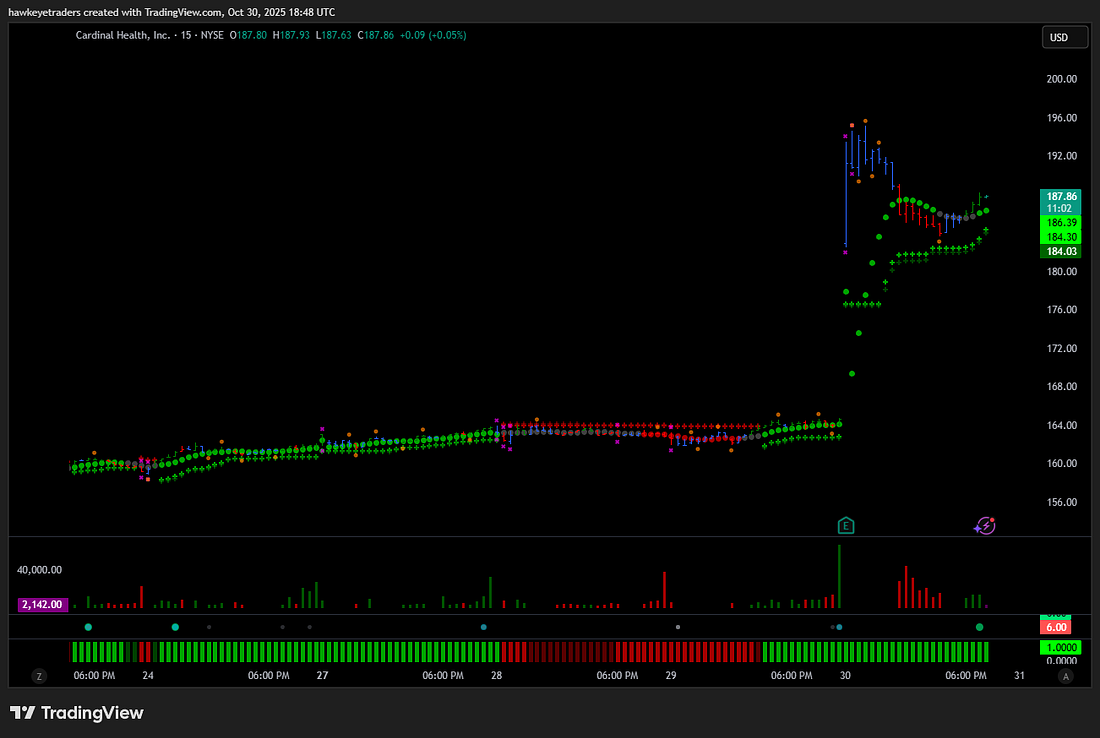

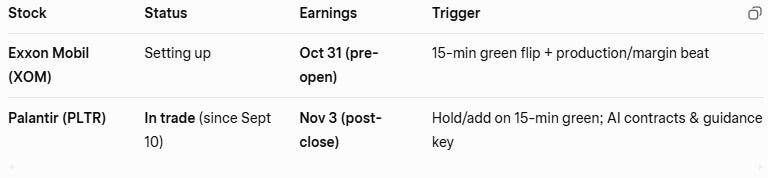

It’s that time again — earnings season — when stocks start popping off the screen as companies report results. Just today, Cardinal Health (CAH) and Guardant Health (GH) both exploded higher after releasing blowout numbers. CAH jumped from around $153 to $195 in a week. GH went from $70 to over $95 in a single session. Both had the same story: And we’re only partway through earnings season… there are still dozens of names yet to report. Stocks I am Looking At NowExxon Mobil (XOM) Exxon is setting up for a potential breakout. On the 1-hour and 4-hour charts, volume and trend are perfectly aligned, both confirming accumulation and strength. The shorter 15-minute chart hasn’t clicked in yet, but once it does, that could be my trigger to step in. Fundamentally, here’s what the market will be watching when Exxon reports on tomorrow: production strength, refining margins, and cost control. The company has been firing on all cylinders in high-return areas like the Permian Basin and Guyana, but falling oil prices could offset some of that production momentum. Analysts are also focused on refining performance, where improved margins could offset softer upstream results. Investors will want to see steady buybacks and dividends, plus commentary around Exxon’s role in the energy transition — carbon capture, hydrogen, and LNG are the buzzwords this quarter. Exxon remains one of the best-capitalized names in the sector, with strong free cash flow and a dependable dividend. What could move the stock meaningfully higher is execution: better-than-expected production, higher margins, or a more confident outlook. If we get that combination, and my shorter timeframe signals align, I’ll be ready to take it. Next up is… Palantir Technologies. We’re already in this trade — the first entry signal came back on September 10th, and it’s been trending well ever since. Palantir reports earnings on November 3rd, and volume remains strong across multiple timeframes. Depending on what the 15-minute chart shows on the day of earnings, I may look to add or take partial profits, but for now the setup still looks great. Palantir’s story is simple but powerful: it’s a company that helps governments and enterprises make sense of massive data sets. Their platforms — Gotham, Foundry, and AIP — are embedded in everything from defense systems to private-sector analytics. The fundamentals are solid. Last quarter, revenue grew 48% year-over-year to just over $1 billion, margins expanded, and profitability continued to improve. But the valuation is rich, and that’s where things get interesting — when expectations are high, the smallest surprise (good or bad) can move the stock fast. Heading into earnings, investors will be watching for major contract wins with U.S. and international agencies, continued commercial growth, and momentum in AI. They’ll also be looking for raised guidance and margin expansion to justify the premium. Right now, the chart is showing persistent buying pressure and trend confirmation across timeframes. If that continues through earnings, this could be one of the strongest momentum stories of the season. You can see the 15 minute chart just went from green to grey. This just means hold for those in that are in the trade. If we see this jump back to green it will be a good entry for new traders. These are the kinds of setups I love — where the technicals are already leaning bullish, and we just need the fundamentals to catch up. And lately, that pattern has been playing out again and again. Just this week, two of our recent positions did exactly that. When Fundamentals Don’t Matter — Beyond Meat (BYND)Not every big move needs good fundamentals behind it. Sometimes the story is pure sentiment — and the chart still tells it before it happens. Beyond Meat (BYND) was a perfect example. On October 20th, my indicators triggered a buy signal around $0.96 on the 15-minute chart. It lined up across the 1-hour and 4-hour timeframes, showing that something unusual was brewing under the surface. A few days later, the stock ripped higher — not because the company turned profitable or launched a breakthrough product, but because the crowd showed up. Retail traders piled in through options, call volumes spiked, and social chatter pushed it into “meme stock” territory again. Short interest was massive — roughly 80% of the free float — so when the price started to move, short covering added fuel to the fire. Even the media joined in, with Beyond Meat getting attention for being added to a meme-stock ETF. That kind of visibility draws in momentum traders, which creates the classic squeeze setup. None of it had anything to do with fundamentals. In fact, the fundamentals are still weak — falling revenue, continued losses, and dilution concerns. But that’s exactly the point. The chart told us the move was coming before anyone could explain it. This is why I always say: price and volume reveal intent long before the narrative catches up. Sometimes the fundamentals confirm the story — and sometimes, like in Beyond Meat’s case, they just get left behind. And one more — Guardant Health (GH)A few days later, we saw the same pattern in Guardant Health. Our indicators gave a buy signal on October 17th at $57.36, and the stock climbed gradually until earnings — then blasted from $70 to over $95 in a single session. The catalysts? Big ones. Once again, everything that the headlines celebrated was already visible in the chart. Volume was rising, trend structure was firm, and multiple timeframes were lined up days before the announcement. That’s the edge — seeing what the market’s preparing for, not what it’s already celebrating. That’s what I mean when I say I “spot” moves before they happen. Learning how to spot these setups early could make the next few weeks incredibly productive. Every trader has that moment where they see a stock explode higher and think, It’s that gut feeling — something subtle on the chart, a pickup in volume, price tightening up — and then a few days later, a headline hits and the stock goes vertical. I’ve learned not to ignore those moments. That’s usually the market tipping its hand. Over the years, I’ve refined a process to catch those setups — the kind that move before the crowd sees them — and I rely on a few tools that make it a lot easier to see what’s actually happening behind the scenes. But before we get to the tools, I want to explain the mindset. Most people believe fundamentals drive markets. And sure — earnings, drug approvals, new contracts — they all matter. But in my experience, fundamentals act more like catalysts than causes. They light the match, but the gas has already been leaking for days or weeks. The buildup — the real story — shows up first in price and volume. Staying in the MoveThe hardest part isn’t finding entries — it’s staying in them. That’s where trend confirmation comes in for me. I use a visual trend system that keeps me in trades longer than I’d probably stay on my own. It changes color as the trend evolves, and when the color holds steady, I do nothing. No second-guessing, no chasing headlines. When the signal shifts, that’s when I know it’s time to tighten up or step aside. A good example was Meta Platforms. Back in April, the chart flipped around $528 — right before it started that massive run toward $795. And again, the “news” came later. Strong earnings, AI expansion talk, the usual catalysts. But the technical picture had already revealed the intent. Another Perfect Example — Cardinal HealthJust last week we saw the same setup with Cardinal Health (CAH). What made that run even more interesting is that the fundamental catalyst came after the signal. Cardinal reported strong fiscal Q1 2026 earnings — revenue up about 22% year-over-year to $64 billion and non-GAAP EPS up 36% to $2.55 per share, well ahead of expectations. They also raised full-year guidance and announced the pending Solaris Health acquisition, both of which sent investors piling in. But for me, the most important part isn’t the headlines — it’s the timing. That’s the edge — seeing what the market’s preparing for, not what it’s already celebrating. Keeping It SimpleMy process is built on simplicity. I don’t chase stories or trade opinions — I trade behavior. Volume shows intent. Trend shows confirmation. The rest is just noise. When both line up, it’s like the market whispering its next move before anyone else hears it. We’re only halfway through earnings season, and there are plenty more names on deck. The trick is to be ready before the crowd — not reacting to headlines, but reading what’s already happening under the surface. The more I trade, the more I realize these so-called surprises aren’t really surprises at all. The market tells the truth early — you just have to know how to read it. I’ll be watching closely this week as more companies step up to report, and I’ll share updates and charts in my next post. If we get the same kind of alignment we saw in Cardinal, Guardant, and Meta, this could be another great stretch for traders who know where to look. Executive Summary: Earnings Season Momentum PlaysKey Theme: The market tips its hand in price and volume before earnings headlines hit. Fundamentals are catalysts — the real move builds in the charts days earlier. Proven Wins This Week

Live WatchlistCore Edge

Bottom LineEarnings season isn’t about reacting — it’s about being ready. The charts are whispering. Are you listening?... Continue reading this post for free in the Substack app |

Tidak ada komentar:

Posting Komentar