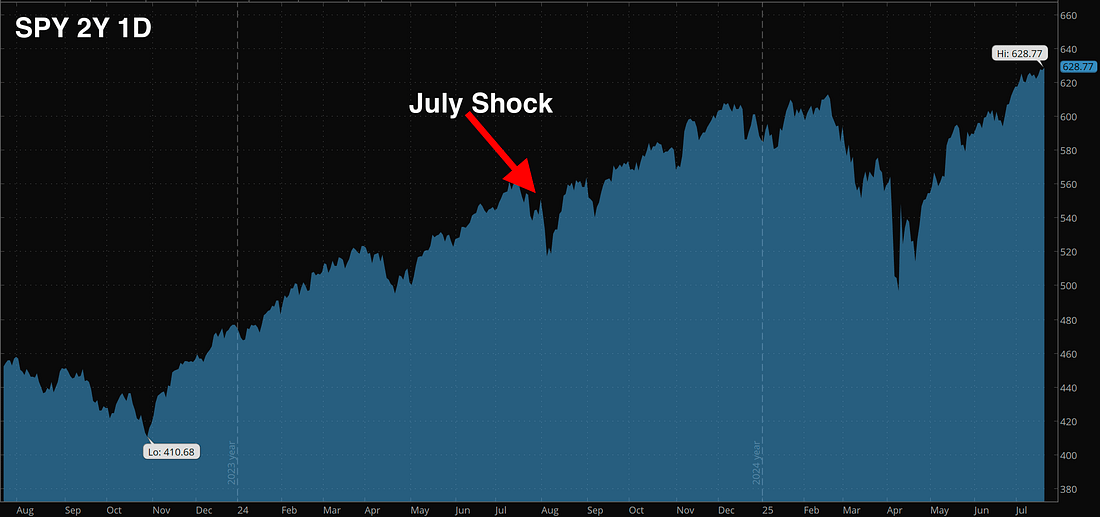

Wall Street’s About to Pull the Rug Again—Are You Ready?It happened last July—the S&P 500 tumbled ten percent in days. I’m seeing the same cracks right now.Stocks just hit a new high. And that’s the first warning. Last July, I was standing in line at a barbecue joint. The young guy behind me was ranting about how the market was finally back. “S&P just hit a new high,” he told his buddy. “No way it pulls back now.” I bit my tongue. Two days later, the S&P dropped ten percent. That was July 2024. And if you’re paying attention right now, you’ll notice we’re walking into the same setup. It Always Starts the Same Way Friday was July options expiration. That’s when trillions in protection roll off. Market makers unwind. The crowd breathes easy. Prices float higher on forced buying. That’s exactly what just happened. The S&P ripped to a new high at 6,315.61—and carried that strength into this morning. But here’s what they won’t tell you on CNBC: This is where the cracks start to form. We saw it last year. We saw it in 2022. We saw it in 2015. Late July pops… lead to early August drops. Because once the hedges are gone, the market’s naked. And when volume dries up in August? There’s no one there to catch the fall. The Pattern Most Investors Miss Over the last five years, August has averaged just 1.23% gains—even including last year’s late rally. Without that snapback, it would’ve joined September in the red. Because September is brutal—the worst month for stocks going back a hundred years. But August is the setup. It’s when the air starts thinning. The smart money steps back. And the crowd starts taking victory laps. That’s when the market is most vulnerable. Right now, I’m watching the same things I saw last summer:

But here’s what most folks miss: It’s not the drop that hurts—it’s being unprepared for it. Because when stocks start slipping, fear takes over. And the average investor reacts emotionally. They sell good names. Dump strong positions. Miss the rebound. That’s exactly what the pros want. They’re not scared. They’re shopping. While the crowd panics, the sharp money loads up. This Isn’t Panic Time. It’s Prep Time. I’m not calling for a crash. But I am calling for a pullback—likely 2 to 5%. And if you’re ready for it? It could be the best setup you’ll see this quarter. Last time this window opened, we watched traders pile into upside calls on the S&P 500. That wasn’t just a bet. It helped fuel an historic 31% rally off the April lows. And you better believe — when Wall Street finds a winning trade, they don’t walk away. They go back like it’s a jackpot machine that won’t stop paying out. You don’t need to guess the top. Just recognize the window we’re in. The herd is still celebrating. But if you’ve seen this game before, you know what comes next. Watch for the fade. Get your watchlist ready. And when the snap hits—be the one buying, not bailing. Trade smart. Until tomorrow, Josh Belanger Disclaimer: Some of the links above are part of paid promotions. If you take action, we may earn a small commission. I only share stuff I believe is worth your attention. Josh Belanger's results are not typical and are not a guarantee of your success. Josh is an experienced investor and your results will vary depending on education, work experience, and background. Josh does not personally participate in every investment alert he provides. Due to sensitivity of financial information, we do not know or track the typical results of our students. Josh’ strategies may not always be accurate, and his investments may not always be profitable. They could result in a loss of an entire investment. We cannot guarantee that you will make money or that you will be successful if you employ his trading strategies specifically or generally. Consequently, your results may significantly vary from his. We do not give investment, tax, or other professional advice. Reference to specific securities should not be construed as a recommendation to buy, sell or hold that security. Specific securities are mentioned for informational purposes only. All investments involve risk, and the past performance of a security, industry, sector, market, financial product, investment strategy, or individual’s investment does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs. |

Senin, 21 Juli 2025

Wall Street’s About to Pull the Rug Again—Are You Ready?

Langganan:

Posting Komentar (Atom)

Tidak ada komentar:

Posting Komentar