January 6, 2025

A New Age of COVID, YOLO & BNPL

Dear Subscriber,

|

| By Nilus Mattive |

Americans have been buying more than they can afford for well over a century now.

It all started after the Civil War with little pieces of metal known as “charge coins” or “credit coins.”

The small metal tokens allowed regular customers to buy items and then settle their tabs later. By the early 1900s, they were being issued by everyone from hotels to tire stores.

Then, in 1934, American Airlines and the Air Transport Association came up with something even better — an “air travel card.” This not only allowed customers to purchase tickets on credit, but also gave them a 15% discount for doing so.

By the early 1940s, all the major airlines were participating in the program … new customers were getting enticed by the ability to pay off their debts in installments … and half of the industry’s revenues were being generated by the cards.

The trend accelerated further in the 1950s, with the creation of The Diners Club card. It was the first general purpose credit card that could be used across different merchants. Customers had to pay off their balance every single month.

Similar cards were soon issued by other companies, including one from American Express that worked internationally.

Today, we’ve reached the logical conclusion of that groundwork: Just one swipe of a card will buy you virtually anything … just about anywhere in the world … with currencies automatically exchanged in the process.

Indeed, the typical American consumer used credit cards for about 33% of their monthly purchases last year. That’s up from 18.2% in 2016 — an 80% increase in just seven short years!

It’s only partly because of the convenience factor, of course.

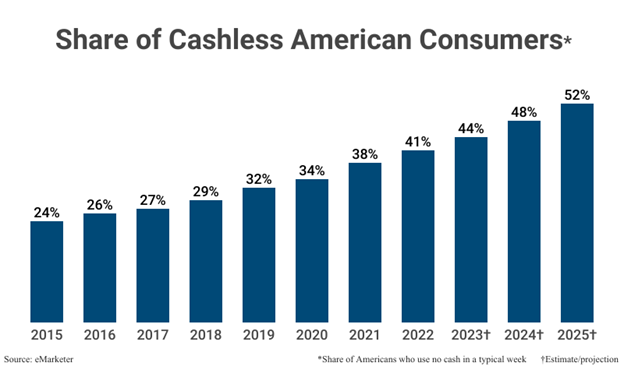

This year, more than 50% of consumers will not touch cash in their typical week.

Source: Capital One.

Click here to see full-sized image.

Credit cards allow people to buy the things they want rather than the things they can afford.

I have friends with tens of thousands of dollars in credit card debt they’ve been carrying for decades. Yes, seriously.

And they aren’t alone. I’ve seen plenty of verified stories about credit card balances of $10,000 … $20,000 … even $125,000. In some cases, the folks didn’t even know the totals they owed because they had so many cards.

Nationally, the numbers are staggering. According to the Federal Reserve Bank of New York’s latest report on consumer debt, U.S. credit card balances rose 8.1% from a year ago and now total $1.17 trillion.

Growing consumer debt has been a long-term trend. But as you can see it has really accelerated post-Covid …

In fact, total credit card debt has risen an astonishing 51% since Q1 2021, which was the last time we saw a little dip in the trend.

I attribute that to several related factors.

First, easy money created by the Federal Reserve — including stimulus funds distributed by the U.S. government — enabled people to consume even more stuff than they already were. While being forced to stay home for months on end, Americans were essentially given money to spend freely. And spend they did!

In addition, large swaths of the population have adopted a “you only live once” mindset. After dealing with the psychological trauma of the pandemic, they’ve continued buying the things they want … taking the trips they’d always dreamed of … and worrying even less about what their expenditures mean for the distant future.

Third, the rise of social media has only exacerbated things further. Everywhere I go, I see people taking selfies of their travels … their meals … their luxury goods … and a million other things. And this has created a “keeping up with the Joneses” feedback loop of epic proportions.

Fourth, our recent bout of inflation has reinforced the idea that all this consumption makes decent financial sense. If prices for the things we’ve been buying are higher today than they were just a few years ago, it actually seems like we got a good deal … and it conditions us to think today’s consumption might look smart in the future, too.

The original easy money has all been spent by now. So, the only way to keep the party going for most people is by tapping more and more credit.

This is precisely why so-called “buy now, pay later” (BNPL) programs — from companies like Klarna, Afterpay and Affirm — really took off in the wake of the pandemic, too.

But they’re just a modern twist on the old layaway plan. As long as you pay the installments on time, you don’t owe any interest.

The lenders get most of their money from late fees, merchant fees and other types of transaction-based costs.

To give us a list of good candidates in this area, I sifted through the Weiss Ratings system for financial services companies.

I quickly saw the more well-known credit card companies with “B” or “B-” ratings, including Visa (V), Mastercard (MA) and American Express (AXP).

Any of them would be a fine long-term holding. But there are some notable differences.

- Visa trades at roughly 31x earnings and yields just 0.69%.

- Mastercard is even more richly valued at 39x earnings and yields even less at 0.51%.

- American Express is a bit better with a P/E ratio of 22 and a yield of 0.89%. But that’s still only in line with the S&P 500’s numbers.

Meanwhile, down in the “C”s, I found more interesting names — including Discover Financial Services (DFS) and Bread Financial (BFH).

Discover, which took over Diners Club, is in the process of being acquired by Capital One (COF).

Meanwhile, Bread looks like a very attractive turnaround story.

If you do want to play this trend, I urge you to dig a little deeper into these financial services companies.

The easiest way to do that is to click on their tickers and explore the vast wealth of data we offer about them on the Weiss Ratings website.

Best wishes,

Nilus Mattive

P.S. Of course, whatever you do, I also urge safety. Fortunately, Weiss Founder Dr. Martin Weiss put together this recent presentation on what could go wrong with AI and how to protect your money in this new digital world. Check out this timely presentation for full details.

Tidak ada komentar:

Posting Komentar