January 23, 2025

Know When to HODL 'em and When to Fold 'em

Dear Subscriber,

|

| By Jurica Dujmovic |

Ever wondered why your crypto portfolio sometimes feels more unpredictable than a cat on caffeine?

Welcome to the fascinating world of crypto sentiment analysis, where market movements aren't just about numbers and charts.

Rather, they're about the collective psychology of millions of traders, each trying to figure out whether they should HODL — that’s “hold on for dear life” in cryptospeak — or fold.

As you know, there’s rarely an easy answer to that question.

From my own trading, I can tell you it’s a weird hybrid of art and science.

And understanding sentiment can drastically change how you invest in and trade crypto.

Today I’ll walk you through how you can recognize when to HODL ‘em and when to fold ‘em in your own trading.

So, let’s start with the basics …

What Is This 'Sentiment' Business Anyway?

Crypto sentiment is basically the collective mood of investors, traders and that guy who won't stop talking about Bitcoin at dinner.

It works like this:

Imagine you're at a party. You grab a drink and mingle. Everything is fine until you overhear someone say they've heard terrible things about the punch.

Then, that message spreads.

Suddenly, everyone's avoiding the punch like it's radioactive.

Now, the drink didn't change.

Only the way people felt about it did.

That's sentiment in a nutshell. But when it comes to the crypto market, we’re talking about projects worth billions of dollars.

When everyone's feeling optimistic, prices tend to rise.

When they're pessimistic, well ... let's just say it's not pretty.

Why Should You Care?

Because crypto markets are driven by human psychology at internet speed.

Unlike traditional markets, crypto is a 24/7 market.

And we’re in an era when news spreads at the speed of a tweet.

A single Elon Musk post, regulatory announcement or viral thread can send prices soaring or plunging. And all before most traders have brewed their morning coffee.

Just look at what happened to Bitcoin between last Friday and President Trump’s inauguration on Monday:

Bitcoin price action over the past 7 days.

Source: Coingecko.

Click here to see full-sized image.

The smaller red circle, on the left, shows the rally that ignited when the then-president-elect launched a new memecoin one business day before he was sworn into office.

As you can see, the hype around the first pro-crypto president going all in carried BTC prices through the weekend.

That is … before sentiment faded.

Once it did, you can see that prices dropped on the eve of Jan. 19.

The second red circle shows the Inauguration Day rally. A spike in sentiment sent prices up as Trump took office on Jan. 20.

And when no news materialized about the rumored Bitcoin strategic reserve, prices fell again.

Let me be clear: Sentiment isn't the only factor you should consider.

Fundamentals, technical analysis and broader market conditions all play crucial roles.

But understanding market mood can give you real advantages. It can help you …

- Spot potential trend reversals before they show up in price charts. Extreme sentiment often precedes major market moves.

- Identify when FUD — or fear, uncertainty and doubt — is overblown. If it is, you could have a buying opportunity on your hands. If it isn’t, then you can prepare for volatility before it hits your portfolio.

- Make more objective decisions by understanding when your emotions might be clouding your judgment.

Where to Find Sentiment Indicators

You don't need a fancy degree or a supercomputer to do this. Basic tools for tracking market sentiment are probably sitting in your "I'll close these tabs later" collection right now.

For example, X.com (formerly Twitter) is the very heartbeat of crypto sentiment. Crypto Twitter is always abuzz with the ins and outs of what is happening in the crypto market far beyond mere price analysis. You can follow accounts of key figures in the industry, track trending topics and watch for sudden mood shifts with an app you likely already have. Not sure where to start? Try searching for “FinTwit,” or financial Twitter.

Same goes for Reddit communities, such as r/cryptocurrency and coin-specific subreddits. You can get a real feel for retail sentiment there.

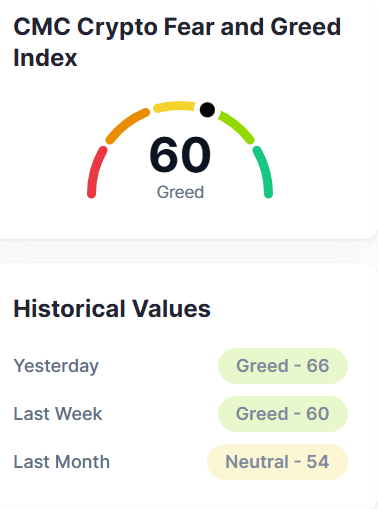

More technical tools include Google Trends, where you can track the search interest in cryptocurrencies ... GitHub, where you can monitor developer activity ... and the Crypto Fear & Greed Index.

This powerful tool analyzes market sentiment for you. It shows simply whether investors are mostly greedy (bullish) or fearful (bearish) to help you make informed crypto investment decisions.

Current Crypto Fear & Greed Index rating has market sentiment just over the line into “greed.”

Source: Coinmarketcap.

Click here to see full-sized image.

In fact, if you type “crypto market sentiment” in your web browser, the first several links that pop up are for the Crypto Fear & Greed Index.

And, of course, you should always follow crypto news and experts on reputable platforms. (Yes, like ours!)

How to Read the Room

Knowing the importance of sentiment and where to find clues is the start. Now, you’ll need to know how to read the (digital) room to determine the direction of that sentiment.

If market sentiment is bullish, you will likely see …

- Rising social media engagement and positive sentiment around new developments

- Increased GitHub activity and technical milestones

- Growing institutional interest and positive mainstream news coverage

- High and rising trading volumes with price increases

- Fear & Greed Index trends toward "Greed"

If market sentiment is bearish, you will likely see …

- Negative regulatory news getting high engagement

- A decline in developer activity or delayed project updates

- Prominent critics gaining traction on social media

- Decreasing trading volumes, even if asset prices rises

- Fear & Greed Index trends toward "Fear"

And, if you see a balanced mix of positive and negative news coverage, steady but unexciting updates from developers and no clear trend for trading volumes, you are likely in a neutral market.

Pro tip: The presence of these signals should be your starting point. You’ll want to dig deeper to examine their intensity and duration.

A few positive tweets don't make a bull market. And one talking head panicking about an imminent correction will not ignite a bear market.

But sustained engagement across multiple indicators could very well indicate a real shift in sentiment.

That’s a solid start. One that should help you make heads or tails of this wacky market.

And if you’re interested, I can show you how to dive even deeper next week. Just write in and let me know!

Best,

Jurica Dujmovic

Tidak ada komentar:

Posting Komentar