In partnership with |

|

Welcome back! |

It's the last "busy" work week of the year for many folks. After Thursday's edition, we're going to break for the holidays and return on January 2nd. |

The market has been stuck in a rut lately, with futures little changed. The Dow has had 6 straight days of modest declines. At this point, there's been no new overarching catalysts over the past week or so. The Fed is expected to cut rates by 25bps to 4.25%-4.50% on Wednesday, which might be a big catalyst for how rates should change in 2025. We also think Google's Quantum Computing announcement could be a bit of a "ChatGPT" moment if we get more positive details about its practicality. |

Here's a look at earnings this week. |

Wednesday: Micron, Lennar, General Mills, Birkenstock Thursday: Accenture, Nike, Cintas, FedEx, Paychex, Carmax Friday: Carnival

|

Here's a look at economic data this week. |

Monday: Manufacturing PMI (est. 49.4), Services PMI (Est. 55.7) Tuesday: Core Retail Sales (est. 0.4% m/m), Retail Sales (est. 0.6% m/m) Wednesday: Housing Starts (est. 1.34MM), FOMC Statement & Economic Projections, Fed Interest Rate Decision (cutting to 4.25%-4.50%) Thursday: Initial Jobless Claims (est. 229K), GDP (2nd revision, est. 2.9%), Existing Home Sales (est. 4MM), U.S. Leading Economic Indicators (est. -0.1%) Friday: Personal Income (est. 0.4%), Personal Spending (est. 0.5%), PCE Index (est. 0.2%, 2.5% y/y), Core PCE (est. 0.2%, 2.9% y/y), Consumer Sentiment (est. 74)

|

|

Earnings Corner 📜 |

Trending Up 📈 |

Broadcom (AVGO) reported earnings that beat estimates with revenue of $14.05B up 51% y/y (vs. $14.09B expected) and EPS of $1.42 (vs. $1.39 expected). The company's semiconductor solutions group, which includes AI chips, saw sales grow 12% y/y to $8.23B, while AI revenue rose to $12.2B annually, up 220%. |

Mgmt. announced that it is partnering with large cloud providers to manufacture custom AI chips, with expected revenue of $60-$90B over the next 3 years . The stock soared 24.4% on the news, breaking a $1T market cap for the first time. |

Trending Down 📉 |

Costco (COST) reported earnings that beat estimates. Mgmt. noted that customers are still being selective with purchases, but are willing to buy more discretionary items as inflation continues to subside. Comparable sales were up 5.2%, both internationally and in the U.S. Membership fee revenue was up 8% to $1.17B, although mgmt. noted that, due to deferred accounting, only 1% of this increase was due to September's price hike. E-commerce sales were up 13% y/y. The stock rose 0.1% on the news. |

|

A Message from Hebbia |

Curious how the world's best investors are using AI? |

|

Hebbia is changing the investing game with AI. |

Hebbia works with many of the largest investment firms. And they've been around for 3 years longer than ChatGPT! |

Hebbia can draft one-pagers based on your team's investment philosophy (and so much more). |

Book a 20-minute demo to see it for yourself. |

|

|

Tonight's Headlines 🍿 |

Wholesale inflation increased in November. The Producer Price Index (PPI) was up by 0.4% for the month, outpacing the Dow Jones estimate of 0.2% The Trump Team is exploring ways to shrink, consolidate, or eliminate the banking watchdogs, including potentially abolishing the Federal Deposit Insurance Corp (FDIC) The Wall Street Journal ran a featured story today on the use of Adderall, Vyvanse, and other stimulants in high finance and the drugs' potential side-effects YouTube's price hike of YouTube TV from $82.99/month to $92.99/month has angered the internet. YouTube TV has dramatically increased in price over time, as it used to be $34.99/month in 2017 Warner Brothers Discovery will be splitting their corporate structure - organizing into two businesses 1) a streaming and movie and tv studio business and then 2) a linear tv and networks business. It's assumed that their declining linear TV business would be an acquisition target, presumably for Comcast Carlyle has raised a $5.7B opportunistic credit fund, less than their initial goals of $6.5B when they started raising money in 2023, but above their prior 2022 vintage of $4.6B MetLife is evaluating acquiring a private credit firm to bolster their efforts. Their internal private credit business has originated $117B of deals since 2019 Shore Capital's Justin Ishiba is evaluating acquiring the Minnesota Twins. The LMM PE founder has $11.5B in AUM. Sportico last valued the Twins a $1.7B PIMCO warns about the hidden risks of bank transfers. A PIMCO PM noted that investors should be careful about significant-risk-transfers ("SRTs") "given significant capital formation or hidden risks that have yet to be tested" ServiceTitan, a software company servicing plumbers and other technicians, had a monster IPO debut rising to a $9B valuation and raising $625mm. This is a bullish sign for the return of the IPO market in 2025 Databricks is seeking a $2.5B Private Credit financing to offset the tax burden from share sales. The deal is structured as an annual recurring revenue loan, with pricing at S+450, and the Company is estimated to be worth $60B Super Micro Computer is in talks with Evercore to raise new financing. They're evaluating debt and equity financing in order to shore things up as a potential delisting nears Distress in Retail: Joann Fabrics is in talks with creditors to raise new financing following poor numbers since emerging from bankruptcy earlier this year, while Party City is evaluating a 2nd bankruptcy in two years. The past two years have been very hard for retailers and restaurants, due to high fixed costs, high cost of capital, and a discretionary offering Sinclair Broadcast Group is in talks with lenders for some sort of super-senior secured term loan that would refinance the $1.2B Term Loan due in 2026 The SALT Write-off limit may increase to $20,000. The new Trump administration is evaluating this currently Buzzfeed divests Hot Ones for $82mm to the host, Sean Evans, as well as a consortium of investors that includes the Soros fund. Buzzfeed has been trying to address $125mm in debt maturities, and needed to sell Hot Ones for partial deleveraging Post Holdings is exploring a deal to buy Lamb Weston, the maker of McDonald's french fries. Additionally, Lamb Weston calls were snapped up just hours before the deal speculation articles came out, meaning some idiot is going to be in big trouble with the SEC. A Former OpenAI researcher and whistleblower was found dead at age 26, with the manner of death believed to be suicide

|

|

|

M&A Transactions💭 |

Patterson Companies (NAS: PDCO), a dental distribution and wholesaler of consumable products, has entered into a definitive agreement to be acquired for $4.1B by Patient Square Capital. EV/EBITDA was 11.95x and EV/Revenue was 0.63x. Guggenheim Partners advised on the sale. |

Orora Packaging Solutions, operator of a global packaging and visual communications company, was acquired for $1.15B by Veritiv. EV/EBIT was 10.5x and EV/Revenue was 0.59x. |

Connexa, operator of a mobile tower business, has entered into a definitive agreement to be acquired for $528.05B by Caisse de Depot et Placement du Quebec. The deal values the company at $1.06B. |

Caribbean Producers (XJAM: CPJ), a wholesaler and distributor of food and beverages, was acquired for $3.0B by Brydens Trinidad & Tobago (XJAM: ASBH). |

Aliada Therapeutics, developer of a drug development therapy designed to treat central nervous system diseases, was acquired for $1.4B by AbbVie (NYS: ABBV). Centerview Partners advised on the sale. |

About You (BER: YOU), a fashion e-commerce and technology group, has entered into a definitive agreement to be acquired for $1.16B by Zalando (ETR: ZAL). EV/Revenue was 0.55x. Deutsche Bank advised on the sale. |

Trader, operator of a digital automotive marketplace, was acquired for $2.7B by AutoScout24. Bank of America and Goldman Sachs advised on the sale. |

Tokyo Garden Terrace Kioicho, a complex building located in Tokyo, Japan, has entered into a definitive agreement to be acquired by Blackstone for $2.6B. |

Shriram Housing Finance, provider of housing finance, has entered into a definitive agreement to be acquired for $464.68M by Warburg Pincus. The deal values the company at $550.31M. Avendus Capital, Barclays, and JM Financial advised on the sale. |

Railsr, developer of global finance experience platform, was acquired for $358.62M by Equals Group (LON: EQLS). |

03 Mining (TSX: OIII), a Canadian mineral exploration company, has reached a definitive agreement to be acquired for $145.15M by Agnico Eagle Mines (TSE: AEM). EV/Cash Flow was 14.53x. |

MPC Muenchmeyer Petersen Capital (ETR: MPCK), an independent asset and investment manager, has reached a definitive agreement to be acquired for $192.56M by Castor Maritime (NAS: CTRM). The deal values the company at $259.9M. EV/EBITDA was 8.16x and EV/Revenue was 5.71x. |

The Water Midstream Division of Gravity Oilfield Services was acquired by Delek Logistics Partners (NYS: DKL) for $285.0M. Piper Sandler advised on the sale. |

Atlantica Sustainable Infrastructure, owns, manages, and acquires renewable energy, conventional power, electrical transmission lines and water assets, was acquired for $2.56B by Energy Capital Partners. EV/EBITDA was 3.16x and EV/Revenue was 2.2x. Citigroup and J.P. Morgan advised on the sale. |

Hexagon (STO: HEXA B) has reached a definitive agreement to acquire the Geomagic Software Business of 3D Systems (NYS: DDD) for $123.0M. |

Nimble Therapeutics, operator of a biotechnology company, has reached a definitive agreement to be acquired for $200.0M by AbbVie (NYS: ABBV). |

Inertial Labs, developer and manufacturer of position and orientation technologies, has reached a definitive agreement to be acquired for $325.0M by Viavi Solutions (NAS: VIAV). EV/Revenue was 65.0x. |

Ecorbit, provider of sewage water treatment services, was acquired for $1.47B by IMM Private Equity. Citigroup and UBS advised on the sale. |

CT Real Estate, operator of a commercial warehouse property, was acquired for $494.86M by Blackstone. |

Private Placement Transactions💭 |

The TCW Group, provider of asset management services, has received $550.0M of financing from Nippon Life Insurance Company. |

Grammarly, developer of writing assistance technology, raised $150.33M of venture funding from undisclosed investors. |

Capstan Medical, developer of catheter-based technology, raised $110.0M of Series C venture funding led by Eclipse Ventures. |

Ayar Labs, developer of optical interconnects tool designed to optimize AI infrastructure, raised $155.0M of Series D venture funding led by Advent Global Opportunities and Light Street Capital Management at a pre-money valuation of $1.05B. |

Angitia Biopharmaceuticals, developer of a global clinical-stage biotechnology company, raised $120.0M of Series C venture funding led by Bain Capital Life Sciences. |

Upvest, developer of an Investment API, raised $105.34M of Series C venture funding led by Hedosophia. |

Rebel Foods, operator of a cloud kitchen, raised $210.0M of venture funding led by Temasek Holdings at a pre-money valuation of $540.0M. |

ANYbotics, developer of an inspection platform, raised $111.34M of Series B venture funding led by Qualcomm Ventures, Supernova Invest, and Walden Catalyst at a pre-money valuation of $96.24M. |

Zest AI, operator of an online financial platform, raised $200.0M of venture funding led by Insight Partners. |

Current, developer of a mobile banking application, raised $200.0M of venture funding led by Avenir Growth Capital, Andreessen Horowitz, and General Catalyst. |

|

A Message from Long Angle |

|

Long Angle is a private, vetted community for high-net-worth entrepreneurs, executives, and professionals across multiple industries. |

Our members are primarily self-made, 30–55-year-olds with $5M-$100M in net worth. Engage in confidential discussions, peer advisory groups, and live meetups. |

Get access to curated alternative investments like private equity and private credit. With $250M+ invested, members leverage collective expertise and scale to capture unique opportunities. |

No membership fees. |

Join Long Angle Today |

|

Noteworthy Chart 🧭 |

|

|

|

Meme Cleanser 😆 |

|

| litquidity @litcapital |  |

| |

When the New York energy analyst laterals to the Houston oil & gas team | |  | | | 7:15 PM • Dec 7, 2024 | | | | | | 3.76K Likes 99 Retweets | 59 Replies |

|

|

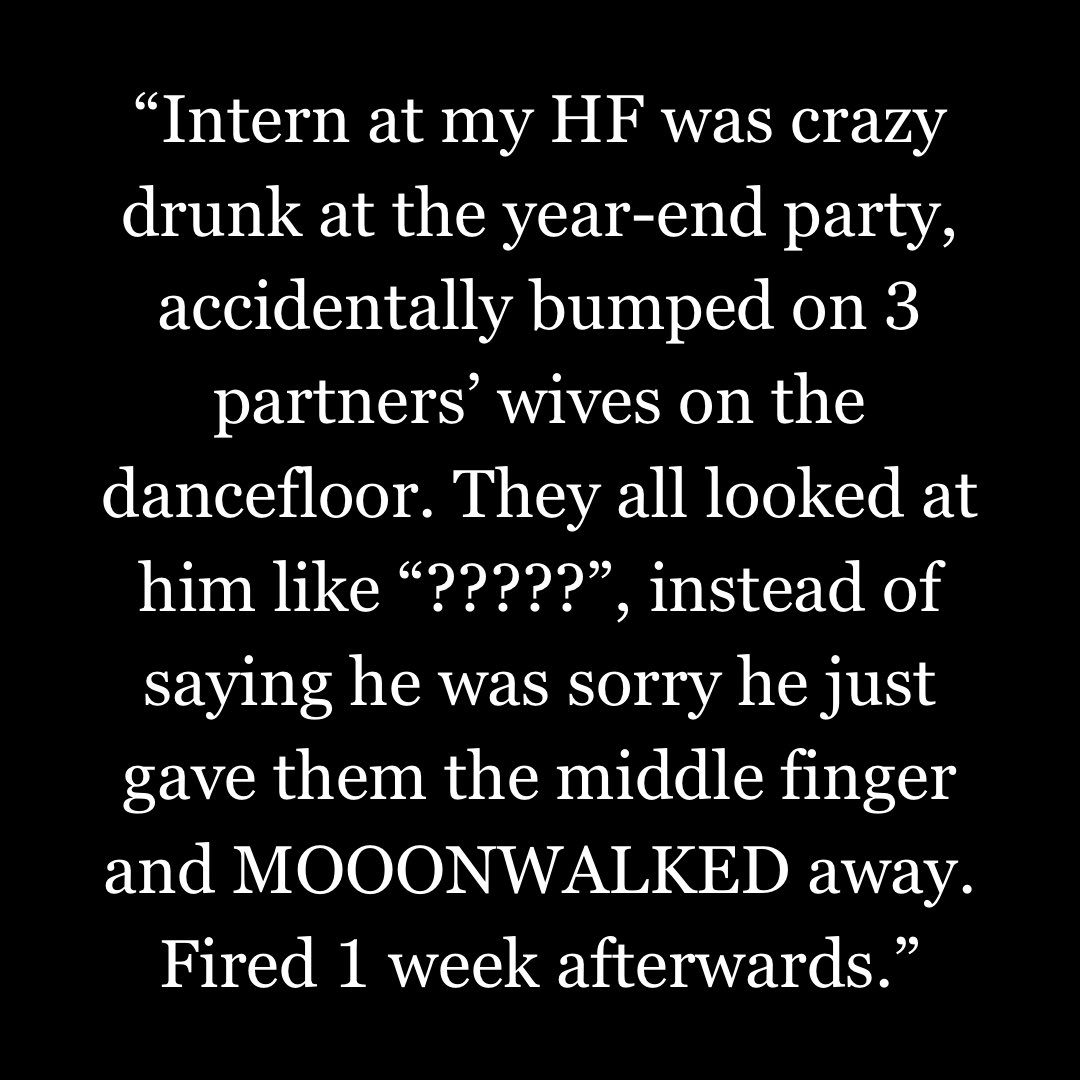

| Wall Street Gossip @WallSt_Gossip |  |

| |

More Wall Street Holiday Party Stories: | |  | | | 1:51 PM • Dec 13, 2024 | | | | | | 722 Likes 8 Retweets | 5 Replies |

|

|

Finance Merch Referrals ☕️ |

|

Until next time! |

Obviously, none of this constitutes financial or investment advice. |

Looking to start your own newsletter? Join beehiiv through us and you'll get 30 days free and 3 months of a 20% discount. |

Tidak ada komentar:

Posting Komentar