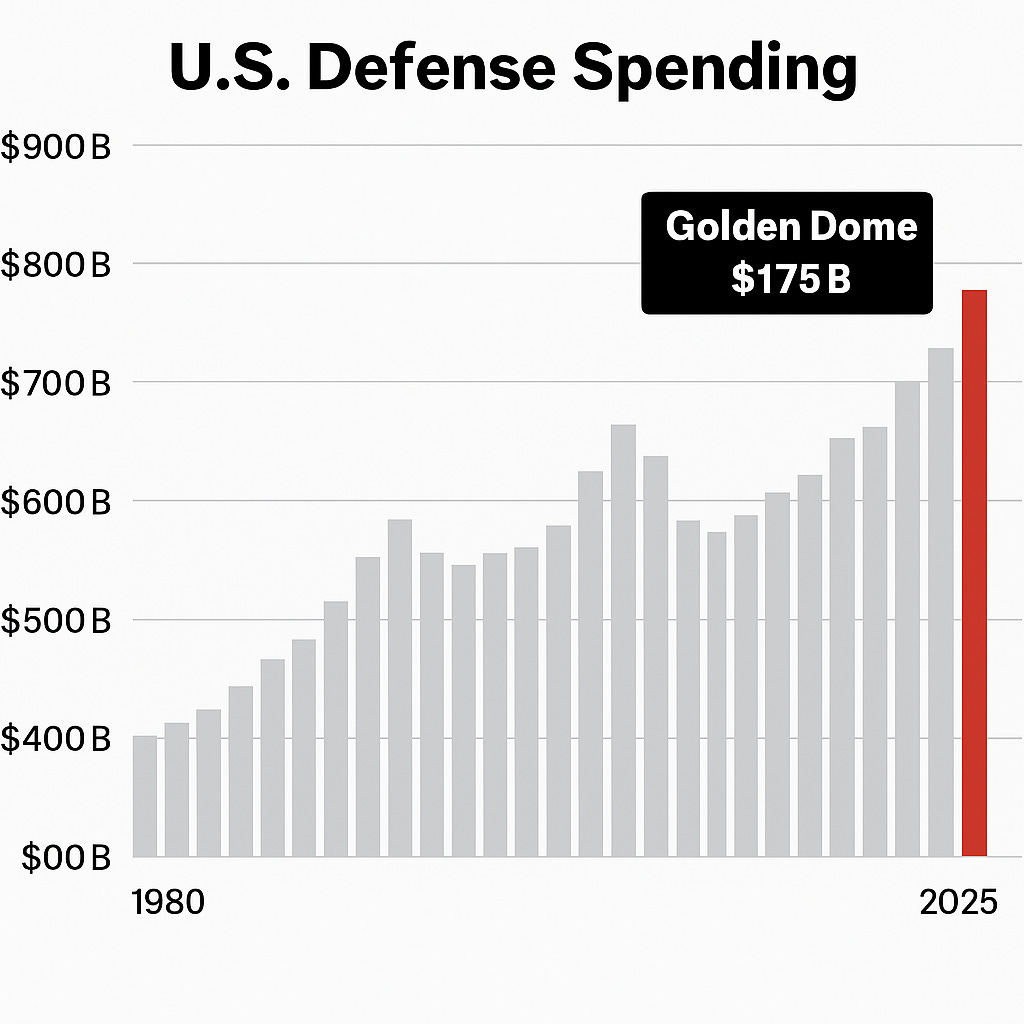

The Defense Stocks Are Flying—And Washington Just Poured Fuel on the FireDrone tech. War spending. Rare earths. A new defense cycle is underway and the smart money is already positioned.Four years ago, defense and aerospace stocks were the slow-moving utility players of the market, dependable, but rarely exciting. That’s changed. Fast. Right now, they’re screaming higher. And it’s not just a news-driven spike. It’s structural. It’s geopolitical. And it’s tied to two of the biggest financial forces in the world: Washington spending and China. Let’s start overseas. Markets had their eyes on London this week. That’s where U.S. and Chinese officials sat down for a second round of trade negotiations, trying to move beyond last month’s fragile truce, the Geneva agreement that temporarily paused runaway tariffs. This week’s focus? Export controls on semiconductors and rare-earth minerals, resources at the very core of defense and chipmaking dominance. Commerce Secretary Howard Lutnick says things are going well. And the markets seem to agree. No news from the talks was good enough to push indexes higher again, with the S&P 500 rising 0.6% and volatility continuing to cool. The VIX is now under 17, the lowest we’ve seen since the tariff shock. But while the market is cautiously optimistic about diplomacy… Washington has quietly made a massive commitment to something far more tangible: Weaponized Spending. President Trump’s latest “big, beautiful” tax and spending bill is controversial for all the usual reasons. Ballooning debt. Trillions in new spending. A growing divide over who pays for what. And yet, buried inside the debate is a line item that has Wall Street’s attention: $175 billion for a new ‘Golden Dome’ air defense system. This is what defense investors live for. A gigantic federal spending wave, attached to national security, with bipartisan cover. It’s like a runway built for Lockheed, Raytheon, and Northrop to take off from. And it’s not just missiles and radar systems getting a boost. A recent executive order has sent a jolt through the drone sector, specifically targeting unmanned aircraft and eVTOL development. That’s “electric vertical takeoff and landing” aircraft. Think drone-helicopter hybrids that are quieter, cheaper, and eventually autonomous. So Here is What To Trade… On news of Trump’s order to establish a national eVTOL pilot program one early-stage defense-aligned stock bumped 15%, and this is exactly the type of innovative company institutional money loves to front-run. The ticker is…... Continue reading this post for free in the Substack app |

Rabu, 11 Juni 2025

The Defense Stocks Are Flying—And Washington Just Poured Fuel on the Fire

Langganan:

Posting Komentar (Atom)

Tidak ada komentar:

Posting Komentar