When Is Altcoin Season Finally Coming? |

There's no denying what's driving this current crypto bull cycle right now: bitcoin. |

Every day, it seems like we see new headlines about a major corporation, international bank, or government entity adopting bitcoin in some form or another. |

Just over the past month: |

JPMorgan, the largest bank in the world, announced it would allow its clients to use crypto-related assets as collateral for loans in the coming weeks. Trump Media – the parent company of President Trump's Truth Social platform – unveiled plans to raise $2.5 billion to create what it claims will be one of the largest bitcoin treasuries held by any public company. GameStop purchased 4,710 bitcoins, valued at over $500 million, as part of its strategy to incorporate cryptocurrency into its corporate investments. And Japanese company Metaplanet announced its purchase of 8,888 bitcoins with the aim of becoming the MicroStrategy of Japan. Shortly after, it became the second-highest performer on the Japanese stock market and most actively traded stock on the week of its announcement.

|

This is all proof that the mass adoption of bitcoin Daily editor Teeka Tiwari has been predicting since 2016 is well underway. |

That begs the question… |

If bitcoin continues to hit all-time new highs – and it's poised to break a new record for the second time in three weeks – why are altcoins lagging so far behind? |

Below, I'll answer that question. Plus, point to a catalyst on the horizon that could kick off an altcoin season for the ages. |

The Great Bitcoin Acquisition Game |

As I mentioned above, bitcoin is sucking up all the oxygen in the room from altcoins. You can see that in the bitcoin dominance rate. |

If you're an altcoin investor, the bitcoin dominance rate is one of the most important metrics in crypto. It's the percentage of the total crypto market cap that bitcoin takes up. |

When BTC dominance is high, it generally means investors are more confident in bitcoin relative to other cryptocurrencies. When BTC dominance is low, it means investors are more willing to take risks on altcoins. |

As of this writing, bitcoin makes up nearly 64% of crypto market share. That's up from nearly 54% in January 2025. Meanwhile, the altcoin share has decreased from 46% to 36%, while at the same time adding over 50,000 new tokens to market per day. |

|

Given all the bullish news about bitcoin over the past few months, it's no surprise the granddaddy of crypto is suffocating its altcoin brethren right now. |

It's what I call the "great bitcoin acquisition game." |

Since 2023, the appetite for bitcoin has exploded. Public companies have increased their exposure to bitcoin by 160%, and they now hold roughly 3.4% of all bitcoin in circulation, according to financial research firm Bernstein. |

Meanwhile, bitcoin has outperformed all major assets since the U.S. government's April 2 tariff announcement, which Teeka predicted would happen as early as April 21… And has begun to show safe-haven qualities similar to gold. |

|

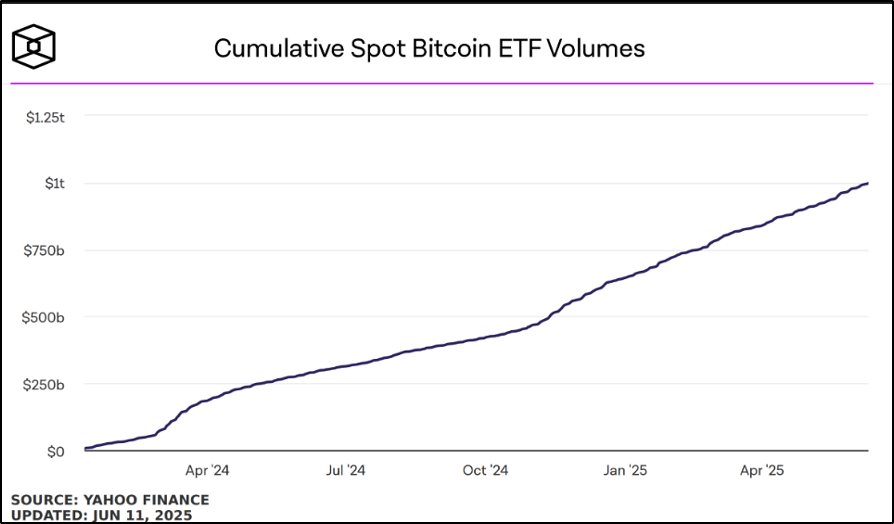

And the demand for bitcoin exchange-traded funds (ETFs) seems insatiable. Just take a look at the chart below of spot bitcoin ETF volumes. |

| Source: The Block |

|

Last month alone, spot bitcoin ETFs saw monthly net inflows soar past $5.3 billion. By comparison, spot Ethereum ETFs saw a record monthly net inflow of $564 million. |

Just think about that. |

Ethereum spot ETFs had their highest monthly net inflow of 2025… Yet bitcoin ETFs still outpaced those inflows by 10x. |

It seems like everyone wants to acquire bitcoin and only bitcoin. That brings me back to my initial question: Why are altcoins lagging so far behind? |

That's because bitcoin's pathway to widespread adoption is decoupling from the pathway altcoins are taking to widespread adoption. |

But what a lot of people who are only focusing on the bitcoin side of the story don't realize is that both paths are bullish. |

Bitcoin Adoption vs. Altcoin Adoption |

Bitcoin is seeing widespread adoption primarily as a monetary asset… not as a technology. |

In other words, bitcoin is becoming a rival to reserve assets like gold and the U.S. dollar. It's not a rival to the Nasdaq or Big Tech. |

This is something Teeka has been predicting since he first recommended it back in April 2016 at $400 and change. |

Bitcoin's original developers designed it as sound money. And Teeka knew people would want to own sound money over debased government fiat currencies. |

Here's what he wrote way back then… |

| ❝ | | | Because of its preset scarcity, [bitcoin is] a disinflationary asset. You can't inflate its value away like the government does with fiat currencies. That made bitcoin the perfect store of value in a world built on technology." |

|

|

Of course, we've seen that all play out in real time – governments pumping stimulus money into the economy, reckless money printing, and the resulting rampant inflation. |

As a result, since April 2016, bitcoin has skyrocketed 24,802%. And as more and more individuals, institutions, and governments acquire it, we believe it will eventually hit $1 million. |

Now, this may sound crazy coming from a person who started buying bitcoin in the back alleys of New York City's Union Square neighborhood back in 2011… |

But as great as bitcoin is as "sound" money… its underlying technology pales in comparison to more innovative altcoins like Ethereum and Solana. |

Bitcoin isn't built to facilitate decentralized finance (DeFi)… Or tokenize real-world assets (RWAs)… Or develop artificial intelligence (AI) apps and agents. |

But as the first widespread digital store-of-value in history, bitcoin has blazed trails for institutions to adopt a new generation of altcoins for these use cases and more. |

(I also give a lot of credit to Satoshi remaining anonymous as a sort of messianic story – it's very hard to reproduce.) |

Unlike bitcoin, however, altcoins won't be just a store of value. |

One recent example is Avalanche (AVAX). |

Just last month, the company announced a deal with a real estate company called Balcony to tokenize property records in New Jersey. |

Through AvaCloud, Balcony has signed a five-year agreement with the Bergen County Clerk's Office to tokenize property records for over 370,000 parcels. |

That represents about $240 billion in real estate value, making it the largest tokenization project in U.S. history. |

Meanwhile, major financial services companies like Robinhood and Kraken are rushing to bring real-world assets (RWAs) on-chain in this friendlier environment. |

RWAs are another crypto megatrend Teeka has been writing about for years. It's where items will be "tokenized" and represented on the blockchain. This includes everything from artwork, to trading cards, to home deeds and titles, to music rights, and beyond. |

The Trading View projects RWA tokenization to become a $30 trillion market by 2030. |

This surge in interest is driven by rising institutional interest in on-chain financial products, which offer faster settlement, greater transparency, and broader asset access. |

I believe the next wave of innovation and institutional interest will come from tokens with use cases like Avalanche. |

Despite all of this bullish news, though, all the hype right now remains about acquiring bitcoin. |

But over the coming months, I expect the bitcoin dominance rate to drop. That's because there is a catalyst on the horizon that could open up the next "alt season." |

Altcoin Season Is Coming |

The catalyst I believe will unleash liquidity involves interest rate cuts. |

It's no secret that the White House is pressuring Federal Reserve Chair Jerome Powell to cut rates. |

The central bank has kept rates higher than usual so far this year in an effort to push inflation down to its goal of a 2% annual rate. But President Trump has repeatedly called on Powell to lower them by at least one full percentage point. |

It appears only a matter of time before the Fed begins to print either of its own volition or due to external influence by the executive branch. |

Any such printing will return market attention to risk-on assets. And that's bullish for altcoins. |

The last major rate cut came in September 2024, when the Fed reduced rates by a half of a percentage point. By the end of 2024, the central bank had delivered two additional quarter-point rate cuts. |

As you would expect, those rate cuts helped fuel a rally in the altcoin space. By November 2024, bitcoin dominance had plunged below 54%. |

During that brief rate-cutting spree, we saw altcoins like PNUT, FRED, and ACT skyrocket 4,825%, 15,338%, and 4,007%, respectively. |

If the Fed cuts rates again – and Wall Street puts the odds of at least one quarter-point rate cut by September at 78% – we could see the rapid redeployment of as much as $35 trillion now held in short- to medium-term interest-bearing instruments be on the move, looking for higher yields. |

This is all part of a phenomenon we call The Convergence. If you're not familiar with The Convergence, it's the confluence of three major trends… |

The launch of exchange-traded funds (ETFs) focused on crypto income tokens… A friendlier regulatory landscape… And mass financialization of crypto products leading to global institutional adoption. (You can learn more by going here.) |

When we first introduced our research on The Convergence, bitcoin was trading a hair below $54,000. Since then, it's traded as high as $112,000. Over the coming years, we believe it'll eventually trade as high as $1 million. |

Our research suggests the biggest gains from The Convergence will come from a tiny subsector of crypto tokens that have automatic payouts. |

We call these "crypto payouts." |

What makes these tokens unique is that they have automatic payouts that generate income month after month after month… no matter what's happening in the market. That's why we call them crypto payout coins. |

It's somewhat similar to the way some stocks pay dividends. Instead of receiving cash, though, you receive more of the underlying crypto. You receive this income through a process called "staking" delivered directly to your crypto wallet. |

We believe crypto payout tokens will be one of the solutions Wall Street will offer to capture a slice of that $35 trillion income pie. |

Teeka recently held a special briefing to explain how these catalysts will push crypto payout tokens much higher. He also shared details about six crypto payout tokens we're targeting in this niche sector. |

You can stream the replay right here. |

Stay curious, |

Graham Friedman |

|

|

|

Tidak ada komentar:

Posting Komentar