In partnership with | | The Week Ahead Of Us 🔍 | Welcome back, I hope everyone had a relaxing Labor Day Weekend. I know it sucks that it's over, but we're so close to finishing off the year (and Football season is back!) - power through! | Futures look relatively unchanged as we head into the new month and as wall street gets back to their desks. | Earnings season is cooling off, but let's take a look at some of the earnings coming up this week. | Tuesday: Zscaler Wednesday: HP, Dick's Sporting Goods, Dollar Tree, Core & Main Thursday: Broadcom, DocuSign, UiPath, RH, National Beverage Corp, Bowlero

| Also reporting on Friday is Big Lots, which is rumored to be the next notable retailer to file for bankruptcy. | | | A Message from High Yield Harry's Newsletter | | Did you know the median compensation for a Private Credit Associate in NYC is $276,000? | Crazy right? But the Credit industry is a fast growing and high returns industry. | That's why if you're trying to break into a career into Credit, or are trying to learn more about the fast growing industry of Private Credit, you need to read High Yield Harry's Newsletter. | Harry has taken all of the materials he's used to land high-paying jobs in Private Credit and Public Credit and is sharing this information within the free newsletter and within his Credit and Buyside Career Resources. | Whether you're looking for deep-dive pieces explaining the Private Credit, High Yield, and Public Credit world, or conducting a specific finance job hunt in big cities like Miami, Dallas, or Los Angeles, Harry has you covered. | | | The Main Stories 🔍 | OpenAI looks to become the largest private tech startup in Silicon Valley: With the valuation rumored to be over $100 billion, this would surpass Stripe, who raised a $95 billion valuation round back in 2021. There are several large companies looking to be a part of the OpenAI financing. Apple, Nvidia, and Microsoft are all among the firms evaluating taking a stake in the financing. OpenAI recently passed 200 million active users, showing strong popularity on both the consumer and enterprise side. | DirecTV and Disney face off, hurting consumers: ESPN networks, as well as ABC and Disney went dark for DirecTV customers right before the USC vs. LSU college football game kicked off, and in the midst of other big sport events like the U.S. Open and College Football. This heated carriage dispute between Disney and DirecTV comes as Disney continues to move more content directly to consumers (aka DTC). | Within the negotiating, DirecTV said Disney offered an distribution agreement extension to keep the channels on the air, but it came with a twist. DirecTV would be required to waive all future legal claims of anti-competitive behavior against Disney. | This is Disney also flexing on DirecTV right before the start of the NFL season. Maybe I sound biased, but it's hard not to agree with DirecTV, since it's clear Disney and other networks want to move away from Cable, Broadcasting, and Satellite distribution in favor higher priced, higher margin streaming alternatives. It was only a couple weeks ago that Disney, Fox, and Warner Brothers Discovery had their mega-sports streaming app deal blocked. With the death of linear and satellite TV impending, this hurts DirecTV and their 11.3 million subscribers much more than Disney. Hopefully a resolution is reached before the NFL kicks off this Thursday. | | More Headlines 🍿 | Brazil has banned X, after a spat with Elon Musk over trying to ban/censor political opponents. This locks out 40 million Brazilians, and the alleged punishment for those who use VPNs to bypass the X ban could be a $8,774 daily fine Meanwhile, this also led to Elon's other company, SpaceX, having their Starlink service suspended in Brazil. Clearly, the Brazilian government is tying the actions of X to Elon's other companies. Starlink has recently just told its Brazilian regulator that they will not comply with banning X access for Brazilians Bill Ackman is up for Round Two: The Pershing Square Hedge Fund titan is giving his IPO a second effort and is looking increase incentives for potential investors Vice President Harris would oppose the U.S. Steel takeover bid by a Japanese firm Private Equity is getting involved with youth sports, and it has a lot of families worried that prices will continue to rise Strikes start at top hotel chains as housekeepers seek higher wages and daily room cleaning work There was an interesting Bloomberg oped on why the NFL should let fans invest in the teams as well Red Lobster, Roti, and World of Beer are among the list of the most notable restaurants to file for bankruptcy so far in 2024

| | M&A Transactions💭 | Medallion Midstream, provider of midstream services, has reached a definitive agreement to be acquired for $2.6B by ONEOK (NYS: OKE). Bank of America and J.P. Morgan advised on the sale. | Mannok Holdings, manufacturer of construction and packaging products, has reached a definitive agreement to be acquired for $362.82M by Cimsa Cimento Sanayi Ve (IST: CIMSA). | Dulwich College International, operator of an international academic institution, has entered into a definitive agreement to be acquired for $600.0M by Hillhouse Investment Group. | PPG Silica, manufacturer of silica products, has entered into a definitive agreement to be acquired for $310.0M by Qemetica. Morgan Stanley advised on the sale. | Oruka Therapeutics, developer of novel biologics, has acquired Arca Biopharma (NAS: ABIO) through a reverse merger. Jefferies, Leerink Partners, LifeSci Capital, TD Cowen, Wedbush Securities advised on the deal. | Iowa Fertilizer Company, producer of nitrogen fertilizer products, was acquired for $3.6B by Koch Ag & Energy Solutions. Morgan Stanley advised on the sale. | Concentric (STTO: COIC), designer, developer, and manufacturer of hydraulic and engine applications, has reached a definitive agreement to be acquired for $821.07M by A.P. Moller Holding. | Wuhan Zhong Yuan Rui De Biological Products, manufacturer of plasma-derived products, has reached a definitive agreement to be acquired for $190.0M by Chengdu Rongshgeng Pharmaceutical Co. | Svenska Nyttobostader (STO: NYTTO), owner and operator of newly constructed residential properties, was acquired for $230.0M by ALM Equity (OMX: ALM). | Coastal Energen, operator of a thermal power plant, was acquired for $397.56M by Adani Power (BOM: 533096) and DHFIN Group. | The North American Conventional Signaling Business of Alstom (PAR: ALO) was acquired for $760.50M by Knorr-Bremse (ETR: KBX). Accuracy advised on the sale. | Private Placement Transactions💭 | AutoAI, developer and operator of map software solutions, has received $107.47M of venture capital from NavInfo Company (SHE: 002405) and Didi Global (PINX: DIDIY) at a pre-money valuation of $460.59M. | Wayve, developer of AI based driving software, raised $1.05B of Series C venture funding led by Nvidia, Eclipse Ventures, and SoftBank Group. | Magic, operator of a software development company, raised $320.0M of Series C venture funding led by Eric Schmidt. | Codeium, developer of a deep learning acceleration platform, raised $150.0M of Series C venture funding led by General Catalyst at a pre-money valuation of $1.1B. | ParaFi Capital, operator of an alternative investment firm, raised $120.0M of venture funding led by KKR & Co, Accolade Partners, and Bain Capital Ventures. | | Noteworthy Chart 🧭 | | | Meme Cleanser 😆 |  | High Yield Harry @HighyieldHarry |  |

| |

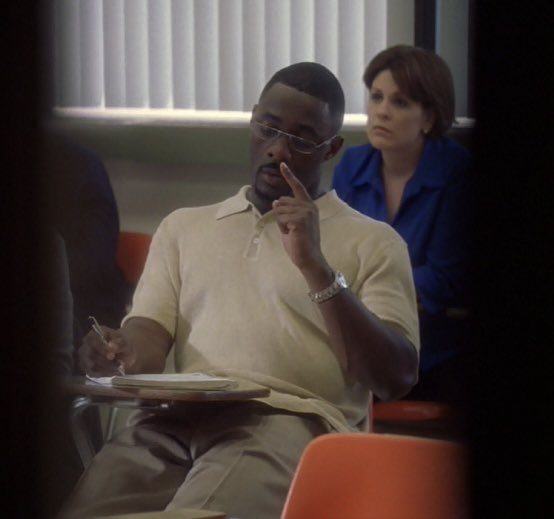

The older guy in your business school class: | |  | | | 4:17 PM • Aug 30, 2024 | | | | | | 6.45K Likes 218 Retweets | 33 Replies |

|

|  | Ketamine Capital @Ketamine_Cap |  |

| |

Work-enstocks | |  | | | 12:17 PM • Aug 23, 2024 | | | | | | 613 Likes 6 Retweets | 23 Replies |

|

|

|

Tidak ada komentar:

Posting Komentar