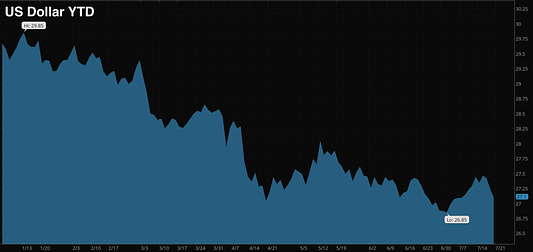

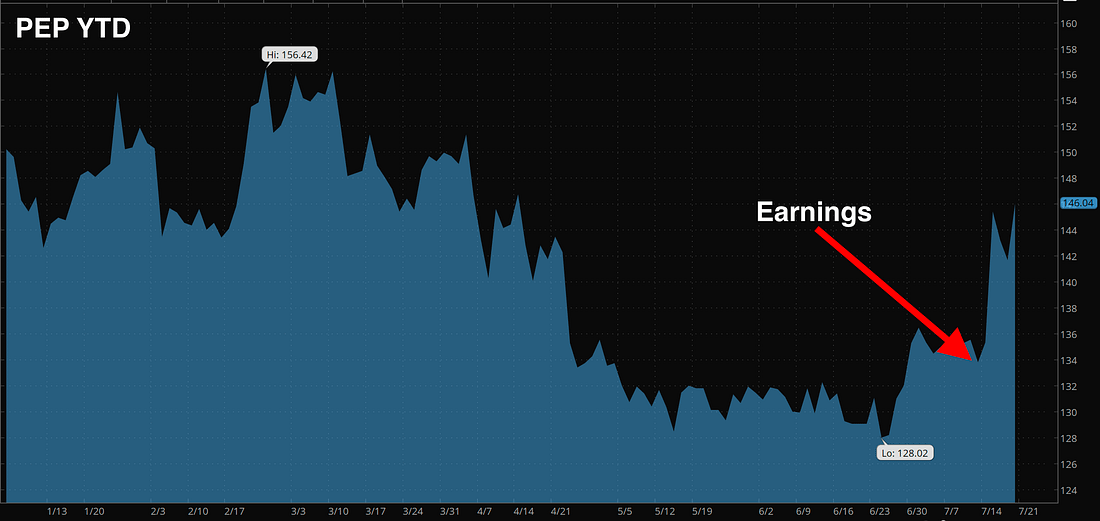

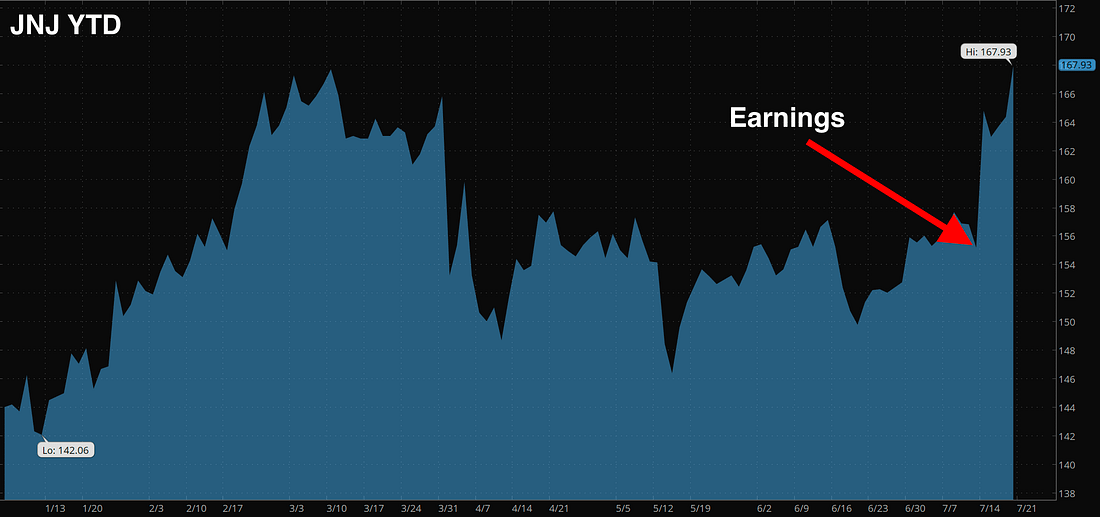

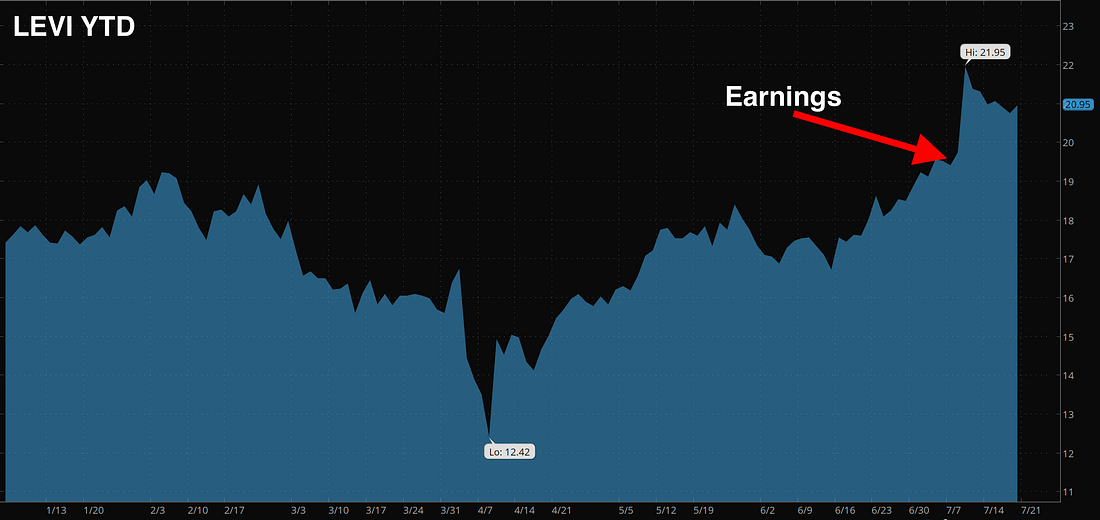

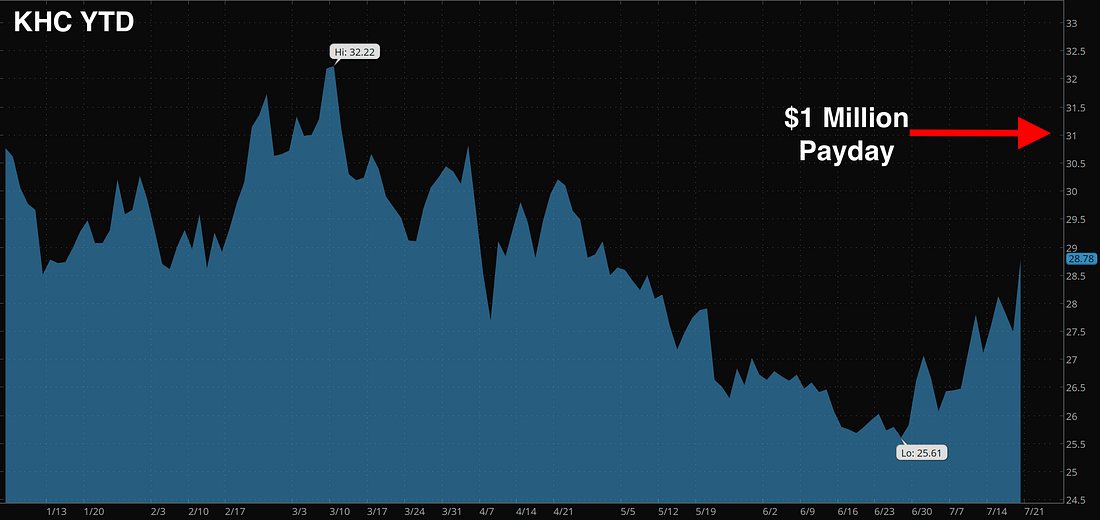

Ketchup Cash: Could This Be Your Next Big Payday?A $1M bet, a rumored split, and how you can profit next weekThey called it Liberation Day. The day tariffs exploded. The dollar buckled. And Wall Street blinked. Since then, the greenback has done something it hasn’t done in 50 years: It posted its worst first-half performance on record. That might ruin a European vacation. But for multinationals? It’s free money. Take a look at what just happened last week during earnings season... Pepsi reported quarterly results that beat analyst estimates by 4.5%, and shares jumped 7.5% on the news .Johnson & Johnson topped expectations and raised full-year guidance, citing currency tailwinds. Levi Strauss also beat consensus. Not because business boomed. Because a weaker dollar made their foreign earnings look fatter. And now Wall Street is scrambling to find the next name to ride that same wave. Foreign Profits = Domestic Gains Roughly 13% of all U.S. corporate profits come from outside America. But when you zoom into the S&P 500? That jumps to 28%. That means these big names are sitting on a tailwind most investors don’t see until it hits the headlines. Because when the dollar falls, their international profits translate into more bucks. It’s not magic. It’s math. Goldman Sachs just ran the numbers: a basket of U.S. stocks with high international exposure is outperforming its domestic-focused counterpart by 7 percentage points year-to-date. And some of the most dollar-sensitive names haven’t even reported yet. We’re talking tech giants like Meta and Qualcomm. Credit card titans like Visa and Mastercard. Even tobacco and telecom players like Philip Morris and Equinix. If that foreign tailwind keeps blowing? Earnings season isn’t over. It might just be warming up. Watch the Footprints Before Earnings That brings me to what I spotted on the tape today. A massive trade just hit in Kraft Heinz (KHC). Options volume was more than double its normal pace. And one trade stood out... A $250,000 bet that KHC will finish above $31 by next Friday. If that trader is right? They’re staring down a million-dollar profit. Now, why would someone make a short-term bet like that? Because Kraft reports earnings on July 30—right before that option expires. And 24% of Kraft Heinz’s profits come from outside North America. So if that dollar weakness shows up again? KHC could surprise the same way Pepsi and Johnson & Johnson just did. But there’s more... Breakup Rumors Are Heating Up The Wall Street Journal dropped a new report Friday: Kraft Heinz is exploring a breakup. It could spin off its grocery business—think Kraft Mac & Cheese, Jell-O, and more—into a separate $20 billion company. That would leave the legacy business focused on Heinz ketchup and its global footprint. Management isn’t denying it either. A spokesperson told CNBC they’re "evaluating strategic transactions to unlock shareholder value." Translation: something is brewing. And when you layer that with currency tailwinds and pre-earnings momentum? You’ve got a recipe that’s hard to ignore. The Big Takeaway When dollar declines, multinationals smile. When a breakup is on the table, Wall Street watches even closer. And when Smart Money makes a $250,000 bet right before earnings? We pay attention. Trade smart. Until tomorrow, Josh Belanger Disclaimer: Some of the links above are part of paid promotions. If you take action, we may earn a small commission. I only share stuff I believe is worth your attention. Josh Belanger's results are not typical and are not a guarantee of your success. Josh is an experienced investor and your results will vary depending on education, work experience, and background. Josh does not personally participate in every investment alert he provides. Due to sensitivity of financial information, we do not know or track the typical results of our students. Josh’ strategies may not always be accurate, and his investments may not always be profitable. They could result in a loss of an entire investment. We cannot guarantee that you will make money or that you will be successful if you employ his trading strategies specifically or generally. Consequently, your results may significantly vary from his. We do not give investment, tax, or other professional advice. Reference to specific securities should not be construed as a recommendation to buy, sell or hold that security. Specific securities are mentioned for informational purposes only. All investments involve risk, and the past performance of a security, industry, sector, market, financial product, investment strategy, or individual’s investment does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs. |

Selasa, 22 Juli 2025

Ketchup Cash: Could This Be Your Next Big Payday?

Langganan:

Posting Komentar (Atom)

Tidak ada komentar:

Posting Komentar