|

|

TODAY'S TOP ALERT! |

Viszla Silver Corp (NYSE: VZLA) |

|

Rise and shine, Folks! |

It's a new trading day, and right now, the markets look like they will keep up the momentum that began after yesterday's open. |

The producer price index just released, and the consumer price index will be out tomorrow, buffeting the indexes, but I'm ignoring the winds and looking for small, standout stocks that are likely to outperform. |

I've had great success doing so over the last two weeks. All five of my "tactical" ideas have gone on to make double-digit, same-day moves… |

Last Tuesday's was a 23% jumper… Wednesday's was 16%... and Friday's moved 29%, making it one of the top movers in the entire market that day. |

Yesterday, I alerted two ideas. One soared as high as 27%, and the other climbed a respectable 11% to make a new 52-week high (and it's up 7% in the pre-market as of this writing). |

Without further ado, my "tactical trade" idea today is Vizsla Silver Corp. (VZLA). |

This mineral exploration and development stock has been doing very well for itself… |

It's up 40% in the past year, with a 10.5% gain to kick off 2025. |

What's caught my attention — and why I think you should get this stock on your radar right now — is that it announced pivotal, game-changing news last Monday. |

The news led to a same-day, 16% hike that was sustained through yesterday's open. |

The stock pulled back a bit yesterday and is now at a great place to visit for the first time if you haven't looked at it already… |

|

Make sure you keep a close watch on this at the $1.85 level. That is where I think support needs to continue to hold up. Otherwise, this might continue in a downtrend. |

With the strong tailwinds of high silver & gold prices, recent analyst upgrade, and massive news, VZLA could stand out again in today's market. |

👉 VZLA is TODAY'S #1 ALERT 👈 |

I hope you spend time doing your own research on VZLA today, there is a lot to unpack here. |

Let me explain… |

VZLA is a Vancouver-headquartered company focused on advancing its flagship, 100%-owned Panuco silver-gold project located in Sinaloa, Mexico. |

The project is an especially rich source for silver, and I didn't realize this, but Mexico is the world's largest producer of the precious metal. |

And while many are familiar with gold's runup in 2024, its unsung little brother had a 21% runup last year and a 3% gain so far this year. |

Aside from usual demand for silver for monetary/investment purposes and jewelry/silverware, there has been a huge rise in demand for silver around solar panels and electrification: |

|

This has resulted in a big deficit in silver supply, with very few new projects coming online: |

|

The company says that its Panuco Project "represents the world's largest undeveloped high-grade silver primary resource," which it is advancing on a "fast track to production," targeting first silver in the back half of 2027. |

It has a vision "to become the world's largest single asset silver primary producer." |

In 2024, the company tripled its land package, which now stands over 17,000 hectares (~42,000 acres). |

|

In July, VZLA released the Preliminary Economic Assessment (PEA) for Panuco which outlined an initial 10.6-year mine with 15.2 million oz. of silver equivalent (AgEq) in annual production. |

That gave the Project an after-tax net present value (at a 5% discount) of $1.1 billion, and 86% internal rate of return. |

These estimates were based on conservative prices for silver (US$26/oz) and gold (US$1,975/oz) and the resulting cash flow would mean a rapid, 9-month payback: |

|

VZLA CEO Michael Konnert says the PEA "indicates there's nothing like it in the silver development space. It'll be a top 5 silver equivalent producer globally." |

Then just last week, the company released huge news in the form of an updated Mineral Resource Estimate (MRE) for Panuco that showed vast increases from its January 2024 estimate. |

Specifically, the report found a 43% increase in combined measured and indicated mineral resources from 155.8 to 222.4 million ounces (Moz) of AgEq. |

It also found a 4.5% increase in global indicated grade, from 511 grams/ton AgEq (already a high level of mineral concentration) to 534. |

As the company's COO Simon Cmrlec — who has been involved in more than 40 mines — said in a January 9 webinar describing the MRE, the results were "more than we could have hoped for." |

The company's ongoing initiatives include a fully funded test mine to further de-risk the project, as well as a 10,000-metre discovery-based drill campaign. |

It is "planning to implement a dual-track approach of mine development and district-scale exploration at the same time" to help get it through first production. |

VZLA says it is "well-funded," with US$92+ million in cash and ITM options, and zero debt. |

It expects this to carry it beyond delivery of its Feasibility Study — a huge potential catalyst for a mineral exploration company — in the second half of this year. |

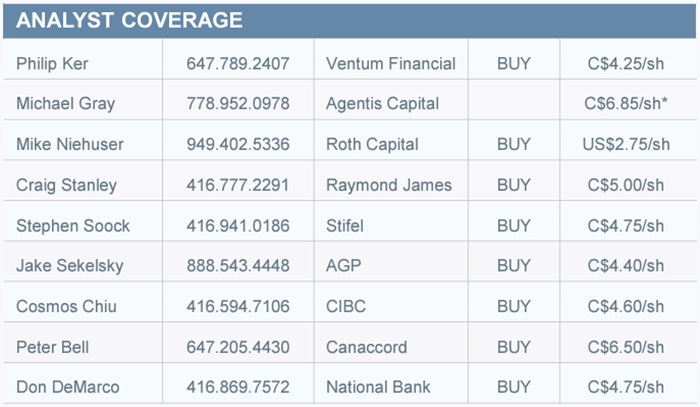

Given the magnitude of the Panuco Project — and VZLA by extension — it unsurprisingly has a lot of analyst coverage, including heavyweights such as Raymond James, Alliance Global, and RothMKM. All the analysts give VZLA a "BUY" rating: |

| (1 Canadian dollar = 0.70 USD) |

|

All told, their average 12-month price target is US$5.01 — a 164% upside from its current price. |

As you do your own research on VZLA, be sure to review the company website, this December 2024 investor presentation, this webinar from just last week, and this interesting October 18 interview with the CEO. |

As always, be sure to approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose. |

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration. |

Bottom line: VLZA has been on a 10% tear to kick off 2025, fueled by news of a 43% increase in combined measured and indicated mineral resources at its flagship project. |

The company is rapidly advancing the project, which has the potential to become a "top 5 silver equivalent producer globally." |

Will it add to my streak of double-digit winners? There's only one way to find out… |

Be sure VZLA is at the very top of your watchlist today so you catch all of the action! |

To Your Success, |

|

P.S. Make sure you join me and over 1000 traders in the Market Master's trading room today for live trading signals and education. You can access it at no cost right now. |

|

|

Questions or concerns about our products? Email Support@ragingbull.com © Copyright 2022, RagingBull |

|

|

*Just so you know, what you're reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let's be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren't what you'd call "typical." |

Just a quick heads up about this ad you're reading—as we've said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of we received thirty one thousand five hundred dollars (cash) from Sideways Frequency for advertising Vizsla Silver Corp for a one day marketing program on January 14, 2025. Prior to this, we received ten thousand dollars (cash) from Sideways Frequency for advertising Vizsla Silver Corp for a one day marketing program on December 18, 2024 in advance of writing the content above. This was paid by someone else not connected to Vizsla Silver Corp. It might be obvious, but whoever paid for this might own shares and is likely looking to sell some or all of them at any time after we send out this information, which might affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither RagingBull nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as our program ends, though that is not always the case. |

Now, diving right into Vizsla Silver Corp might sound exciting. But remember, it's like venturing into the wilderness—be aware that there's exceptional risk involved in trading. This isn't small potatoes we're talking about; you could lose every dime you put in, so always carefully think about what you're doing. That's why they call this trading, after all. We're shining a light on the good stuff about the company here, but it's on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r. |

Oh, that brings us to another crucial point—we're not here to tell you (or even recommend) what you should do with your hard-earned money. We're simply sharing our non-expert thoughts by highlighting some companies we like that could use some help telling their story to more people. We're obviously biased in our writing. We're not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as "forward-L00king statements" under the securities acts, so take those with a grain of salt. As with all forecasts, they're not set in stone, often wrong, and we certainly can't know where the Company's earnings, business, or share price will be tomorrow or a year from now. |

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can't wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who's licensed to give you real advice. To be clear, |

Neither Raging Bull nor its owners, employees, or independent contractors are registered as a secur1.ties br0ker-deale.r, br0ker, 1nvest.ment advis0r (IA), or IA rep's with the SEC, any state securities regulat0ry auth.ority, or any self-regulat0ry organization. |

So, that's the scoop! If you're intrigued and want to learn more about the companies we talk about, hit up the SEC's website to dig into their filings and see the full picture. |

Tidak ada komentar:

Posting Komentar