A Sneak Peek Into Belanger’s Premium Market Moves—Get a Taste of the Insider Edge Dear Insider, Every quarter, the market braces for a phenomenon known as triple witching—a powerful, often chaotic event when stock options, index options, and futures contracts all expire simultaneously. This week marks the year’s largest triple witching, with trillions of dollars in contracts set to roll off. Picture a dam breaking, releasing a surge of water that no one can fully control. That’s the potential impact of this event on market flows and momentum. Why does this matter? Triple witching often forces large institutional players to adjust their positions. Hedges tied to these contracts expire, leaving portfolios exposed and sparking a domino effect of rapid repositioning. In simple terms, it can create wild swings, with volatility erupting out of nowhere. At the same time, complacency has lulled the market into a false sense of calm. The VIX remains subdued, and investors are riding the high of a tech-led rally. But history has shown that triple witching can act like a lightning rod, transforming this calm into chaos. This is no ordinary week. The forces converging now could define the market's trajectory into the new year. Let’s unravel the story behind this event and prepare for the opportunities it creates. Here’s What We’ll Dive Into This Week:

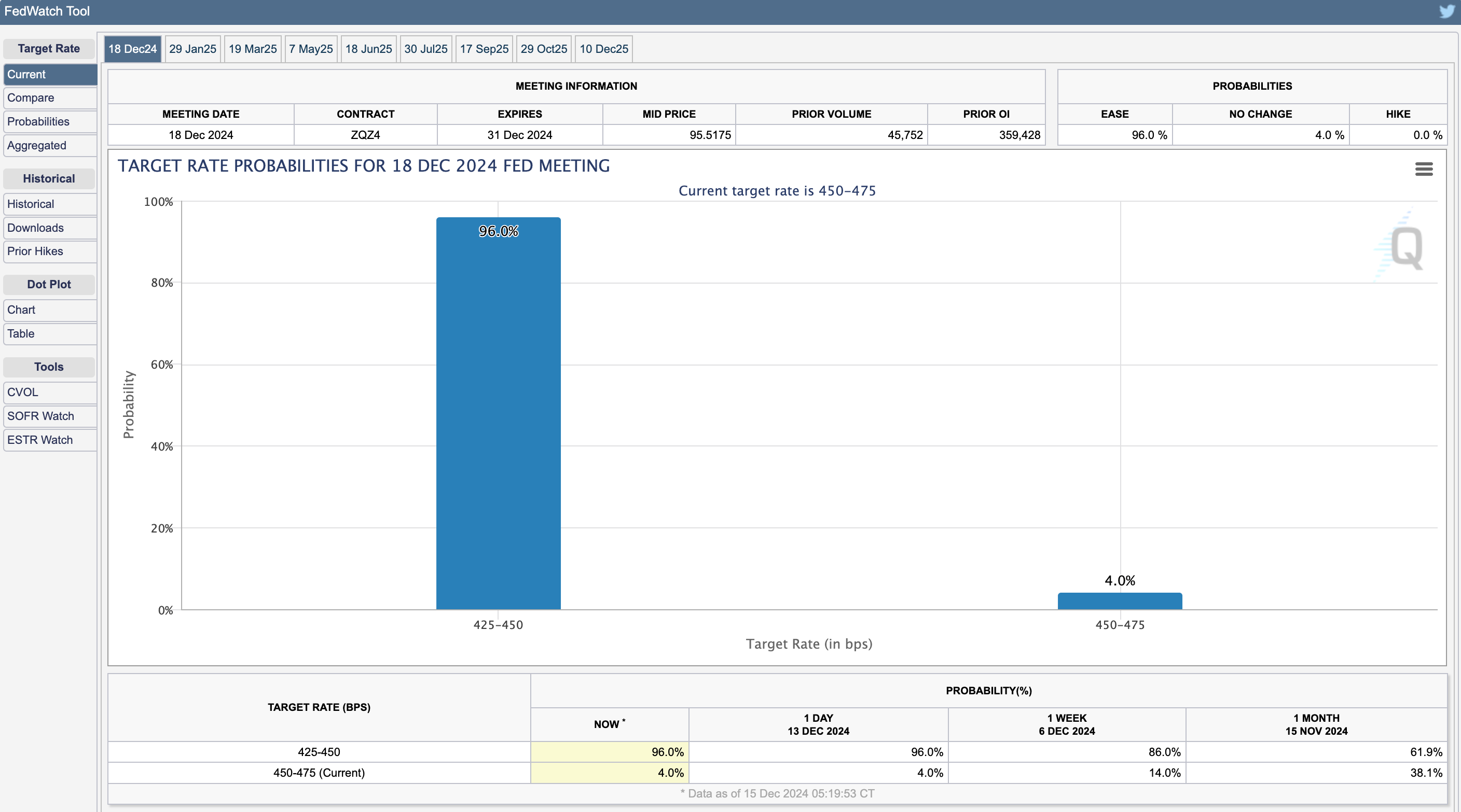

This Week in StocksThe S&P 500 finished slightly lower on the week, contrasting with the NASDAQ, which achieved new all-time highs. This divergence underscores the fragmented nature of today’s market. Big tech stocks continue to dominate, propping up the broader indices, while the Dow and Russell 2000 lag with consecutive weeks of losses. Beneath the surface, the lack of breadth points to fragility within the rally. Adding to the uncertainty, the 10-year Treasury yield surged 6%, reaching levels last seen in November, suggesting inflation remains a persistent concern despite the Fed’s dovish tone. With a 97% probability of a 25-basis-point rate cut at this week’s FOMC meeting, markets are bracing for the impact of further easing. However, this rally in bond yields also hints at a broader concern: inflation may persist longer than markets currently expect, potentially fueling further volatility as we enter 2025. The dollar finished the week strong, reflecting continued investor caution, while Bitcoin futures broke past $100,000 for the first time, fueled by speculative fervor and institutional interest. Meanwhile, gold experienced a volatile week, with sharp two-day gains wiped out by a subsequent sell-off, ultimately closing flat. Each of these moves underscores a market on edge, balancing optimism against looming uncertainty. Volatility remains suspiciously subdued, with the VIX closing below 14 for the eighth time in 10 weeks. Such low levels typically indicate market complacency, but the looming expiration of $2–$5 trillion in options during this week’s triple witching event could shake up the status quo. Beneath this calm lies the shadow of a potential storm, hinted at by an audacious VIX trade from the mysterious trader known as “50 Cent.” Strategic Insight: Wall Street Fears the Boogie ManThey call them “50 Cent,” a trader infamous for massive, calculated bets on volatility. And this week, he’s back... Subscribe to Belanger Trading to unlock the rest.Become a paying subscriber of Belanger Trading to get access to this post and other subscriber-only content. A subscription gets you:

|

Tidak ada komentar:

Posting Komentar