The Great Crypto Conspiracy: The $117 Trillion Trigger |

"The government is about to seize everyone's claims. Sell now or lose everything." |

It's 1876. |

You're standing in the muddy streets of Deadwood, Dakota Territory. |

The gold rush is at its peak. Miners are hitting new fortunes daily. But then whispers spread… |

"The government will seize your mine." |

Panic erupts. |

Prospectors flee, selling their land for pennies. |

What they don't know is that the whispers were planted. And the man who planted them: George Hearst, a ruthless tycoon who secretly bought the local newspapers. |

While fear gripped Deadwood, Hearst's agents scooped up the land. |

Hearst had masterminded one of the greatest swindles in American history. He got hundreds of small individual miners to sell their claims for peanuts. The mining claims they sold would become known as the Homestake Mine. |

The Homestake Mine would go on to become America's longest and richest gold mine. More than $100 billion worth of gold was pulled out of the Homestake Mine… All while the original miners walked away penniless. |

George Hearst's business interests went on to become known as Hearst Publishing. At his death in 1951, Hearst was worth over $200 million. Last year, Hearst Publishing generated $13 billion in revenue. |

Our best guess is Hearst Publishing may have generated as much as $300 billion in value since George Hearst swindled those poor miners in 1876. |

Hearst laid down the playbook for how to make truly epic wealth: Through fear and manipulation. |

And the exact same playbook is being used against you today. |

How I Unmasked "The Great Crypto Conspiracy" |

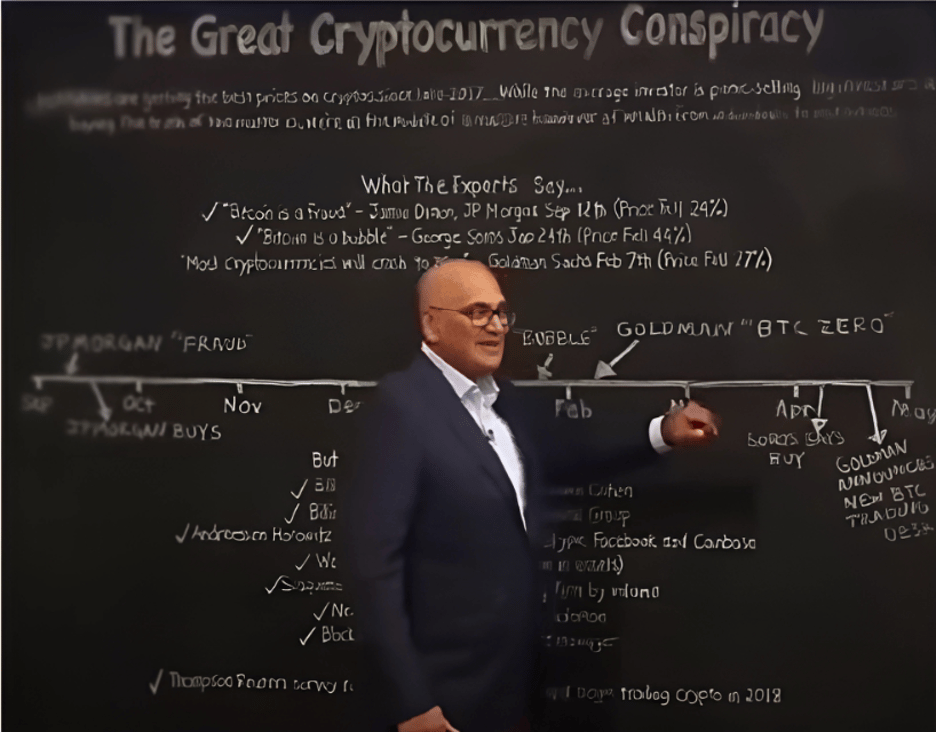

Back in 2018 (when bitcoin was around $8,000), I told my readers about what I called The Great Crypto Conspiracy. |

I held a special briefing with media personality Glenn Beck and warned everyone that Wall Street was working to scare the public out of crypto, crush prices, and accumulate the best asset man has ever created at fire-sale prices. |

| Teeka warning about the Great Crypto Conspiracy during a special briefing in 2018 |

|

Here's what I said back then: |

All year long, we've been under assault by rumors of central bank collusion against cryptos. Threats of bans. Endless investigations… and the ceaseless drumbeat of negativity from the traditional press. And yet – amid this shower of negative news – careful observers will have noticed institutions are actually running into crypto investments. Today, I'm seeing banks, regulators, and the press drown the market in negative news. They're using the same old trick Hearst used to scare speculators so he could scoop up [mines] for pennies. |

|

|

I also predicted the same powerful insiders who mocked bitcoin would one day build the rails to control it. |

Most people didn't believe me then. But today, it's undeniable. |

150 Years Later – The Same Scam |

Today's "Homestake Mine" is bitcoin. |

And the new George Hearsts? The Jamie Dimons, Larry Finks, Ray Dalios, and Mark Cubans of the world. |

These men have spent the past decade scaring you away from bitcoin – while quietly positioning themselves to control it. |

Dimon, the CEO of JPMorgan Chase, is one of the chief villains. In 2017, he infamously declared "bitcoin is a fraud" and threatened to fire any employee caught trading it. |

The media parroted his every word, driving fear deep into the hearts of everyday investors. |

And while you were selling? Dimon was quietly building JPMorgan into a crypto empire. |

Today, the bank processes $10 trillion in transactions every single day. Imagine when even a fraction of that can flow into crypto rails. |

And that's exactly what Dimon has been planning all along. |

Since his infamous "bitcoin is a fraud" comments, JPMorgan Chase has developed JPM Coin, its own internal settlement coin. |

It's been building custody services for hedge funds and positioning itself as the ultimate gateway to the crypto economy. |

And now? |

Dimon has dropped the mask with a historic partnership with Coinbase that will open the largest bitcoin onramp in history. |

I'll get to that partnership in a moment. But before I do, let me unmask some of the other conspirators. |

Larry Fink: The Puppet Master of Wall Street |

Larry Fink, CEO of BlackRock – the world's largest asset manager with $10 trillion in assets under management – played the same game. |

Back in 2017, he mocked bitcoin as "an index of money laundering." He also predicted governments would shut down bitcoin. |

But while those words were amplified by CNBC and Bloomberg, Fink was quietly preparing BlackRock to dominate crypto. |

BlackRock now manages the largest bitcoin exchange-traded fund (ETF) in the world with net assets of about $86.1 billion. |

Just consider this… |

BlackRock's iShares Bitcoin Trust ETF (IBIT) launched in January 2024. And it already ranks among the Top 25 ETFs in the world by assets under management. |

It's so successful that in 18 months, it makes more money for BlackRock than its 25-year-old S&P 500 fund. |

Fink, who once dismissed bitcoin as worthless, now calls it "digital gold" and predicts trillions will flood into crypto. |

There's more… |

Just last month, JPMorgan announced it would allow its clients to use crypto-related assets as collateral for loans. And it will start with BlackRock's bitcoin ETF. |

Ray Dalio and Mark Cuban: The Opportunists |

Hedge fund billionaire Ray Dalio once said: "If bitcoin ever becomes a real threat, governments will ban it." |

But he was quietly buying. Today, Dalio admits he owns bitcoin and calls it a "digital alternative to gold." |

Mark Cuban, the celebrity billionaire, once scoffed: "I'd rather own bananas than bitcoin." |

That quote went viral, convincing many retail investors to stay out of crypto. |

Now? |

Cuban is heavily invested in decentralized finance (DeFi) protocols and non-fungible tokens (NFTs) – the very sectors he once mocked. |

The Coinbase-JPMorgan Bombshell: The Largest Crypto Onramp in History |

Now these men – and the institutions they control – are ready to cash in. |

And one of them dropped a bombshell announcement on Wednesday. |

JPMorgan Chase has partnered with Coinbase to allow customers to fund their crypto wallets using its Chase credit cards and buy crypto on the exchange. |

Starting in fall 2025, the partnership will create the largest onramp to crypto ever built. |

Consider this… |

Chase has 80 million retail customers. Every one of them will soon be able to buy crypto directly from their banking app with one click. Credit card rewards can be instantly converted into crypto – an incentive that could trigger billions in inflows. And Coinbase, with 110 million verified users worldwide, will see its wallet technology directly embedded into Chase's banking ecosystem.

|

Friends, this is the single biggest floodgate to ever open for the crypto market. |

And here's what it means… |

If just 5% of Chase's 80 million customers use these new embedded onramps to invest $1,000 each… That's $4 billion in inflows – before the copycat effect from Citi, Bank of America, Wells Fargo, and others even begins. |

The $117 Trillion Trigger |

The Coinbase-JPMorgan deal is just the ignition switch. The true price detonation lies in the GENIUS Act, which was signed into law earlier this month. |

As I've written over the past two weeks, this new law gives stablecoins – cryptocurrencies pegged to the U.S. dollar – direct access to the $117 trillion global bank deposit market. |

That's $117 trillion sitting in traditional banks… now able to flow directly into the crypto economy. |

And once that flood begins, the market will be permanently repriced higher. |

This wasn't just some random act. |

On the same day JPMorgan and Coinbase announced their partnership, the White House released its Crypto Policy Report. It's the culmination of months of behind-the-scenes work by a presidential task force. |

The report is crystal clear… |

Banks are now formally encouraged to integrate stablecoins and other digital assets into their operations. |

A framework for using stablecoins as the backbone of the U.S. payments system is being implemented. |

This is not Washington trying to kill crypto. |

This is Washington giving the green light for trillions of dollars to flow into the system – through the very rails controlled by JPMorgan, BlackRock, and their billionaire peers. |

The Trojan Horse: Stablecoins |

While the public obsessed over bitcoin's volatility, stablecoins quietly became a payments juggernaut. |

They're cryptocurrencies pegged to real-world assets, usually the U.S. dollar, and they rarely deviate from their $1 price point. |

In the second quarter of 2024 alone, stablecoins processed $8.5 trillion in transactions. That's more than double what Visa handled in the same period. |

And now, thanks to the GENIUS Act and White House policy, stablecoins are plugged directly into the global banking system. |

That's why I have been pounding the table on a handful of small, overlooked crypto projects that power the stablecoin ecosystem. |

I recently held a special briefing where I revealed: |

The exact clause in the GENIUS Act that triggers the $117 trillion capital flood. My six top plays – including one company I believe will be the primary gateway between Wall Street and crypto. Plus, a free coin recommendation I believe could rocket from this trend.

|

Click here now to stream the briefing before it's removed. |

Friends, you have a chance to position yourself before the floodgates open. |

Because once tens of millions of Americans rush in through the Chase app, it will be too late. |

This Is Your Moment |

Back in 2018, I warned you against falling victim to the Great Crypto Conspiracy. Now, that warning is playing out exactly as I predicted. |

The villains have already made their moves. |

Now it's your turn. |

Go here before the $117 trillion wave hits. |

This is your chance to flip the script – and be on the right side of the greatest wealth transfer in history. |

Let the Game Come to You! |

Big T |

|

|

|

Tidak ada komentar:

Posting Komentar