In partnership with | | The Week Ahead Of Us 🔍 | Welcome back! | This is a jam packed edition as DeepSeek has rocked the AI landscape, with Nasdaq futures down -1.2% currently. If you don't know what DeepSeek is yet, we'll get into it below. | Let's get into it. | Here's a look at earnings this week. | Monday: AT&T, Progressive Tuesday: Raytheon Technologies, Stryker, Boeing, Lockheed Martin, General Motors Wednesday: Microsoft, Meta, Tesla, T-Mobile, ServiceNow, IBM, Alibaba, Danaher, ADP, Starbucks, General Dynamics Thursday: Apple, Visa, Mastercard, Blackstone, Thermo Fisher, Caterpillar, Comcast, UPS, Intel, Altria, Northrop Grumman, Southwest, U.S. Steel Friday: Exxon Mobil, Abbvie, Chevron, Eaton

| Here's a look at economic data this week. | Monday: New home sales (671k) Tuesday: Durable goods orders (0.7%), Consumer confidence (106.3) Wednesday: FOMC interest-rate decision, Fed Chair Powell press conference Thursday: GDP (2.5%), Initial jobless claims (225k) Friday: Personal income (0.4%), Personal spending (0.5%), PCE index (0.3%, 2.6% y/y), Core PCE index (0.2%, 2.8% y/y)

| | A Message from Brex | Brex understands the importance of making every dollar count for growing companies. | Designed to scale with businesses of all sizes—from fast-growing startups to global enterprise leaders—Brex offers a comprehensive platform that includes modern corporate cards, banking, treasury solutions, bill pay, accounting, travel, and expense management. | With no minimums, access to 20x the standard FDIC protection via program banks, and industry-leading rewards from the first dollar spent, Brex empowers businesses to save, spend, and grow efficiently. | If you want to ensure your portfolio companies have the tools they need to manage and grow their capital, check out Brex here. | | | The Main Story 🔍 | The Chinese AI Company that has shocked American firms: Introducing DeepSeek, China's answer to ChatGPT that supposedly only took 55 days to make and cost $5.5mm to train. This compares to models typically costing $100mm-$1B to train. | Even more "insulting", is the fact this was initially more of a side-project of Liang Wenfeng, a Chinese Hedge Fund Manager running a $8B fund called High-Flyer. | DeepSeek-R1 was launched on January 20th and is raising alarm bells across the Tech industry. DeepSeek beats OpenAI on metrics such as math and reasoning, while also costing significantly less to develop. The Company reportedly used 2,000 Nvidia chips to train its V3 model, much less than firms who have been using tens of thousands of chips for training. |  | Deirdre Bosa @dee_bosa |  |

| |

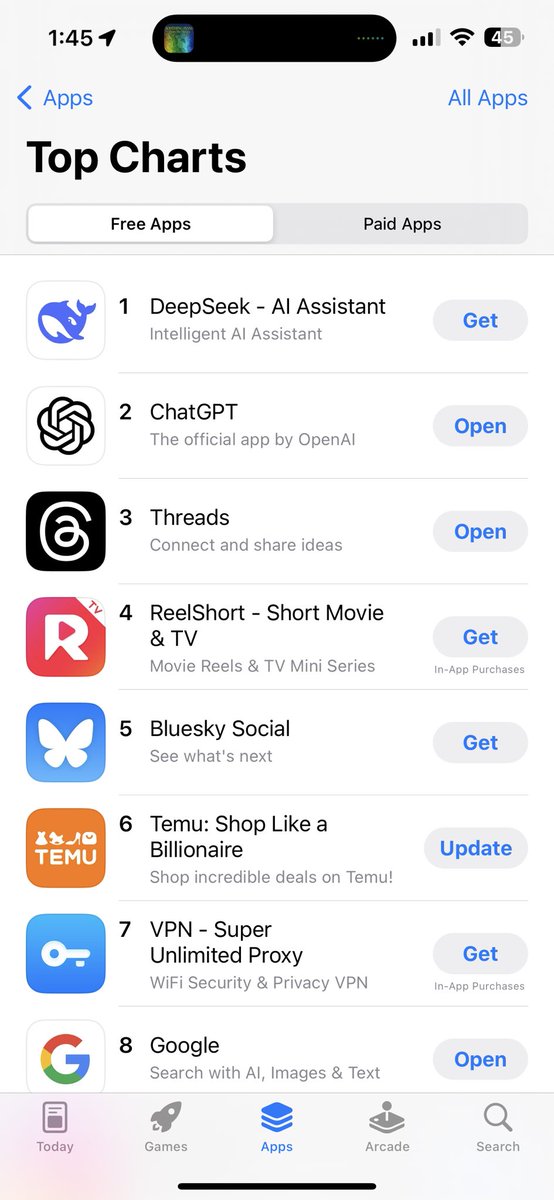

👀 DeepSeek now #1 in App Store, ahead of ChatGPT | |  | | | 9:47 PM • Jan 26, 2025 | | | | | | 34 Likes 6 Retweets | 8 Replies |

|

| DeepSeek is open-source, as opposed to proprietary, and has quickly gained in popularity. The success, speed, and cost, if true, is alarming (and amazing) the market. Several industry participants are calling DeepSeek the best AI model on the market. |  | Marc Andreessen 🇺🇸 @pmarca |  |

| |

Deepseek R1 is one of the most amazing and impressive breakthroughs I've ever seen — and as open source, a profound gift to the world. 🤖🫡 | | | 9:19 AM • Jan 24, 2025 | | | | | | 33.9K Likes 3.6K Retweets | 1.1K Replies |

|

| If this is all true, then this draws a significant amount of questions regarding 1) the valuation of AI startups, 2) the gains we've had in the U.S. stock market, and 3) The US's standing in the "battle" to build great AI. |  | Holger Zschaepitz @Schuldensuehner |  |

| |

China's #DeepSeek could represent the biggest threat to US equity markets as the company seems to have built a groundbreaking AI model at an extremely low price and w/o having access to cutting-edge chips, calling into question the utility of the hundreds of billions worth of… x.com/i/web/status/1… | |  | | | 9:49 PM • Jan 24, 2025 | | | | | | 17.2K Likes 3.33K Retweets | 930 Replies |

|

| | Earnings Corner 📜 | Trending Up 📈 | GE Aerospace (GE) reported earnings that substantially beat estimates, with revenue of $10.81B (vs. $10.01B expected) and EPS of $1.75 (vs. $1.10 expected). The revenue outperformance was driven by the commercial engines and services segment, which saw revenue of $7.65B (vs. $7.39 expected). Mgmt. projects low double-digit revenue growth in FY 2025, with EPS of $5.10-$5.45. The stock was up 4.5% at Friday's close | Verizon (VZ) reported earnings that narrowly beat estimates. The telecom giant saw wireless services revenue grow 3.1%, while acquiring 568k new postpaid phone subscribers (vs. 479k expected). The firm also added 373k new fixed wireless broadband customers. Mgmt. projected wireless service revenue to grow 2.4% in 2025, in line with analysts' expectations. The stock was up 0.6% at Friday's close | NextEra Energy (NEE) reported earnings that beat estimates, while missing on revenue. The stock was up 5.2% at Friday's close | Trending Down 📉 | Texas Instruments (TXN) reported earnings that beat estimates, with revenue of $4.01B down 1.79% y/y (vs. $3.87B expected) and EPS of $1.30 (vs. $1.23 expected). However, investors were disappointed by mgmt.'s Q1 revenue projections, which were only in line with expectations, as industrial and automotive demand for TXN's analog chips remains weak. TXN's analog segment has suffered in the wake of the pandemic, when many customers stockpiled excess chips. Mgmt. also noted that the company is facing an investigation from China's commerce ministry into its subsidies from the U.S. government. The stock was down 7.5% at Friday's close | American Airlines (AAL) reported earnings that beat estimates. However, mgmt.'s Q1 projections surprised analysts, as they forecast a loss of $0.20-$0.40 per share (vs. $0.04 expected). While revenue is expected to grow, higher non-fuel costs are projected to eat away most of those gains. The stock is down 10% at Friday's close | American Express (AXP) reported earnings in line with expectations. Mgmt. noted that the firm saw record levels of member spending, record fee revenue, and a record acquisition of 13MM new members over the holidays. They projected 2025 revenue growth of 8%-10% (vs. 8.2% expected) and EPS in line with estimates. The stock was down 1.7% at Friday's close | Intuitive Surgical (ISRG) reported earnings that beat estimates. However, FY gross margin projections of 67%-68% missed the estimated 69%. The stock was down 4% at Friday's close | | More Headlines 🍿 | OpenAI officially launched Operator, an AI agent that can take control of a browser and perform tasks. Operator is part of OpenAI's $200/month Pro plan, with positive early reviews thus far. If agents such as Operator gain mass adoption, there are significant productivity gains on the table, but also concerns this will replace jobs X Debt is finally getting syndicated. Debt used to take X, formerly known as Twitter, private is finally being offloaded off of bank balance sheets. Up to $3B of debt will be sold to credit investors, with a price range between 90 to 95 cents on the dollar expected. X debt has been "hung" for more than 2 years, with limited investor appetite to buy the loans and bonds Colombia vs. Trump. A travel ban, visa revocations on Colombian government officials, and 25% tariffs on all goods coming into the U.S. from Colombia were declared immediately, with a rise to 50% if Trump's demands aren't met. Columbia's President has since imposed 25% tariffs on US imports. Colombia's three biggest exports are oil, coffee, and cut flowers. It appears Colombia will be leveraging their presidential aircraft to assist in migrant deportation, but the tic for tac tariffs game is on TikTok may have a buyer within 30 days, with Oracle and other U.S. investors looking to take control on the U.S. unit. Trump has denied this, but there's other large investors hanging around the hoop Meta is bumping its CapEx guide to $65B, well above estimates of ~$51B. The bulk of additional spending will go towards expanding the company's AI infrastructure as it seeks to outcompete OpenAI and Google No more taxes on tips: Trump announced at a Las Vegas rally that "if you're a worker [who] relies on tipped income … Your tips will be 100% yours." The President repeatedly pledged to secure tax-free tips throughout the campaign as part of a broader range of initiatives, including lowering the corporate rate and exempting overtime from taxation LLMs are burning the midnight oil: The manager of the country's largest electrical grid projected that peak summer power demand will be 38% higher this year, driven by computing processes. The AI boom will reportedly require the equivalent of two New England size networks over the next decade The CIA calls out Beijing: In an updated assessment, the CIA announced that COVID-19 may have leaked from a Chinese laboratory. In a Saturday statement, the agency said that it had "low confidence" that the virus originated in a research facility Double confirmations: Pete Hegseth was selected as Defense Secretary, thanks to J.D. Vance's tie-breaking vote, and Kristi Noem as Homeland Security head Trump says he will "demand that interest rates drop": The President claimed that he has a better understanding of monetary policy than JPow or the Fed Government blockchain? Elon Musk, head of DOGE is leading an effort to strengthen the digital asset ecosystem. Musk reportedly sees a digital ledger as a means of cutting down the Federal bureaucracy and reducing fraud Steve Schwarzman's Spending Spree: Blackstone's founder roiled the UK art market with his record purchases of 18th-century portraits. Having received an honorary knighthood last year, Schwarzman is restoring a 2,500 acre estate in Britain New oil partnerships in Eastern Europe: Volodymyr Zelensky announced on Saturday that Ukrainian infrastructure could be used to transport gas from Azerbaijan to Europe. Kyiv had shut down a 50+ year old route in December driving up pressure for members of the former Soviet Bloc including Slovakia and Hungary ICE has been given expanded powers: Accelerating what Trump promised to be the largest mass deportation in American history, military planes are being used to transport immigrants around and out of the country. The Administration has rapidly expanded ICE and border patrol authority, now allowing arrests in churches and schools A new biography of Masayoshi Son tracks the SoftBank Group founder's story from his father's origins as a pig farmer, to a meeting with Steve Jobs, to the acquisition of Arm and beyond Venture Global's IPO disappointed: The LNG exporter initially aimed for a market value greater than giant BP ($110B). Even after scaling down its offering to $60B, Venture Global dropped below its listing price on Friday. Both founders made $24B How Private Credit is driving Tech Firms to stay private: Clario and Databricks are among the fast-growing companies leveraging the private credit markets for financings. Many companies are delaying their IPO timelines due to the soft IPO market MidOcean's bets on its own CLO Equity drove 25% returns in 2024, an outperformance from the range of 8%-21% returns that CLO equity investors saw last year Sky Island raised a $300mm LMM PE fund to acquire small manufacturers UnitedHealthcare has named Tim Noel, their medicare chief, as their new CEO Housing sales hit a 30 year low due to high rates and low inventory The Buyside Hub Job Board is Live: Looking for a job in Finance? Join Buyside Hub to access the Job Board for free.

| | M&A Transactions💭 | Smartsheet, a provider of collaborative work management software, was acquired for $8.4B by Blackstone, Abu Dhabi Investment Authority, and Vista Equity Partners. EV/Revenue was 7.75x. Qatalyst Partners, Innisfree M&A advised on the sale. | Oil Refinery Assets of Ovintiv were acquired for $2.0B by FourPoint Energy. Bank of America and Jefferies advised on the sale. | Minimalist, manufacturer of skincare and haircare products, was acquired for $338.55M by Hindustan Unilever. EV/Revenue was 6.26x. | First Chatham Bank, operator of a community bank, has reached a definitive agreement to be acquired for $103.6M by Cadence Bank (NYS: CADE). Janney advised on the sale. | Wingify, developer of visual website optimizer platform, was acquired for $200.0M by Everstone Capital. EV/Revenue was 5.8x. | Universal Stainless & Alloy Products, manufactures and markets semi-finished and finished specialty steel products, was acquired for $539.0M by Aperam (LUX: APAML). EV/EBITDA was 8.89x and EV/Revenue was 1.65x. TD Cowen advised on the sale. | Potomac Energy Center, provider of energy generation services, has entered into a definitive agreement to be acquired for $1.0B by Blackstone. | Nimble Therapeutics, developer of oral peptide therapeutics, was acquired for $200.0M by AbbVie (NYS: ABBV). | Alphabet (NAS: GOOGL) has reached a definitive agreement to acquire a Part of Extended Reality XR Unit of HTC (TAI: 2498) for $250.0M. | Easybrain, developer of mobile games, was acquired for $1.2B by Miniclip, a subsidiary of Tencent Holdings (HKG: 00700). Aream & Co. advised on the sale. | Hitachi Zosen Fukui, manufacturer of press machines, reached a definitive agreement to be acquired for $112.58M by Amada (TKS: 6113). | Private Placement Transactions💭 | Anthropic, developer of large language model platform, raised $1B of venture funding from Alphabet (NAS: GOOGL). | Tune Therapeutics, developer of an epigenetic programming platform, raised $182.41M of Series B and Series B2 venture funding led by Hevolution Foundation, Regeneron Ventures, and Yosemite at a pre-money valuation of $157.4M. | Stackblitz, developer of website development software, raised $105.5M of venture funding led by Emergence and Ghosal Ventures. | Predictiv, developer of personal genomics systems, joined Tech Incubator Program for Startups and received $1.7B in funding in the form of grant. | Neko Health, developer of medical scanning technology, raised $260.0M of Series B venture funding led by Lightspeed Venture Partners at a pre-money valuation of $1.54B. | Moniepoint, developer of a financial ecosystem, raised $120.0M of Series C venture funding led by Development Partners. | Infra.Market, developer of an online procurement marketplace, raised $121.97M of Series F and Series F1 venture funding led by Tiger Global Management. | | Odds of the Day 🍒 | Sports Trading is now legal in all 50 states on Kalshi: | | New Traders on Kalshi receive a $20 bonus of trading credit when depositing $100+ with the code "HYH". | | Noteworthy Chart 🧭 | A look into why China remains so important to Apple's share price: | | | | | Meme Cleanser 😆 |  | Aravind Srinivas @AravSrinivas |  |

| |

New OpenAI | |  | | | 7:42 PM • Jan 25, 2025 | | | | | | 10K Likes 611 Retweets | 218 Replies |

|

|  | High Yield Harry @HighyieldHarry |  |

| |

Our Special Sits team explaining what they do all day | |  | | | 1:50 PM • Jan 23, 2025 | | | | | | 533 Likes 12 Retweets | 8 Replies |

|

| Finance Merch Referrals ☕️ | | Until next time! | | Housekeeping Items: | Our Weekly Poll: | How are we doing?Tell us how we're doing and any feedback you have | | Finance Jobs: Looking for a job in Finance? Join Buyside Hub to access the Job Board for free. | Recruit for Private Equity: Check out Peak Frameworks through us, the Private Equity Course that has placed thousands of students into elite private equity shops. | Join beehiiv: Looking to start your own newsletter? Join beehiiv through us and you'll get 30 days free and 3 months of a 20% discount. | | Obviously, none of this constitutes financial or investment advice. |

|

Tidak ada komentar:

Posting Komentar