This ETF Holds SpaceX Shares …

Time to Buy? |

Money & Markets Daily,

In 2008, SpaceX launched its first rocket, the Falcon 1, into space, where it reached orbit.

Not bad, considering it was founded six years earlier.

Since then, the company has docked a spacecraft with the International Space Station (ISS), released Starlink internet satellites into orbit, became the first private company to send humans into space and sent an all-private crew to the ISS.

Like many innovative companies, investors have been chomping at the bit to get a chance to buy into what has become the preeminent leader in space exploration.

The problem?

SpaceX is a private company … it's not publicly traded, making it next to impossible for Main Street investors to get a piece of the action.

However, what if I told you there was now a way to invest in SpaceX?

I’m going to share this unique opportunity with you in…

Three…

Two…

One!

| Imagine being able to see through brick walls.

Well, thanks to a mind-blowing military technology, American troops could soon possess the gift of bionic vision.

Deemed “poised for mission use” by the Department of Defense…

It even has the potential to “see” concealed nuclear materials.

With a ton of commercial applications, too, now’s the time to invest in the underlying technology that enables the military’s device.

Informed investors have a shot to top some of the market's biggest winners lately.

Click here for the urgent details >> |

One Small Step for Potential SpaceX Investors

In August 2024, a relatively unknown fund manager — ERShares — decided to convert its U.S. large-cap exchange-traded fund (ETF) to focus on large-cap “entrepreneurial” stocks based on various investment factors and macroeconomic themes.

The new ETF was transformed into the ERShares Private-Public Crossover ETF (XOVR).

In December 2024, XOVR became the first ETF to hold private shares of SpaceX.

Now, the details of how the fund actually owns the shares is unknown, but in other cases, asset managers have run a pooled fund that has shares in a private company.

ERShares founder told Bloomberg that the fund owns SpaceX shares through a “special purpose vehicle” but provided no other details.

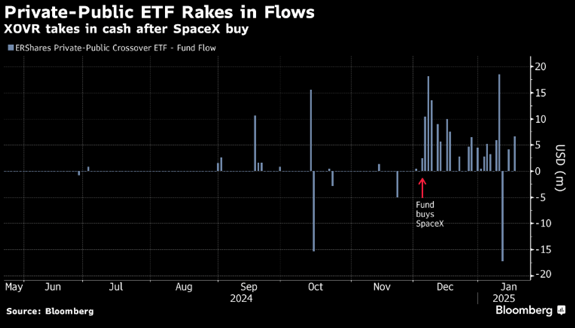

Now that Wall Street has caught wind of this rare circumstance, money has been piling into XOVR.

(Click here to view larger image.)

Since adding SpaceX, the ETF has received more than $120 million in inflows, nearly doubling its assets in just a month.

As I write, SpaceX makes up 8.1% of the ETF’s holdings — the largest percentage of any 32 stocks held in XOVR. It’s also the first private holding since changing its structure in August.

For reference, the top five holdings in XOVR are:

- SpaceX — 8.1%.

- Alphabet Inc. (GOOGL) — 6.1%.

- Nvidia Corp. (NVDA) — 5.3%.

- Meta Platforms (META) — 4.6%.

- Oracle Corp. (ORCL) — 4.3%.

In the last 12 months, the ETF has been on a solid run:

XOVR Up 44% in 12 Months

(Click here to view larger image.)

As a smart investor, you should ask yourself: Does this momentum and the addition of SpaceX make XOVR a strong consideration for my portfolio?

For that, we can turn to Adam O'Dell’s Green Zone Power Ratings system.

| Tech monsters like Apple, Amazon, Microsoft and many more can no longer avoid doing business with this one company that trades for less than $5...

All of them are held "hostage" by the "Patent King" CEO's brilliant business tactics.

And what's even crazier...

Is that his tactics reach all the way to the public.

He intentionally set up his company's stock under a secret trade name...

Did he fool you too?

Click here to see more. |

XOVR: Not Bad, but Not Great

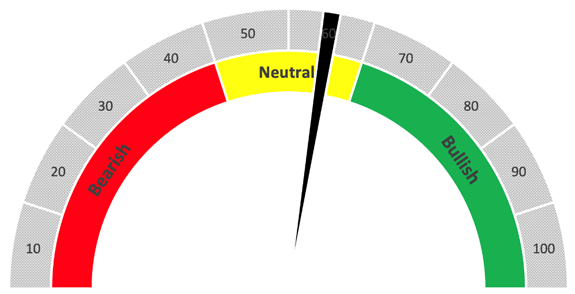

I ran all of XOVR's holdings through the Green Zone Power Ratings system in what I call an ETF X-ray.

This allows me to break down each individual’s holding and take a snapshot of the health of the entire ETF.

XOVR Rates “Neutral”

XOVR earns a “Neutral” 54 out of 100 on the Green Zone Power Ratings system … not bad, but not Earth-shattering.

In terms of individual holdings, the ETF is pretty balanced.

Three of the 29 trackable holdings are “Strong Bullish,” while eight are rated “Bullish.”

Likewise, three earn a “High-Risk” rating, and four are “Bearish.”

The rest fall right in the middle at “Neutral.”

On the two extremes of the Green Zone Power Ratings scale:

- United Therapeutics Corp. (UTHR) is the highest-rated with a "Strong Bullish" 97 out of 100.

- DraftKings Inc. (DKNG) is the lowest-rated with a "High-Risk" 3.

And of note, SpaceX stock does not rate in our system since it is still a private company. We don't have access to the numbers to accurately give the stock a score.

Aside from holding private shares of SpaceX, this is a vanilla ETF based on the Green Zone Power Ratings system.

And, if you are considering jumping into XOVR for exposure to SpaceX stock, remember that the more people who do that, the more diluted the holding becomes… The only way to avoid further dilution is for either the fund manager to acquire more shares or for other investors to sell their XOVR shares (that doesn't seem likely without a massive crash).

The bottom line is that if XOVR is still an interesting proposition to you, exercise caution.

That’s all for me today. Have a great weekend!

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets Daily

Check Out More From Money & Markets Daily:

Tidak ada komentar:

Posting Komentar