January 21, 2025

Trump's Era Begins with a Bang for Bitcoin & Memes

Dear Subscriber,

|

| By Dawn Pennington |

Yesterday marked an explosive new chapter in both crypto and U.S. history.

Bitcoin (BTC, “A-”) soared to an all-time high of $108,784 just hours after now President Donald Trump’s inauguration yesterday.

The crypto momentum accelerated dramatically when Donald Trump made an unexpected entry into the digital asset space late Friday with the launch of his latest memecoin, Official Trump (TRUMP, Not Yet Rated).

Its performance in just a few short days — surging an extraordinary 27,000% to reach a fully diluted valuation of $50 billion — stunned market observers.

Price action of TRUMP from launch to date. Source:

CoinGecko Click here to see full-sized image.

A trading frenzy ensued.

Investors shifted capital from other cryptos into TRUMP, causing its market caps to swing by billions of dollars within minutes.

The surge in market activity was enough to drive Coinbase's app to No. 21 in global App Store rankings.

The digital asset landscape saw further disruption with the subsequent launch of Melania Meme (MELANIA, Not Yet Rated).

Despite featuring less favorable tokenomics, it quickly achieved a fully diluted valuation of $8 billion.

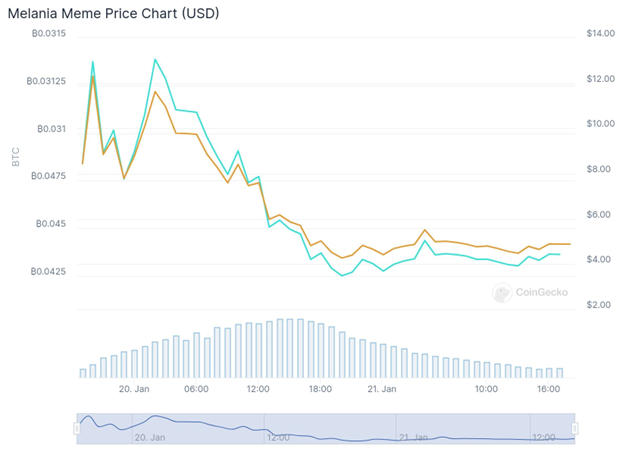

MELANIA (blue line) vs. Bitcoin, last 24 hours. Source: CoinGecko.

Click here to see full-sized image.

The introduction of MELANIA created an interesting dynamic.

It drew lots of liquidity away from TRUMP.

Ultimately, though, both MELANIA and TRUMP show the strong market appetite for Trump-branded digital assets.

Quick traders and those interested in the memecoin sector may want to keep an eye on this sub-narrative.

As always, our Weiss crypto experts urge caution when it comes to memecoins in general — and with newly created ones like these in particular.

Their volatility and lack of fundamental value make them tricky to trade.

As Juan Villaverde reminds his New Crypto Wonders Members, “Don’t bet the farm on a memecoin.”

Good thing there are plenty of other investable options out there.

Other Cryptos Set to Feel the Trump Effect

When we start to see real liquidity pour back into the market, the choice of Solana (SOL, “B”) blockchain for TRUMP and MELANIA will likely prove even more beneficial for the Layer-1.

After all, it has already driven SOL's price to an all-time high of $293 as retail investors flock to its trading platforms to check out these launches.

This high-profile technical validation has sparked speculation about Solana's growing institutional appeal. Some analysts even suggest this could lead to a potentially accelerated timeline for a Solana ETF approval.

But it’s not the only blockchain for the Trump family.

In fact, they are grabbing more exposure to the crypto space through World Liberty Financial (WLFI, Not Yet Rated).

The venture is focused on building a blue-chip portfolio in the DeFi space. And it critically represents a more institutional approach to cryptocurrency investment.

Many believe — and hope — it can act as a bridge between traditional and decentralized finance.

It Already Has Backing from Within the Crypto Community

Tron (TRX, “C+”) founder Justin Sun, for example, boosted his investment in the project by $45 million to bring his total commitment to $75 million.

World Liberty Financial’s broad portfolio is now valued at $325 million. It includes significant positions in ETH, TRX, and Aave (AAVE, “C+”).

On-chain analysis reveals WLFI's aggressive accumulation strategy.

Its latest notable move was made just yesterday as WLFI acquired $6.66 million in Chainlink (LINK, “B-”) and $5.54 million in Ethena (ENA, Not Yet Rated).

World Liberty Financial is clearly in prep mode. It is setting itself up for a wave of adoption.

Not surprising when you consider that inauguration euphoria helped the market see inflows of about $2.2 billion last week.

Bitcoin naturally took the lion’s share at $1.9 billion, while Ethereum (ETH, “A-”) attracted $246 million.

This interest extends to venture capital.

The recently ended quarter marked a decisive shift in investment patterns for VCs.

According to Galaxy Research, VC funding in crypto and blockchain startups reached $3.5 billion across 416 deals.

That’s a 46% quarter-over-quarter increase and a two-year high.

Looking ahead, institutional investors will closely monitor any potential policy shifts that could reshape the crypto landscape and grant even more accessibility to institutions.

But don’t expect any quick returns on that front. Policy change is a slow beast.

2 Near-Term Catalysts

For those who have an itchy trading finger, don’t worry.

There are more immediate catalysts loom on the horizon that may offer short-term boosts while we wait.

These include …

- The SOL ETF: Four Solana ETF applications have deadlines later this week. That doesn’t mean they will get approved. But as the Bitcoin ETF approval process proved, any bullish indication could provide short-term momentum for the market. The next deadline will come in March.

- More Global Liquidity: The Bank of Japan has a crucial interest rate decision later this week. And, as Juan Villaverde loves to point out, global liquidity is the life force of the markets.

Still, the convergence of political and institutional factors is likely more significant for the longer term.

And, for those willing to wait, it sets the stage for what could be a defining moment in cryptocurrency's adoption.

3 Things You Can Do Right Now

It’s time to decide which strategy best suits you for your crypto journey.

HODLing — or “holding on for dear life,” in cryptospeak — is just one approach.

It is an easy one in theory. Though holding for long periods of time can be challenging.

You can also try to time the market to get the most out of quick trades.

This method requires constant vigilance and a degree of comfort when it comes to navigating crypto.

Another option is to target the DeFi sector’s high yields.

Right now, TradFi yields are in a death spiral …

- Money market rates average a paltry 0.6%

- Bank CDs rates are at 1.75%

- And S&P yields at a two-decade low of 1.18%

But at the same time, my colleague Marija Matić has been able to target an average APY of 315% for her Crypto Yield Hunter Members.

And if policy changes do come sooner rather than later, they could open up entire new avenues of opportunity for DeFi yield seekers.

To learn more about this strategy, watch Marija’s recent Superyield Income Summit. In it, she breaks down all the details behind her strategy’s success … and how you can use it for yourself.

To your health and wealth,

Dawn Pennington

Editorial Director

Tidak ada komentar:

Posting Komentar