Why Wall Street’s “Safe Income” Is Draining Your Nest EggThe “High Yield” Scam Costing Retirees EverythingHe looked at me like I’d just offered him a free lunch. We were halfway through our Trading Club session today when one of my sharpest students—the kind who actually reads the fine print—hit me with this:

Now, I love a skeptic. Especially one who’s been burned before. So I did what any honest trader would do. I tossed the question right back:

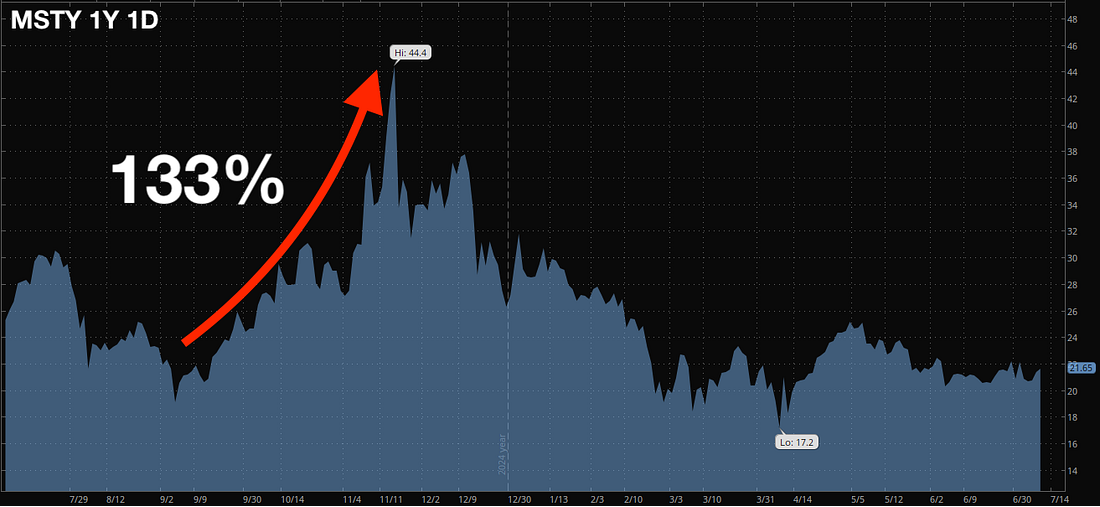

That made him pause. The way most do when Wall Street flashes a fat yield in their face. Because let’s be honest—income is what the Street loves to sell you. It’s the lure, the sizzle, the thing that sounds “safe” while the big boys keep the real action for themselves. But he answered right. Growth. Good. Because the reality? When Wall Street starts handing out gifts, check your wallet. Someone’s paying the tab—and it’s not the guys in pinstripes. The Bait and SwitchHere’s what Wall Street doesn’t spell out on the label: Buying stock just to “sell calls” (collect premium and trade upside for a few extra bucks) isn’t a free-money move. It’s like trading your winning lottery ticket for a coupon at the deli. You’re still taking all the principal risk—meaning, if the stock drops, you’re on the hook. But you cap your upside, tie up a pile of capital, and what do you get? A little pocket change if everything goes right. Options were built for capital efficiency and flexibility. Owning shares is a growth bet. You want to own the story. So why limit your upside if you think you’re holding a winner? To prove it, we pulled up the latest poster child for these “income” funds—the YieldMax™ MSTR Option Income ETF (MSTY). This ETF makes its “income” by selling call options on MicroStrategy (MSTR), which is really just a Bitcoin proxy. So, I asked him again: If you want to own Bitcoin, are you looking for growth or for income? You want monster growth. That’s the whole point. Wall Street’s Dirty Little SecretI pulled up a simple chart. Between September and late November last year, Bitcoin gained 74%. Now look at MSTR, the underlying stock. Up 312% in the same stretch. That’s the kind of move you dream about if you’re a growth investor. So, what happened if you tried to “collect income” by buying MSTY instead? You made a fraction of that. In fact, since those highs, MSTR is down about 10%… but MSTY? It’s down 51%. Fifty-one percent. That’s the kind of loss that sends most folks reaching for the Tums. Read that again. You gave up the upside, still took all the downside risk, and now your “income” ETF is down five times as much as the stock itself. That’s the kind of math that sends average investors to the poorhouse. But it’s worse than just “underperforming.” As the Wall Street Journal just reported, most of these high-yield ETFs lag their stocks by 50, 100, even 200 points since inception. Sometimes they lose just as much as the stock—minus the growth. And often, the yield you’re “earning” is just your own principal coming back to you in dribs and drabs. It’s not return on your money. It’s the slow return of your money. The Big TakeawayHere’s the difference no one on CNBC will say out loud:

You sell your potential for a little bit of short-term cash flow. But when the market turns, you get left holding the bag. Wall Street pockets the fees, and you wonder where your nest egg went. You want income? There are ways to do it right—ways I teach inside my Trading Club. But don’t fall for Wall Street’s shell game. These yield ETFs look good on the label, but they drain you slow—until you’re left wondering where the money went. So next time you spot a “100% yield” headline, hit the brakes and ask yourself:Am I getting paid, or just getting played? Keep your eyes open. Always know what you’re risking. And if you’re not sure, I'm here to help you win—not to watch you get fleeced. Don’t let Wall Street talk you into settling for crumbs. Trade smart. Until tomorrow, Josh Belanger Disclaimer: Some of the links above are part of paid promotions. If you take action, we may earn a small commission. I only share stuff I believe is worth your attention. Josh Belanger's results are not typical and are not a guarantee of your success. Josh is an experienced investor and your results will vary depending on education, work experience, and background. Josh does not personally participate in every investment alert he provides. Due to sensitivity of financial information, we do not know or track the typical results of our students. Josh’ strategies may not always be accurate, and his investments may not always be profitable. They could result in a loss of an entire investment. We cannot guarantee that you will make money or that you will be successful if you employ his trading strategies specifically or generally. Consequently, your results may significantly vary from his. We do not give investment, tax, or other professional advice. Reference to specific securities should not be construed as a recommendation to buy, sell or hold that security. Specific securities are mentioned for informational purposes only. All investments involve risk, and the past performance of a security, industry, sector, market, financial product, investment strategy, or individual’s investment does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs. |

Kamis, 10 Juli 2025

Why Wall Street’s “Safe Income” Is Draining Your Nest Egg

Langganan:

Posting Komentar (Atom)

Tidak ada komentar:

Posting Komentar