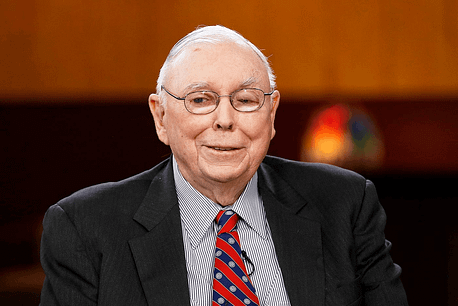

This July 4th, Don’t Settle for Index Fund “Freedom”Why “Playing It Safe” Could Be the Biggest Risk You Ever TakeToday is July 4th… When Americans celebrate independence, rebellion, and the freedom to choose their own future. It’s also my mother-in-law’s birthday. She was born in Germany. As a young girl, she came to America with her parents, searching for opportunity and a fresh start. That’s what this country is really about. The chance to take risks and build something better. But step back and ask yourself: Are you really free in the market? Or are you just following the herd, doing what Wall Street tells you is “safe”? For generations, we fought for independence. But most investors are still chained to the biggest lie in finance: that “indexing” is the safe play. Maybe you remember when “just buy the index” was a fringe idea. It was something only academics talked about, not real investors. Now, it’s everywhere. “You can’t beat the market. Diversify. Set it and forget it. Let the pros do the heavy lifting, and you’ll wake up rich.” Every financial guru, every TV pundit, even your neighbor repeats it like gospel. But here’s the reality. Most Americans aren’t worried about “beating the market.” They’re worried about having enough. About not running out of money. When this country was founded, it was about opportunity and freedom, not safety. Today, the message everywhere you look is “play it safe.” Wall Street will sell you on anything that sounds safe, because that keeps you in the herd. But the truth is, making money in the stock market always involves risk. That’s okay, as long as you understand what you own. Take the S&P 500. Sure, it’s a basket of five hundred stocks, but let’s be honest. It’s been led by just seven for years. The rest? Dead weight. Or worse, a trap. Wall Street gets paid whether you win or lose. The Herd Loves a Good StoryIt’s not your fault if you bought in. Charlie Munger (God rest him) used to say, “Invert, always invert.” Flip the puzzle upside down and look at what doesn’t make sense. So let’s invert the sacred cow of “indexing.” The S&P 500 is just a basket of businesses. Some are winners. Most are mediocre. Since 2000, over half the Fortune 500 have disappeared. Bankrupt. Gone. Zero. You want to “own the market?” You’re guaranteed to own those losers too. But the financial industry keeps chanting: “Diversify, diversify, diversify.” Not to keep you safe. To keep you passive. To keep you paying fees while they ride your money up and down. Mostly down. Ask yourself, does that sound “conservative” to you? Volatility ≠ RiskHere’s the next half-truth they sell. Volatility is risk. Indexing is the safer bet. But volatility is just the price of opportunity. In April, when the market plunged during the Tariff Tantrum, anyone holding the index was told to grit their teeth and ride it out. Sure, the market bounced back and the headlines are cheering new highs. But just getting back to even isn’t winning. It’s lost opportunity. You missed buying great businesses at a discount when fear was at its peak. That’s the real cost of indexing. You become a passenger, not a player. When you’re stuck in the index, you’re just along for the ride, never in control. Volatility does matter. When prices swing wildly, most people panic. They sell at the wrong time and miss the recovery. That’s why allocation matters. Even Warren Buffett’s Berkshire Hathaway dropped more than 50% twice in the last twenty-five years. The business didn’t fail. Investors who stuck with it did just fine. Volatility feels so brutal in stocks because of liquidity and mark-to-market pricing. Every day, you see the value. In real estate, you don’t get that. You don’t wake up to a new price tag on your house every morning. If you did, you’d probably panic there too. So yes, volatility can be scary. It can cause real loss if you let emotions run your playbook. But risk isn’t about price swings. Risk is not understanding what you own, or betting on businesses that can go to zero. Wall Street loves to talk about volatility because it’s easy to sell products around. But what actually matters is real risk. The kind that comes from holding dead companies, not just stocks that bounce around. Why Indexes Are Built to Fail YouIf you own the S&P 500, you’re not buying five hundred good companies. You’re buying size. You’re buying what’s popular. You’re buying what already ran up. Indexes are “market cap weighted.” The biggest get the most of your money. GE. AT&T. IBM. All were index darlings. All are ghosts now. Apple. Microsoft. Today’s giants. Will they stay at the top forever? Don’t bet on it. History says the opposite. A Goldman Sachs study broke it down this way:

So why is everyone still doing it? Because it’s easy to sell. Because it’s easy to automate. Because it keeps the money machine humming for Wall Street, not for you. Only a Few Stocks Matter. The Rest Are Dead WeightHere’s the brutal truth. Over the last century, only 4% of all stocks created all the real wealth in the market. That means ninety-six out of one hundred stocks are dead weight. Or worse, a trap for your wealth. If you buy the whole index, you guarantee you own all the garbage. The Real Secret: Capital EfficiencySo what should you do instead? Stop pretending you have to settle for average. Start demanding better. I don’t invest in indexes. I look for capital efficient businesses. What does that mean? Companies that make more on every dollar invested. High returns on capital. Strong free cash flow. Businesses that compound. Hershey. Texas Pacific Land. The kinds of names that keep throwing off profits, year after year. I’ve run the numbers. If you’d just owned a basket of the most capital efficient stocks, by the simplest measures, you’d have crushed the S&P 500 over the last seventeen years. Not a theory. Not a backtest. A fact. Nearly triple the market’s returns. With less gut-wrenching swings. Don’t Be an Index Statistic. Claim Your Financial FreedomYou can keep playing the Wall Street game and hoping for average. Or you can step out of the herd, flip the script, and start demanding more from your money. Independence Day is about more than fireworks and hot dogs. It’s about the courage to walk your own path. In the market, that means ditching the herd and choosing real financial freedom. Until then, look at your portfolio. If you own a big, fat index fund, ask yourself why. Whose dream is it serving? Yours, or Wall Street’s? Don’t settle for average. Don’t buy the lie. Trade smart. Until tomorrow, Josh Belanger If you enjoyed today’s essay, please forward it to someone you think will appreciate it. You never know whose financial freedom you might spark. Disclaimer: Some of the links above are part of paid promotions. If you take action, we may earn a small commission. I only share stuff I believe is worth your attention. Josh Belanger's results are not typical and are not a guarantee of your success. Josh is an experienced investor and your results will vary depending on education, work experience, and background. Josh does not personally participate in every investment alert he provides. Due to sensitivity of financial information, we do not know or track the typical results of our students. Josh’ strategies may not always be accurate, and his investments may not always be profitable. They could result in a loss of an entire investment. We cannot guarantee that you will make money or that you will be successful if you employ his trading strategies specifically or generally. Consequently, your results may significantly vary from his. We do not give investment, tax, or other professional advice. Reference to specific securities should not be construed as a recommendation to buy, sell or hold that security. Specific securities are mentioned for informational purposes only. All investments involve risk, and the past performance of a security, industry, sector, market, financial product, investment strategy, or individual’s investment does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs. |

Tidak ada komentar:

Posting Komentar