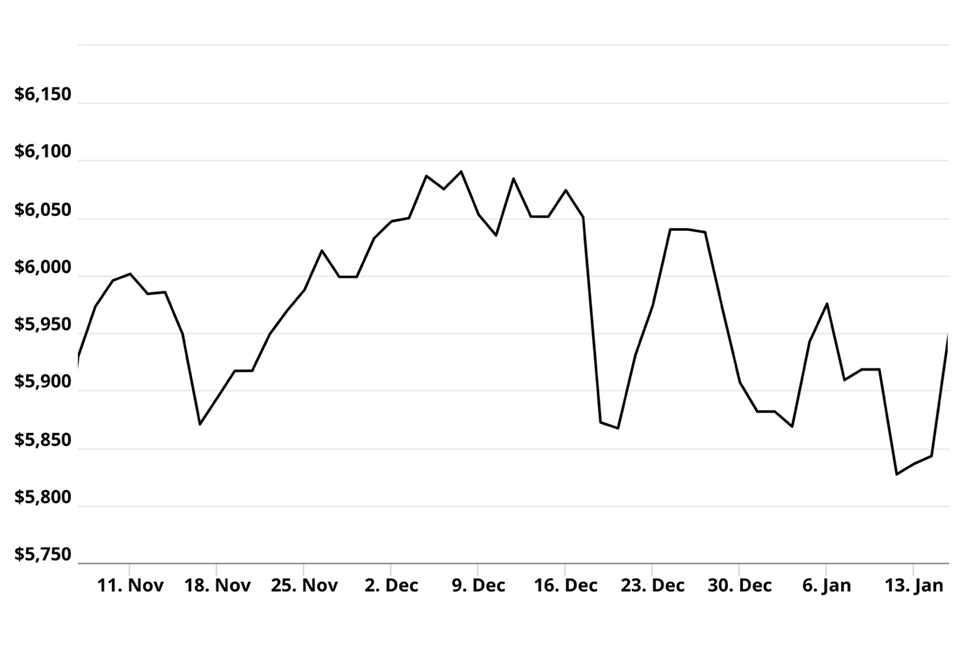

Don’t Wait for a Correction to Join a Bull Market If you’re interested in investing, you’re likely familiar with Warren Buffet’s famous quote from his 1986 Chairman’s letter: “Be fearful when others are greedy and greedy when others are fearful.” But there is another quote from the 94-year-old “Oracle of Omaha” that many people forget … and this second quote seems to fit today’s business/investment climate. A shareholder asked Buffett: “If you had three great companies, wonderful businesses…is it better to wait a year or two to see if the company stumbles?” Buffett responded that waiting to buy a quality company was usually a mistake. “To sit there and hope that you buy them in the throes of some panic, that you would take the attitude of a mortician waiting for a flu epidemic, I’m not sure that will be a great technique,” he said. The market has been “stumbling” the last two months. As of a few days ago, the market had given up all the gains that investors enjoyed after the election. The S&P chart below shows that clearly.

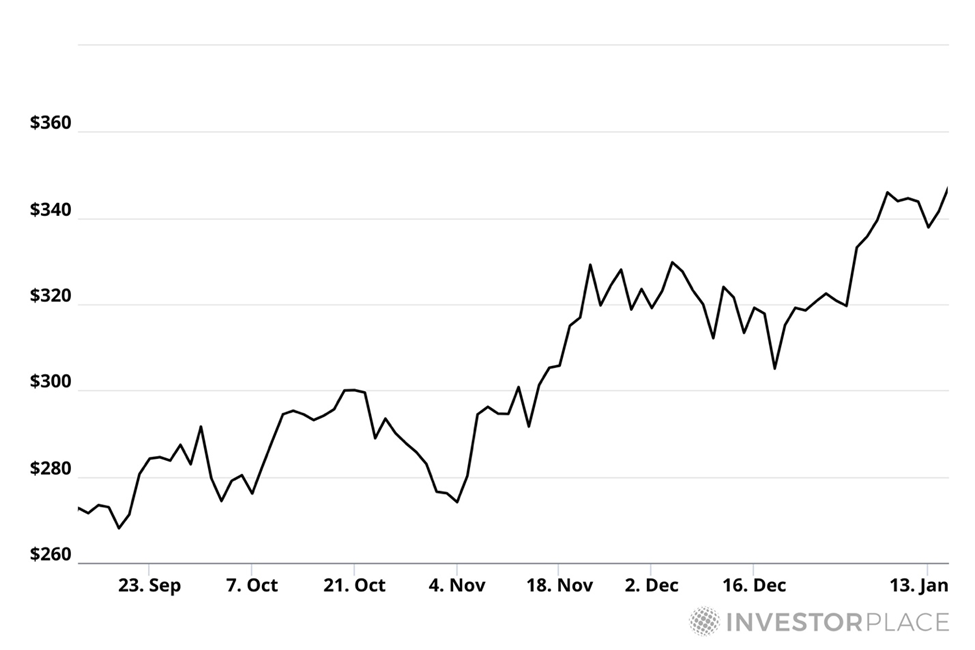

Behind this market reversal were a few factors… Bond yields were rising, expectations of more interest rate cuts from the Federal Reserve had been slashed, and reinflation was creeping back into the market narrative for 2025. That investors might be feeling more cautious makes sense. After all, consecutive years of 20%+ returns is great, but it’s also rare. Many folks are ready to believe the market wave is on the verge of crashing. Then this week we got two soft inflation reports and that changed the story. In response, the market had its best single day since November. Traders that were anticipating no interest rate cuts in 2025 now have priced in at least one and maybe two. The VIX, often called the markets “fear indicator,” started the week at 20 yet dropped to below 16 as I write Friday morning. The inauguration of Donald Trump on Monday is setting up to be another huge bullish catalyst for investors. His focus on deregulation, winning the tech race, “drill, baby, drill” and other pro-business ideas are likely to provide more fuel for market gains. So, what’s coming next? Where should investors be putting money now? Tying back to Buffett, which specific stocks of “wonderful companies” should we feel confident in buying today instead of waiting for a crash that might not materialize? Our analysts have some specific ideas for you to consider. | Recommended Link | | | | Jeff Clark has a bold prediction. During Trump’s first 100 days back in the Oval Office, there could be at least one trade every week that has the potential to double your money. Jeff’s 40-year track record is packed with triple-digit gains, and he’s ready to share his number one strategy for capturing these explosive opportunities NOW. With market volatility set to skyrocket under Trump’s aggressive agenda, now is the time to get in the game. Don’t let these potentially profit-rich weeks slip by. Join Jeff’s live event, The Most Profitable 100 Days of Your Life, and discover how to make the most of this historic trading window. Claim Your Spot for Free Now. |  | | Louis Navellier’s Next Big Call Louis Navellier predicted Trump’s win in the spring of 2024 long before many others. He’s been getting his Growth Investor subscribers positioned for the spate of executive orders and policy changes that will boost select stocks in the first 100 days of Trump 2.0. Here is how he summarized the big picture in the latest Growth Investor issue. The simple fact is that when the U.S. economy is performing well, folks are in a more positive mood and likely to spend more – which in turn, also boosts business activity. In other words, corporate earnings are also anticipated to increase. Interestingly, the earnings environment has already improved dramatically. The S&P 500 is now forecast to achieve more than 10% average annual earnings growth for the next three quarters. FactSet currently projects 12.1% average earnings growth in the fourth quarter, 12.7% in the first quarter of 2025 and 12.0% in the second quarter of 2025. Regular Digest readers know that the emphasis on earnings is Louis’ bread and butter. We already saw this play out firsthand in the past week with Cal-Maine Foods, Inc.(CALM). Here is Louis’ summary of its recent performance. The leading producer and distributor of shell eggs in the U.S. benefited from an uptick in dozens of eggs sold and rising egg prices in the most recent quarter. As a result, earnings surged 1,188% year-over-year and sales jumped 82% year-over-year. Earnings per share also topped analysts’ expectations, and the stock rallied nicely higher on Wednesday. I anticipate this will be par for the course as earnings season heats up for us. The reality is earnings momentum hit the gas in the fourth quarter – and it’s set to accelerate in every quarter of 2025. FactSet expects the S&P 500 will achieve 11.9% average earnings growth and 4.6% average revenue growth for the fourth quarter. CALM is up 17% since he picked it in November.

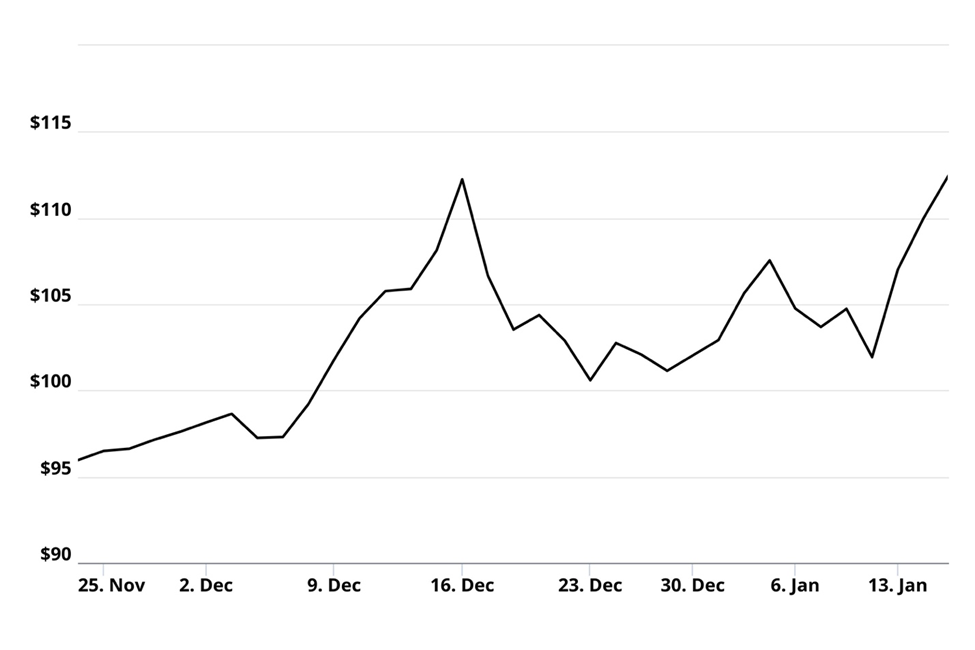

| Recommended Link | | | | The market opportunities during Trump’s first 100 days aren’t for the faint of heart. But if you’re prepared, they could redefine your financial future. On Wednesday, renowned trader, Jeff Clark, will unveil his number one trade for Trump’s second term — a stealth play to take advantage of a promise Trump is pounding the table on. Jeff’s methods have already delivered gains like 186%... 238%... and 490% to his readers — often in less than a week. You don’t want to miss what he has planned for Trump’s explosive honeymoon period! Sign Up to Reserve Your Spot. |  | | Luke Lango Nailed the CPI Forecast too Hypergrowth analyst Luke Lango was clear on Monday that there was every reason to expect soft inflation reports. Here is what he wrote to Innovation Investor subscribers: This week’s inflation reports will likely be soft. Although the stock market is worried about reinflation pressures at the current moment, we are positive on current inflation trends. That’s because – based on real-time estimates – inflation appears to be turning a corner. That is, throughout late 2024, both headline and core inflation rates were reinflating. But headline inflation rates are now starting to flatline, while core inflation rates are falling. That is, the trends in both headline and core inflation velocity are improving. We like those trends and believe they bode well going into this week’s inflation reports. And that’s exactly what happened. After the inflation reports came in as soft as Luke expected, here is what he thinks will happen next: We think this is the start of a big, multi-week march higher in stocks. Fundamentally, inflation fears should ebb over the next few weeks while economic growth hopes take center stage. We’re going into earnings season – the meat of it is the last week of January and the first week of February – and we think the earnings season will be good. Plus, we have Trump’s inauguration next week and we expect a flurry of pro-growth policies to be announced in his first few weeks back at the White House. The combination of those pro-growth policies and strong earnings should keep economic growth hopes front-and-center in the market, which should help propel stocks higher into February. One of Luke’s recent Innovation Investor picks leveraging the AI megatrend is CyberArk Software (CYBR). CyberArk is a cybersecurity company that specializes in identity security and privileged access management software. As we go deeper into the age of AI, the risks of AI-powered hacks only grows. The demand for cybersecurity solutions will only become more acute. The stock is up more than 32% since Luke picked it in September.

Investing can be difficult. We’re only human and we’re bound to react emotionally to something we see or hear. But don’t let your fears drive your investing. It’s too easy to let talk of a correction or a downturn keep you from potential profits. The key, however, is the quality of the stocks you choose. Bottom line: When you invest in quality companies at reasonable prices that are set up for success, you put the odds in your corner, even if the market is “stumbling.” But don’t take it from me. Here’s “Uncle Warren”: Time is the friend of the wonderful company, the enemy of the mediocre. Enjoy your weekend, Luis Hernandez

Editor in Chief, InvestorPlace |

Tidak ada komentar:

Posting Komentar