President Trump & the Art of the Tariff |

Money & Markets Daily,

The first day of the Trump White House has now come and gone with much pomp and circumstance.

As promised, President Trump spent his first day back in office signing a flurry of executive orders ranging from stepping up border security to pausing the ban on the popular social media app TikTok.

The mainstream media elected to place its crosshairs squarely on those orders pertaining to immigration.

But for my money, the biggest surprise among the dozens of orders signed were those relating to tariffs (or the lack thereof)…

Among Trump’s most provocative promises on the campaign trail were planned 25% tariffs on goods from Canada and Mexico. His tariffs were aimed at cracking down on illegal immigration and the flow of fentanyl into the United States.

He also discussed placing a tariff as high as 60% on goods coming from China.

Yet amid the flurry of executive orders signed during Trump’s first day in office, the onlyone relating to tariffs was somewhat vague — even though they did set a date of February 1 for tariffs to begin.

This hardly rules out the prospect of tariffs in the near future.

On the contrary, I believe the broad nature of Trump’s initial executive order could be a clear indication of what’s to come.

Let me explain…

| This company holds the AI 2.0 Key Elon Musk recently teamed up with Nvidia – and another, emerging tech titan to build a new AI mothership. A supercomputer so massive … it contains 100,000 units of Nvidia’s most advanced chip… Making it the biggest AI achievement to date. And you have a chance to get ahead of this massive AI story – BEFORE 99% of investors realize what’s coming. I’ve found a unique way for you to essentially “partner” with Elon as he continues building the world’s largest AI supercomputer.

Click here and see what Elon is planning. |

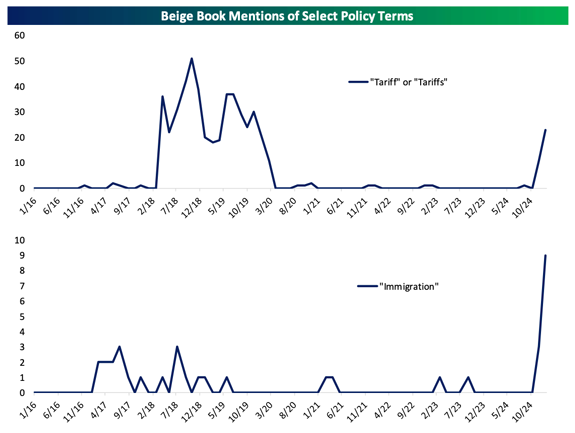

Chart of the Week: Tariff Talk Spikes

Eight times a year, the Federal Reserve issues its newest “Beige Book.”

This publication summarizes economic conditions across all 12 Federal Reserve districts, giving a snapshot of regional economic activity based on information gathered from companies within each district.

The Beige Book provides a unique and up-to-date glimpse at key macroeconomic trends and factors.

And the most recent release (from just two weeks ago) delivered some especially interesting data…

As you can see in the chart below, we’re now observing a sharp spike in mentions of both tariffs in immigration among major American companies:

(Click here to view larger image.)

A climb in immigration mentions was to be expected as this was a cornerstone of Trump’s campaign for the White House.

However, mentions of tariffs were the highest we’ve seen since 2018-2020.

Companies across the United States expressed a genuine worry about the potential tariffs proposed.

The reason is simple: Higher prices for importing goods mean higher prices for the companies that bring those goods in.

They either have to “eat” those higher costs — which they have done before — or pass those higher costs to consumers.

Businesses don’t want to do either, but the “Beige Book” noted a “greater difficulty passing costs on to customers.”

If they don’t pass it on, those potentially higher tariffs mean declining profit margins.

Here’s why:

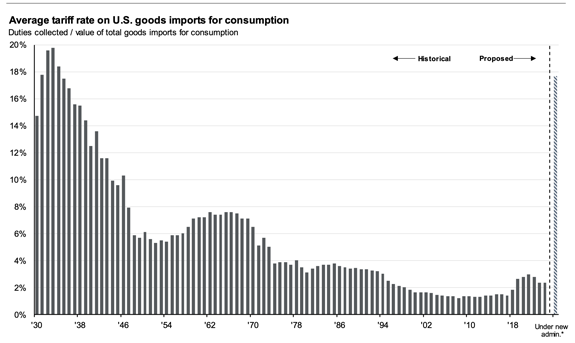

America’s Tariffs Were at Their Highest in the 1930s

(During the Great Depression)

(Click here to view larger image.)

Obviously, correlation doesn’t always indicate causation…

However, the Tariff Act of 1930 (aka the “Hawley-Smoot Tariff”) was historically seen as a key catalyst in deepening America’s Great Depression. It triggered a round of retaliatory tariffs and effectively exported America’s inflation worldwide.

Meanwhile, proposed tariffs under the new administration are estimated to be as high as 17% to 18% … taking us back to that same territory.

At a time when inflation is still chugging along, this creates even more worry for U.S. companies importing goods from around the world.

Trump’s "Big Picture" Approach to Tariffs

I won’t delve into the political motivations behind tariffs here.

However, it seems clear that any new tariffs come with complicated implications for the same American businesses that Trump is aiming to help.

This could be why Trump is starting with such a “big picture” approach that’s more general rather than specific.

It doesn’t mean we won’t see tariffs on goods down the road, but the idea is for federal agencies to look for any remedies to the problems tariffs are supposed to quell.

As I mentioned earlier this month, tariffs have a way of driving the market down — especially on days when those tariffs are announced.

With the market churning higher and businesses clearly worrying about the impact of these tariffs, the smart play here was to put all options on the table.

And that’s precisely what we’re seeing now.

That’s all from me today.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets Daily

Check Out More From Money & Markets Daily:

Tidak ada komentar:

Posting Komentar