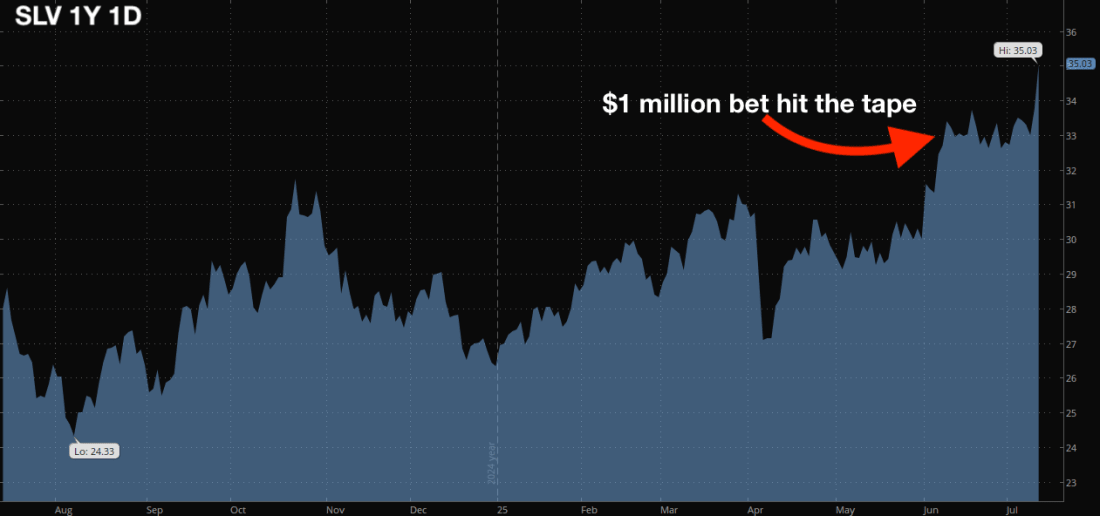

Who Really Made the Money on Silver’s Surge?How Smart Money Nailed the Move While the Crowd Chased the HypeFriday, 3:59 p.m. My screen flashes: SLV at $35.03. Not a bad way to close the week — unless you’re the guy who chased, not the one who got in early. Let’s go back to early June. Silver was getting all the loud headlines. You had the Reddit crew chanting “$50 silver!” and posting memes. But Wall Street? The real money? Most were still shrugging it off. I wrote you then because I saw something different. Not just the hype — but a real trade, with heavy capital behind it. A nearly $1 million bet hit the tape, targeting $35 by July. That wasn’t small potatoes. That was conviction. And it changed the game for anyone paying attention. The Setup Most Missed Right after my essay hit, SLV jumped 3%. Victory laps everywhere. But silver doesn’t just go up — it’s a whipsaw market. It punishes late money — and sure enough, it dropped right back to $32 on June 24. If you bought the hype, you got a gut punch. If you followed the money, you got paid. Who Really Made the Money? This is where most folks miss out. Sure, buying SLV shares made you a little money. But the real payday? That was the option trade I teased for my Hot Money Trader readers. That single trade hit a peak profit of 120% by Friday’s close. That’s why we trade options. Because in a whipsaw market like silver, it’s not about holding for dear life — it’s about spotting the setup, pulling the trigger, and taking your money off the table before the crowd catches on. Silver: The Wildest Ride in the Room Here’s the hard truth. Silver’s not a steady climb. It rips, it whipsaws, it fakes out the latecomers — and it only rewards the patient or the prepared. That’s why when you see big options trades hit the tape, you pay attention. Wall Street doesn’t show its hand by accident. What I’m Seeing Now Right now, I’m still spotting bullish options in SLV out to August. But let’s get real — the bets aren’t as bold as before. The smart money is playing for a move, but they’re not swinging for the fences. That’s the clue you need: The pros are tightening up. They’re not betting on a moonshot. They’re playing the wave, and ready to bail when it breaks. Here’s the Lesson Most Ignore Making money isn’t about running with the loudest crowd. It’s about buying right — and selling when there’s still a line at the door. If you’re in this silver trade? Don’t get greedy. You’ve seen what silver can do when the hype runs hot. Take profits, stay patient, and let the late money chase the next headline. You already know how to spot the footprints. That’s your edge. Keep this lesson in your back pocket: The crowd chases headlines. Smart money follows the footprints — and cashes out while the noise is still building. Watch SLV. If the options action heats up, I’ll let you know. But for now? Don’t fall for the moon talk. Buy right. Trade smart. Take your money before the crowd wakes up. Until tomorrow, Josh Belanger Disclaimer: Some of the links above are part of paid promotions. If you take action, we may earn a small commission. I only share stuff I believe is worth your attention. Josh Belanger's results are not typical and are not a guarantee of your success. Josh is an experienced investor and your results will vary depending on education, work experience, and background. Josh does not personally participate in every investment alert he provides. Due to sensitivity of financial information, we do not know or track the typical results of our students. Josh’ strategies may not always be accurate, and his investments may not always be profitable. They could result in a loss of an entire investment. We cannot guarantee that you will make money or that you will be successful if you employ his trading strategies specifically or generally. Consequently, your results may significantly vary from his. We do not give investment, tax, or other professional advice. Reference to specific securities should not be construed as a recommendation to buy, sell or hold that security. Specific securities are mentioned for informational purposes only. All investments involve risk, and the past performance of a security, industry, sector, market, financial product, investment strategy, or individual’s investment does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs. |

Minggu, 13 Juli 2025

Who Really Made the Money on Silver’s Surge?

Langganan:

Posting Komentar (Atom)

Tidak ada komentar:

Posting Komentar