January 22, 2025

Trump's First Days in Office Could Clear the Way for a Crypto ETF Boom

Dear Subscriber,

Donald Trump ran on a pro-crypto platform.

So, when his inauguration speech did not mention Bitcoin (BTC, “A”) or any blockchain in particular, some in the crypto community were disappointed.

If you were one of them, I encourage you to pick your chin up.

Despite his silence in front of the crowd, Trump’s administration has made a few key early decisions that have already made an impact.

The appointment of Mark Uyeda as acting chair of the SEC is a big one.

Uyeda, known for his criticisms of the previous administration’s enforcement-led crypto policies, is expected to bring a more balanced approach to regulation.

And he’s off to a strong start.

Just yesterday, Uyeda announced the formation of a new crypto task force aimed at developing a clear regulatory framework for digital assets. This task force represents a shift from the SEC’s previous reliance on enforcement actions.

We called it “enforcement through legislation.” Platforms and projects only found themselves on the wrong side of regulators … when they came knocking with a warrant. That led to a lot of regulatory uncertainty and stifled crypto growth in the U.S.

Now, though, Uyeda’s leadership indicates an effort to provide clarity and consistency in the regulatory landscape.

And that could set the tone for the rest of the year.

Especially when it comes to …

The Crypto ETF Boom in 2025

Cryptocurrency ETFs, particularly those focused on Bitcoin and Ethereum (ETH, “A-”), have significantly altered the landscape of digital asset investment.

They offer both retail and institutional investors a more straightforward and secure method of investing in cryptocurrencies.

For most investors, getting in is as simple as buying a stock. That means they do not need to figure out a new financial system or deal with the complexities of managing personal wallets or private keys.

With firms tripping over themselves to be among the first to offer Bitcoin ETFs, these funds have attracted billions of dollars.

Take BlackRock's iShares Bitcoin Trust (IBIT), for example. It is one of the more popular ETFs, with net inflows from launch to early Jan. 2025 exceeding $37 billion. And it has seen tremendous growth with assets at about $60 billion as of Jan. 21.

And their success has granted long-awaited legitimacy for crypto as an asset class.

In anticipation of Trump's pro-business, pro-crypto agenda, we’ve seen a surge in new ETF applications. The number of these offerings is at an all-time high, with impending deadlines that could have a substantial impact on the market.

And they range from targeting blue-chip cryptos to memecoins.

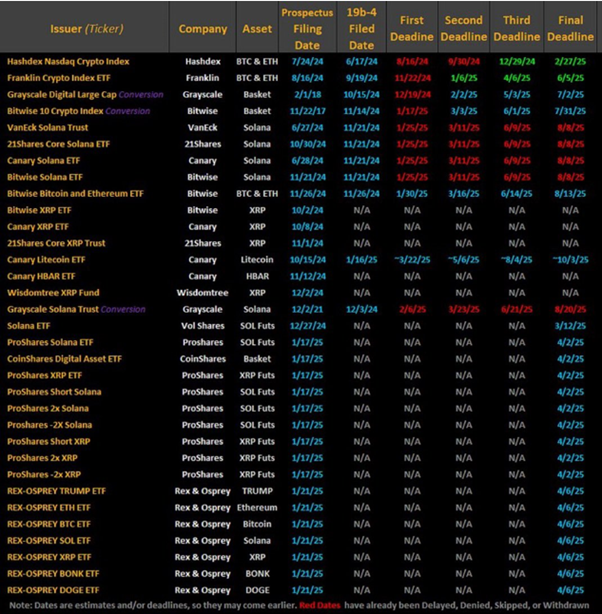

The number of these offerings is at an all-time high. The SEC has over 30 crypto ETF applications at the moment:

Source: SEC.gov.

Click here to see full-sized image.

Not all have impending deadlines. But look at the figures in red. Those are the ones that will need to be addressed soon. And that could have a substantial impact on the market.

And the first one up is …

Solana ETF May Be Days Away

Solana (SOL, “B”) has emerged as a prominent player in this bull market. It has outperformed both Bitcoin and Ethereum since mid-2023 thanks to its scalable and dynamic ecosystem.

In fact, my colleague Juan Villaverde believes SOL is ready to stand next to those two as one of three crypto dominators. To learn more about his Solana outlook, I suggest you watch his latest briefing.

And you may want to watch it sooner rather than later. Because the first SOL ETF deadline is coming later this week, on Jan. 25.

If the SEC chooses to defer its decision until the next deadline — which is very likely — SOL is expected to pull back from its current price. This could present a purchase opportunity if you’ve been looking to load up on SOL.

Because a deferment means we’ll go through the process again come March 11. And renewed speculation then could improve sentiment … and prices.

Other Notable ETFs on the Docket

Solana is definitely the application most eyes are on. But, as you can see, it is far from the only one.

Other notable application types include …

- XRP ETFs: Following XRP’s (XRP, “B+”) legal victories over the SEC, it is looking to the future. Funds from 21Shares, WisdomTree and Bitwise target its stronghold in payments and cross-border transactions. The three have various deadlines, but they all roughly land in mid-2025.

- Basket ETFs: For those seeking diversified exposure, basket ETFs combine multiple cryptocurrencies into a single fund. Examples include offerings such as the Grayscale Digital Large Cap Conversion and Bitwise 10 Crypto Index.

- Memecoin ETFs: The wild world of memecoins may gain legitimacy if a meme ETF gets approved. These might appear to be novelty investments. And the issue of memecoin volatility is still one any investor should seriously consider. But their inclusion underscores the extensive development of the ETF market.

Closing Thoughts

From Solana ETFs and XRP funds to Trump-themed financial products, 2025 is anticipated to be a significant year for cryptocurrency.

The early stages of Trump's administration have already indicated potential for substantial changes, with a perceived pro-crypto stance likely to foster innovation and attract investment.

With important deadlines and regulatory decisions on the horizon, this year is expected to be highly eventful for cryptocurrency enthusiasts and investors.

That means it’ll be more important than ever to stay connected with all things crypto. For that, be sure to check in with us here at Weiss Crypto Daily for the latest actionable updates.

Best,

Mark Gough

Tidak ada komentar:

Posting Komentar