4 AI Trends I'm Tracking in 2025 |

Money & Markets Daily,

While the hype surrounding artificial intelligence (AI) has taken the world by storm, most investors quote the famous Janet Jackson song…

"What have you done for me lately?"

We’re using AI to help automate and organize our lives, and we can’t wait to see what else this innovative tech can do.

It makes sense.

After all, investing in the early days of the AI mega trend made many people a lot of money from 2022 to now.

With that as a setup, I’ve got a few trends I’m keeping my eye on for AI in 2025…

Welcome to the Virtual World

We’ve used AI to create images, audio and video … but the next generative thing to come from AI? New worlds.

There was a taste of this last year when Google DeepMind unveiled Genie — a program that takes a still image and turns it into a side-scrolling 2D platform video game (think Super Mario Bros.).

Months later, DeepMind went a step further with Genie 2, which can take one image and turn it into an entire virtual world.

AI will eventually be able to build landscapes, cities, weather patterns and even moving crowds.

This is a big benefit for the video game industry, where a simple drawing can be transformed into a playable game.

It can also help with robotics. Hear me out on this one…

Training robots is a challenging endeavor, especially when accounting for real-world scenarios.

What if you could build a virtual world and put virtual robots in that world and use trial and error to teach robots how to operate in the “real world”?

Well, using generative AI to build such a world would allow robotic engineers to have a field day.

- "Like Facebook, Nintendo, Shopify, Netflix, Spotify, Slack and PayPal rolled into one..."

- More A.I. patents than Tesla, Nvidia, OpenAI and Microsoft COMBINED

- "A juggernaut... to rival the likes of Google and Netflix in power and value"

- "An incredible cash-generation machine."

- Possibly the final investment of Warren Buffett's investing partner of 60 years, Charlie Munger...

CLICK FOR ALL THE DETAILS. |

AI and National Security

When I think of this, I’m reminded of one of my favorite television shows … Person of Interest.

At the heart of the show is a human-created AI that utilizes global video feeds, listens to conversations, examines digital communication, and returns a threat assessment.

This system is designed to detect threats to national security.

But I’m here to tell you that we are not too far off from using this kind of AI technology in the real world.

It’s actually already here.

One company has entered into a joint venture to boost national security using AI in data readiness and Big Data.

Its partnership secures large-scale data and prevents the loss of valuable defense information.

In just 45 days, this company’s AI machine learning and data integration also created a prototype program to assist the military in warfighting operations.

I can see AI companies approaching the U.S. military to use classified military data to train AI models for everything from battlefield decision-making to logistics support.

And, let’s be honest … while some will pay for a program to use AI in virtual world development, those Pentagon contracts are very lucrative.

Competition for Nvidia

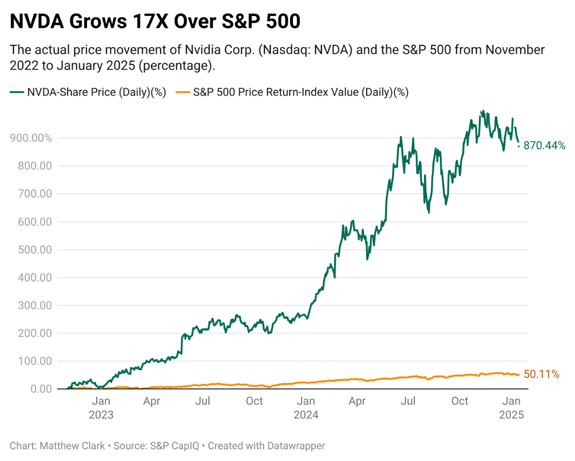

Since the AI mega trend started in 2022, the one name consistently mentioned, especially among investors, is Nvidia Corp. (Nasdaq: NVDA).

The company came to the forefront as the preeminent maker of chips used to train AI models.

Since November 2022 (when ChatGPT was released to the public), NVDA stock has climbed 870%, compared to the S&P 500’s 50% increase.

This hasn’t been lost on other potential competitors like Amazon.com Inc. (Nasdaq: AMZN), Broadcom Inc. (Nasdaq: AVGO) and Advanced Micro Devices Inc. (Nasdaq: AMD), who have all started to invest billions of dollars into chip development.

And don't forget about those under-the-radar AI startup companies fighting for a slice of this tech's lucrative market share.

Toss in a continuing global chip war, in which the U.S. aims to limit the export of chips and the technology to make them to places like China, alongside potential tariffs on goods coming in from China, and you have the makings of a domestic chip boom.

One that Nvidia alone will not be able to handle.

The New Kid on the AI Block … Kind Of

A phrase you might see cropping up in AI spaces recently is "quantum computing."

Without getting too technical, quantum computing uses quantum mechanics to solve complex problems at lightning speed compared to today's traditional computers.

There is a little correlation between quantum computing and AI, but the differences are less subtle.

Quantum computing uses the laws of physics to compute, and AI tries to mimic human intelligence.

Nonetheless, quantum computing stocks have been called the "new AI stocks" in some circles.

The biggest problem with quantum computers right now is that they are rare and expensive. In a recent article from the Massachusetts Institute of Technology, data firm McKinsey estimated that 5,000 quantum computers will be operational by 2030, but the hardware and software needed to handle most complex problems wouldn’t be available until 2035.

Regardless, Wall Street’s gonna Wall Street, and investors have piled money into companies developing quantum computers.

The problem … volatility.

In just three trading sessions earlier this month, four of the most well-known quantum computing stocks (IONQ, QBTS, QUBT and RGTI) sank between 41% and 70%.

As Adam touched on in yesterday's Money & Markets Daily, top CEOs are trying to throw cold water on quantum computing for various reasons.

Make no mistake, though: The quantum computing mega trend is here. Companies that are developing this innovative tech early are set to rake in the lion's share of the early profits, which will be a boon for the smart investors buying in now.

We'll see more volatility within these related stocks in the future, but that comes with the territory. Just look at how certain stocks like NVDA and PLTR have performed in the early innings of the AI revolution…

Since ChatGPT unleashed generative AI on the world in November 2022, NVDA stock is up almost 700% and PLTR has gained more than 800%! The latter was the best-performing stock of 2024!

And we're watching the quantum space closely…

It's been a busy start to 2025, but AI is still top of mind in this bull market.

Whether it's AI, quantum or anything in between … Adam, Andrew and I will monitor these trends for new investment opportunities as 2025 rolls on.

In the meantime…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets Daily

Check Out More From Money & Markets Daily:

Tidak ada komentar:

Posting Komentar