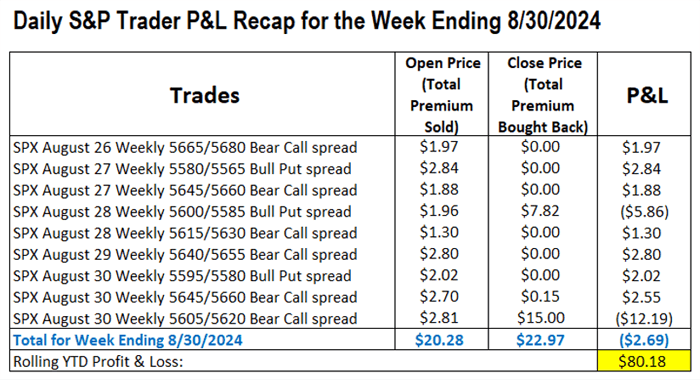

Jobs Data Could Set Off Further Volatility This Week By Larry Benedict, editor, The S&P Trader Last week, we ended slightly down due to Friday’s market action. We finished down $269 (on a one-contract basis). I know it can be frustrating when we go through these choppier periods. Yet as we’ve discussed previously, I recommend you place every trade that I do. If in doubt, adjust your trade size lower to a level you feel comfortable with (rather than pick and choose which trades to do). I’ll come back to our performance in our mailbag segment at the end of today’s update. But first let’s check out last week’s trades…

(Click here to expand image) As you can see, the final bear call roll on Friday put us behind for the week. As of Friday’s close, though, we’re tracking on an 82.4% win-rate from the 222 trades we’ve done in 2024. We’re also averaging a 1.7% gain on capital committed per trade. That’s not 1.7% a year – our average holding period is just one day. If you made 1.7% a day and repeated that over the 252 trading days in the year, you’d be up 428.4%. And so far, on a one-contract basis, we’re standing at $8,018 in profit year-to-date. That’s why I encourage you to stick with each trade. Our wins throughout the year tend to more than cover the inevitable losers. What to Watch for This Week Last week, there were two key economic releases… Gross domestic product (GDP) data for Q2 was upwardly revised from 2.8% to 3.0% (annualized). That’s a big bounce back from Q1’s 1.4% reading. And personal consumption expenditures (PCE) inflation data came in at 2.5% year-over-year. That was 0.1% below forecasts. This adds further confirmation that the Federal Reserve’s grip on inflation is tightening. Yet the focus this week returns to jobs. The latest Job Openings and Labor Turnover Survey (JOLTS) is due out tomorrow. The market has become accustomed to a gentle slide. So it will take a surprise reading to catch the market off guard. Then the market will be waiting intently for release of both nonfarm payrolls (NFP) and the latest unemployment rate on Friday. A further drop in NFP coupled with another jump in unemployment would just about lock in a 0.5% rate cut in September. Yet that would also add weight to the narrative that the economy is slowing. Depending on how these data releases go, we could see volatility in the week ahead. As always, I’ll be watching everything closely… Mailbag I’ve gotten a few questions this past week to address in this week’s mailbag… A couple readers asked why their results might vary from mine. First, note that our year-to-date profits reflect all the trades we’ve done from the first trading day of 2024. If you’ve missed any trades or joined this service at a later date, then your overall results will differ. Beyond that, your results will also depend on the price at which you enter the trade. When I send trades, I share the minimum amount you should receive for the trade. That’s because we always want to be adequately compensated for the risk we’re taking on. Usually, though, traders have the chance to enter their trade at a much better price than the minimum. The price we record in the weekly trade table is our best attempt to mark what prices traders are likely to have gotten. To do that, we use the 10-minute volume-weighted average price (VWAP) right after we send the trade. It’s a bit complicated. But in essence, the VWAP looks at the prices that traded for each minute over that 10-minute time frame. It assigns more weight to prices that traded with higher volume. So, for example, if 2,000 contracts traded at $2.00 at minute 3, then that pricing gets weighted higher than the 200 contracts that traded at $2.50 at minute 5. In the end, the VWAP hands us the average price most traders would’ve gotten during the 10-minute window. This should be close to what our subscribers are seeing. Some people may get slightly worse prices… and some may get slightly better prices than we mark. But overall, we should be in a similar range. The other question I’ve gotten relates to how we “manage” our trades… When we open an SPX spread trade, our goal is to collect a credit and then have that spread expire worthless. That way, we keep the full credit from selling the spread. Nearly all of our trades are same-day expiration, and we typically let the trade expire at the end of the day. So after opening a trade, we typically don’t need to take any action to close it. But there are instances where we do close a trade before expiration. Most often, this is when a spread trade is working in our favor and we want to open another trade. This is called “rolling” the trade. We close our existing spread trade and sell a new one with the same directional bias (for example, closing a bear call spread and opening a new bear call spread). This lets us bring in more premium – either to increase our profits or to balance another spread trade that’s moving against us. Regardless, I’ll always send out an alert if I recommend rolling a trade. And rest assured, I’ll always send out an alert if I recommend you close out a trade or take any other action. So if you don’t hear from me, that means I intend to leave our trade open until it expires, and there’s nothing you need to do. The most important thing is to follow my instructions in the alerts and do each trade that’s recommended. Thank you to everyone who wrote in. And if you have any questions, comments, or suggestions for The S&P Trader, you can send them to feedback@opportunistictrader.com. I’m always glad to interact with readers. Happy Trading, Larry Benedict

Editor, The S&P Trader |

Tidak ada komentar:

Posting Komentar