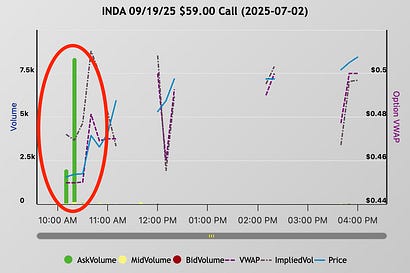

On June 9, I told you the U.S. dollar looked ready to bounce. The setup was there. The probabilities lined up. I put my conviction on the line. But the dollar didn’t bounce. It broke. In just three weeks, the greenback tumbled 2%. That’s the worst first-half slide in more than thirty years. There’s no sugarcoating it. I got this one wrong. That’s the reality of the market. You call the play. You run the play. When the tape shows you something new, you don’t hide. You flip the playbook and hunt for the next edge. Why I Made the CallTrading isn’t about being right every time. It’s about taking your shot when the odds are in your favor. Move fast when they flip against you. The dollar was sitting on key support. Sentiment was stretched. The White House was pounding the table about making the dollar strong again. I thought we’d see a relief rally. A quick move higher as shorts scrambled to cover. That’s what history said should happen. This time, history got run over. How the Playbook Broke: Tariffs, Debt, and Fed DramaHere’s what changed: • Trump’s tariffs backfired. Retaliation from China stoked fears of a trade war. The April "Liberation Day" tariffs set off a market-wide panic. Suddenly, the dollar wasn’t a safe haven. It was a target. • The U.S. deficit ballooned. Moody’s cut its outlook on Treasury debt. Fund managers who once hid in the dollar started looking for the exit. • The Fed became the wild card. Trump attacked Powell for being “too tight” and openly suggested he wants a looser Fed in 2026. Now the market expects at least one rate cut before year end. That’s further weakened the dollar’s appeal. Add it up and the script flipped fast. Even the best-laid plans can blow up when new facts hit the tape. You have to stay humble. Flexible. Quick to adapt. Where the Real Money Went: The Emerging Markets PlaybookSo where did the smart money run when the dollar broke down? They rotated capital into the one place that loves a weak dollar. Emerging markets. Here’s what the tape shows: • The iShares Core MSCI Emerging Markets ETF (IEMG) saw $3 billion in inflows in June. Its best month since January 2023. • Emerging markets stocks are up nearly 10% year to date. Their best run since 2017. • When the dollar drops, EM stocks have gained in 72% of months since 2008. With average returns over 2% per month. This isn’t just a stat. It’s real money moving across the tape. But here’s where the story gets even more interesting. India stands out as the new epicenter for growth. Tech investment is soaring. Manufacturing is expanding. The country’s middle class is exploding. Global capital is chasing that momentum. And the tape is backing it up. Today, a $500,000 upside position was established in the India ETF—INDA—expiring in September. Options volume spiked 200% on the day. Why does this matter? Because this isn’t a headline grab. It’s not showing up on CNBC or anywhere else. This is a calculated, all-or-nothing move by a deep-pocketed player. They’re not here to lose $500,000 on a whim. Their job is to find trades with real asymmetric payoff, and that kind of risk only gets taken when they believe there’s a real edge—something big on the horizon. When this type of capital moves in quietly, it’s usually a tell. They’re not looking for a modest uptick. They’re swinging for a breakout or a catalyst that could put Indian shares on the global stage. In a market full of caution, this is real conviction. It’s a signal of where the most sophisticated players are placing their bets before the rest of the world catches on. How to Flip the Playbook (and Stay Ahead)When you get it wrong, you learn fast. Listen to what the market is telling you. Not what you wish would happen. Then look for the next edge. I’m still watching the dollar. But right now, the odds say the edge is with the emerging markets. That’s where capital is flowing. That’s where the options tape is lighting up. That’s where the next payoff could be hiding. If you want the next big move, keep watching the tape and the options flow. Don’t get anchored to your last trade. Be ready to flip when the odds shift. You don’t have to be perfect. Just adapt faster than the crowd. Trade smart. Until tomorrow, Josh Belanger Disclaimer: Some of the links above are part of paid promotions. If you take action, we may earn a small commission. I only share stuff I believe is worth your attention. Josh Belanger's results are not typical and are not a guarantee of your success. Josh is an experienced investor and your results will vary depending on education, work experience, and background. Josh does not personally participate in every investment alert he provides. Due to sensitivity of financial information, we do not know or track the typical results of our students. Josh’ strategies may not always be accurate, and his investments may not always be profitable. They could result in a loss of an entire investment. We cannot guarantee that you will make money or that you will be successful if you employ his trading strategies specifically or generally. Consequently, your results may significantly vary from his. We do not give investment, tax, or other professional advice. Reference to specific securities should not be construed as a recommendation to buy, sell or hold that security. Specific securities are mentioned for informational purposes only. All investments involve risk, and the past performance of a security, industry, sector, market, financial product, investment strategy, or individual’s investment does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs. |

Rabu, 02 Juli 2025

Dollar Gets Crushed—Here’s The Next Big Trade

Langganan:

Posting Komentar (Atom)

Tidak ada komentar:

Posting Komentar