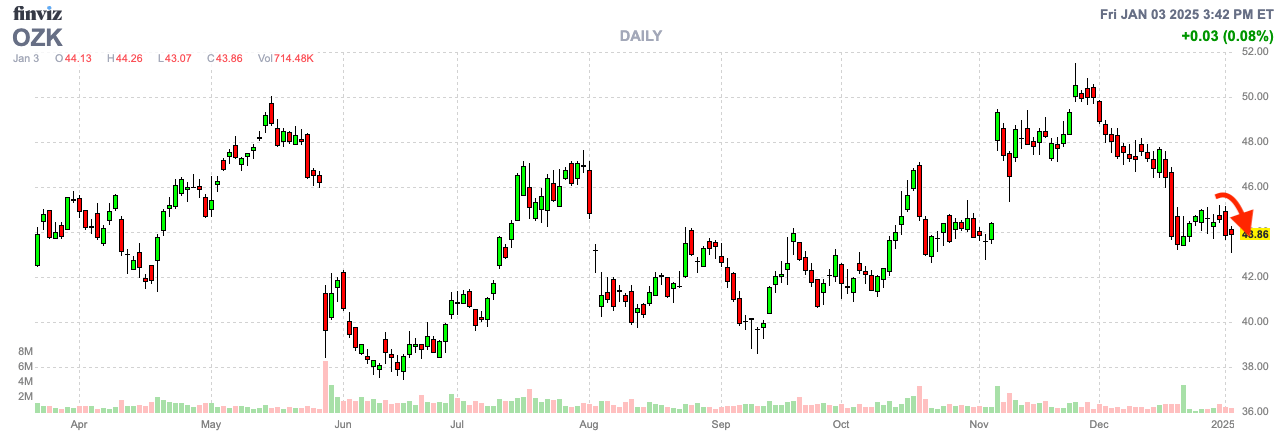

A Sneak Peek Into Belanger’s Premium Market Moves—Get a Taste of the Insider Edge Dear Options Insider, On a crisp spring morning in 1979, in the heart of Little Rock, Arkansas, a 25-year-old named George Gleason walked into a bank—not as a customer, but as a buyer. A fresh law graduate with no banking experience, armed with little more than a $10,000 down payment and a dream, negotiating to purchase the struggling Bank of the Ozarks. His pitch? Gleason offered to use his family’s farm and a trust fund as collateral to secure the $3.6 million deal. It was audacious, borderline reckless, and downright unconventional. And it worked. But that was only the beginning of the story. Gleason didn’t inherit a thriving institution; he bought a bank on the brink. With no background in finance, his office soon resembled a makeshift classroom. Stacks of regulatory manuals and financial textbooks cluttered his desk as he taught himself the intricacies of banking. Each day was a lesson in survival, and each decision carried enormous stakes. Yet, through grit and determination, Gleason turned his modest purchase into a behemoth. Over the next four decades, Bank OZK grew to hold over $30 billion in assets, becoming synonymous with bold bets and unconventional strategies. One such strategy was its unwavering focus on commercial real estate loans. While other banks diversified, Bank OZK doubled down, shunning syndicated loans to maintain direct control. This approach earned them accolades during boom years, as their carefully managed portfolio delivered outsized returns. Gleason’s mantra of excellence over size propelled the bank to heights no one could have predicted back in 1979. But every bold strategy comes with risks, and today those risks are mounting. Rising interest rates, tightening economic conditions, and cracks in the real estate market are exposing vulnerabilities that even Gleason’s meticulous management cannot shield entirely. The very bets that built Bank OZK’s empire are now under scrutiny. And that’s where we come in. Today, Bank OZK finds itself at a critical juncture, and our Bear Plunge Trigger is lighting up. This isn’t just a trade; it’s an opportunity to act decisively amid uncertainty. The Bear Plunge Trigger Imagine standing at the edge of a cliff, watching a massive boulder teeter on the brink. All it takes is one final nudge, and gravity does the rest, sending it hurtling downward. The Bear Plunge Trigger identifies these moments in the market—those critical points where selling pressure builds to a tipping point, and a stock begins its accelerated descent. This strategy isn’t about guesswork or speculation. It’s rooted in years of data, recognizing repeatable patterns that signal when the probabilities of further downside are highest.

Why Bank OZK? Let’s take a closer look at the factors putting Bank OZK in the spotlight. The bank’s success has long been tied to its strategy of avoiding syndicated loans in favor of direct control over its commercial real estate portfolio. This approach worked wonders during periods of economic stability, but as rates rise and property values come under pressure, it’s becoming a double-edged sword. The concentrated risks in its portfolio are starting to weigh heavily. Recent technical signals underscore the growing vulnerabilities:

This combination of technical and fundamental weaknesses makes Bank OZK a textbook candidate for the Bear Plunge Trigger. The boulder is teetering, and the plunge is imminent. Trade Setup Details Here’s how we’re positioning ourselves to capitalize on Bank OZK’s potential decline:... Subscribe to Belanger Trading to unlock the rest.Become a paying subscriber of Belanger Trading to get access to this post and other subscriber-only content. A subscription gets you:

|

Jumat, 03 Januari 2025

Trade Alert: 505% Bear Plunge Triggered in Bank OZK – Act Now!

Langganan:

Posting Komentar (Atom)

Tidak ada komentar:

Posting Komentar