How Small-Cap ETFs Are Rigged Against Investors  | | Robert Ross

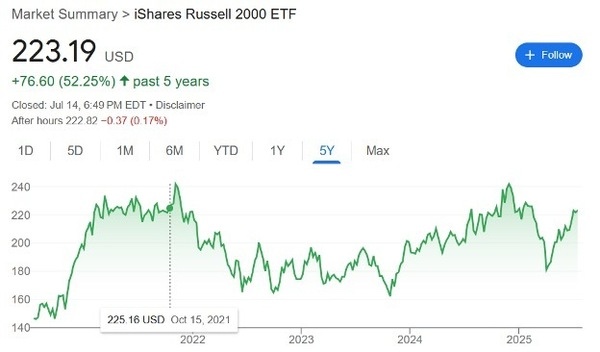

Speculative Assets Specialist | Wall Street is gearing up for what I call the Stimulus Wave - a multitrillion-dollar surge in spending that's already pushing risk assets higher. It's coming from every direction: tax cuts, deficit-funded growth, deregulation, and even stealth money-printing through Treasury buybacks. And while megacap tech stocks like Nvidia (NVDA) and high-quality crypto assets like Bitcoin (BTC) have certainly benefited from this liquidity tide, it's actually small caps that stand to gain the most. That's because small-cap stocks are typically more domestically focused, more sensitive to interest rates, and more directly tied to government stimulus. They also tend to rally hardest when investors shift from defense to offense - exactly what's happening right now. But there's a problem... You can't just buy a small-cap ETF and expect to catch this move. In fact, most investors who go that route are almost guaranteed to miss the best-performing names. Why Small-Cap ETFs Work Against You The difference between small-cap and large-cap ETFs is more than just market size - it's structural. When a stock in the S&P 500 performs well, it simply gets a higher weighting in the index. So when Apple (AAPL) or Nvidia (NVDA) goes up, S&P 500 investors benefit. But in small-cap indexes like the Russell 2000, the best-performing stocks get kicked out of the index entirely. Once a company gets "too big," it graduates to mid- or large-cap indexes and is removed from the small-cap ETF. That means if you own a fund like the iShares Russell 2000 ETF (IWM), guess what? You're constantly holding a rotating group of underperformers while the winners move on to other indexes - and other investors. This is why you always see headlines about small caps "being flat for five years." If the main indexes kicked out the best stocks, I'd bet my bottom dollar they'd be flat over the same period too.

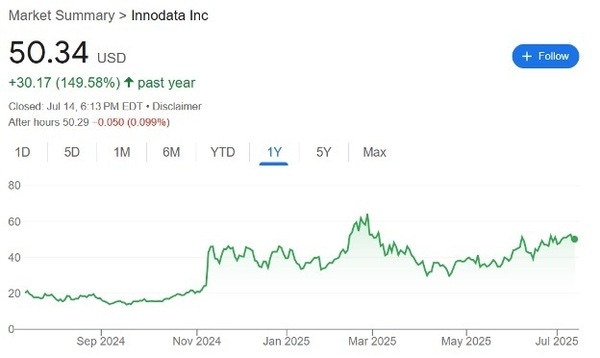

View larger image That's why targeted selection matters more than ever when it comes to small-cap investing. You need to know which names have breakout potential before they hit the headlines... and before they leave the index behind entirely. The Small-Cap Comeback Is Already Here We're already seeing this play out with incredible force across several high-conviction narratives. Let's start with artificial intelligence... Innodata (INOD), a holding in my Breakout Fortunes trading service, has surged from $17.50 to over $50 in the past year - a gain of more than 185%. The company is helping AI models like ChatGPT get smarter by refining the data they're trained on.

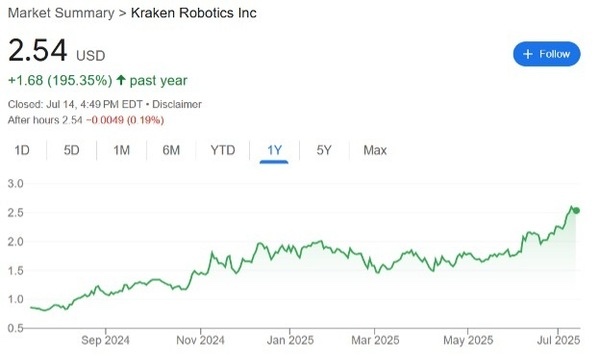

View larger image Then there's the resurgence in defense and underwater robotics... Our position in Kraken Robotics (KRKNF) has more than doubled, moving from $1.06 to $2.54 as global militaries race to modernize. With tensions rising and marine tech gaining funding, it's a perfect example of a small-cap narrative meeting strong fundamentals.

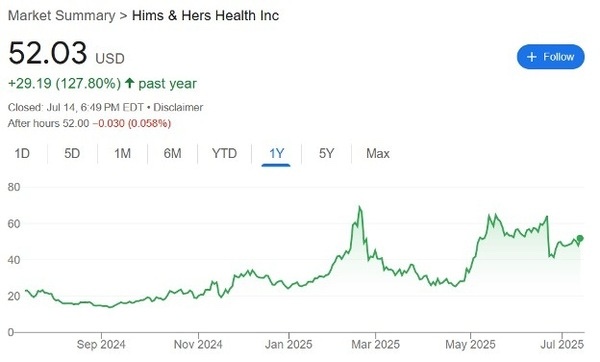

View larger image And of course, we can't forget the booming healthcare trade. Hims & Hers Health (HIMS) has exploded from $23 to $64 over the past year, fueled by direct-to-consumer prescriptions and the GLP-1 boom.

View larger image All of these stocks had two things in common: - They were small caps completely off the radar of mainstream investors.

- They had powerful tailwinds from macro narratives - AI, defense, and healthcare disruption.

These weren't lucky guesses. They were early entries into themes with room to run, identified before they became household names. Our Next Play? Think Axon... But Smaller You might've heard of Axon Enterprise (AXON). It makes Tasers and police body cams - and it's one of the most successful small-to-mid-cap stories of the past decade. Since 2019, Axon is up more than 700%, transforming from a niche defense tech play into a mainstream stock now held in major ETFs. Well, our latest small-cap recommendation reminds me a lot of Axon five years ago.

View larger image It sits at the intersection of two major macro themes - ones being backed by billions in stimulus - and it's trading at a valuation that still offers huge upside. Like Axon in its early days, this company is riding the wave of federal tailwinds, growing contracts, and a category-defining product. But here's the catch... Just like with Axon, the window to get in before institutional money piles in won't stay open for long. So, if you're serious about profiting from the next chapter of this small-cap bull market - the one most people will miss - you'll want to seek out opportunities like the ones I've mentioned here. Because with the stimulus wave building and capital rotating into underappreciated corners of the market... The small-cap breakout is just getting started. Stay safe out there, Robert Want more content like this? | | | | | |

Tidak ada komentar:

Posting Komentar