Editor’s Note: Today, we’re excited to share our first-ever Featured Chart of the Week! This special new column will give you a “deep dive” into the week’s most compelling news and surprising new data — straight from the desk of our own Chief Analyst and investing wizard Matt Clark. Read on for more on one of 2024's most successful (and most overlooked) investments…

Featured Chart of the Week: An ETF Powerhouse — South of the Border |

Money & Markets Daily,

2024 was an absolutely outstanding year for stock investors.

The S&P 500 saw a stunning 23% gain (nearly 2.5X the average return), and even small caps managed an impressive 16% gain in turn.

Of course, we can’t forget about crypto.

The “Big Daddy” of all cryptos, bitcoin, topped $100,000 in early December, capping a strong year that started at around $45,000.

But what if I told you there was another asset class out there…

An asset class that absolutely blew the doors off 2024 — yet virtually no one talked about it…

Except Adam O'Dell and I, of course.

This particular asset class came with less volatility than cryptocurrencies and shows little sign of slowing down in 2025.

Let’s get into it.

| Former hedge fund manager and Wall Street insider Adam O'Dell is targeting a company that he says could explode...

It's not one of the big AI firms... in fact, most people don't know about this company at all.

This company has a secret partnership with Amazon. And it’s about to get flooded with orders.

You’ll want to see this before the full story breaks out and hits mainstream.

Click here and get all the details. |

This South-Of-The-Border

Market Blew Everyone Away

If you were looking for the big market winner of 2024, I can promise you that this South American country was almost certainly not on your bingo card.

Even if you were looking South of the Border, you likely would’ve followed the flow of emerging market investors toward the continent’s largest economy, Brazil.

But that wouldn’t have paid off.

Instead, Argentina was the global index benchmark that blew the doors off everyone else… including the United States.

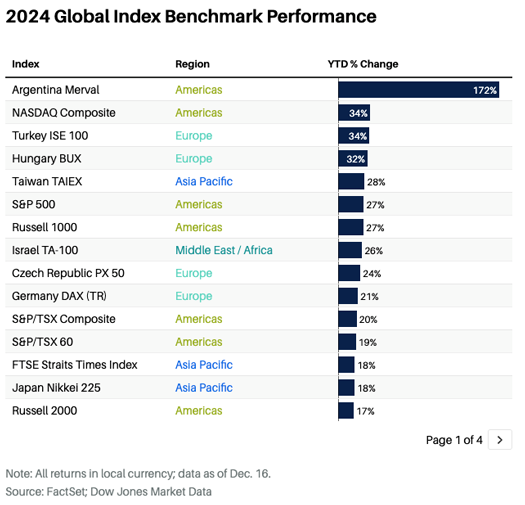

And as you can see below, it wasn’t even close…

The Argentina Merval Index grew an astonishing 172% in 2024.

Its next competitor, the Nasdaq Composite Index, rose 34%. For reference, the S&P 500 returned 27% for the year.

The main reason for this was the rise to power of new Argentine President Javier Milei, who took over the fledgling economy in December 2023 and mounted a virtual war against hyperinflation and government spending.

Instead of mass riots in the streets of Buenos Aires, the measures successfully tamed the world’s largest inflation and shored up currency reserves.

His actions took inflation from triple-digit highs to single digits in just 11 months.

| A Code Red is very, very rare. It’s only used by the government on technology that’s of the highest national priority. And there’s only 2 people in the entire world who can issue a Code Red: 1, The Secretary of Defense. And 2, The Deputy Secretary of Defense. That’s it... And right now, a Code Red is being planned for artificial super intelligence, the technology at the center of Trump’s Executive Order 001. It’s why Ian King is preparing for an emergency briefing for this Friday at 1pm ET. I’ve already reserved you a spot… but you’ll need to confirm by clicking here. (Clicking any of the links above will automatically register you. By reserving your spot, you will receive event updates and offers. We will not share your email address with anyone. And you can opt out at any time. Privacy Policy.) |

Featured Chart of the Week: Argentina ETF

While the chart above would be a good candidate for a chart of the week, I found something even more amazing.

A chart that shows how American investors responded to the Argentine market:

ARGT Up 78% in Last 12 Months

This is the chart for the GlobalX MSCI Argentina ETF (NYSE: ARGT). Its basket of 25 stocks represents those with the most exposure to the Argentine market.

In the last 12 months, the ETF has jumped more than 78% into 2025, and it reached a new 52-week high in intraday trading on Tuesday. That seems like a clear vote of confidence to me (and investors vote with their wallets).

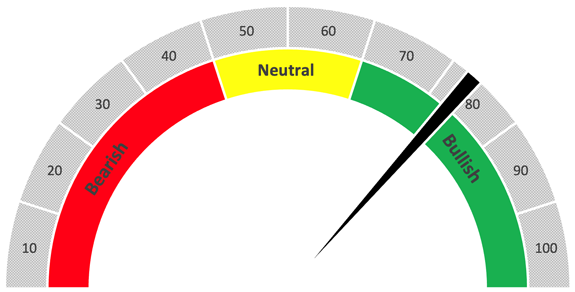

I ran an x-ray on ARGT to see how the ETF stacks up on Adam’s Green Zone Power Ratings system, and I was pleasantly surprised:

ARGT Rates in the Green

As a whole, the ETF earns a 73 out of 100 on Adam’s system. Of the 25 stocks in the ETF, 14 have a rating above 74, while only three have a rating below 13.

Recently, Fidelity Investments unveiled the top 10 exchange-traded funds in 2024:

ARGT's annual return for 2024 was good enough to be the sixth-best ETF of the year. The top five performers were all related to crypto or the Magnificent Seven.

Adam and I had you covered when it came to the Argentinian market. We have strong exposure to Argentine stocks in several of our premium subscription services:

- A state-owned oil and gas exploration and production company is in both the Green Zone Fortunes and 10X Stocks model portfolio … both showing triple-digit gains.

- An Argentine bank was recommended in Green Zone Fortunes PRO and is flirting with a triple-digit gain after just three months in the model portfolio.

- Our Infinite Momentum Alert model portfolio has a natural gas transporter in the country that has increased by double digits in less than two months.

In all, 2024 was a good year for the Argentinian market.

And it looks like 2025 has more in store.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets Daily

P.S. What are YOUR thoughts on Argentina and emerging markets investing in general? Would you like to hear more about overseas opportunities in Money & Markets Daily? I’m curious to hear your feedback. Send me an email at Feedback@MoneyandMarkets.com to share your thoughts.

Check Out More From Money & Markets Daily:

Tidak ada komentar:

Posting Komentar