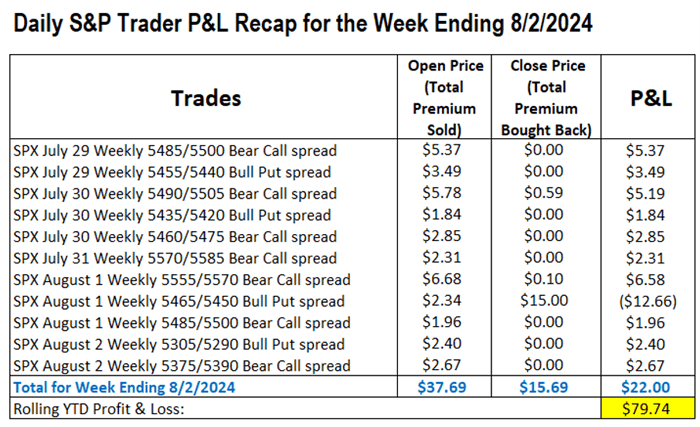

In This Volatile Market, We're Bringing in Profits By Larry Benedict, editor, The S&P Trader We’ve just wrapped up one of our most profitable weeks of the year right as the market has gotten turbulent. Stock markets around the world are in free fall today as volatility surges. The S&P 500 peaked on July 16. But the decline really started picking up steam last week. At last week's rate-setting meeting, the Federal Reserve held rates steady at the highest level in over 20 years. That wasn’t a huge surprise. Fed Chair Jerome Powell also nodded to growing cracks in the labor market. So investors felt confident that a September rate cut remains on the table. But just two days after the Fed meeting, a much weaker-than-expected payroll report came out. And it sparked fears that the central bank has already kept rates too high for too long. Job growth in July was just 114,000 compared to estimates of 175,000. And the most concerning data point was the unemployment rate, which increased to 4.3%. That’s the highest level since October 2021. Recession concerns have sent stocks crashing, with the S&P 500 finishing lower for the third week in a row. The Nasdaq officially entered correction territory with a 10% decline off of the July 10 peak. And markets are sinking even faster today. But guess what? We’re navigating the volatility just fine and using it to our advantage. As I mentioned at the beginning, we turned the market’s choppy action into solid profits… We Use Volatility to Our Advantage Unnerved markets mean volatility is picking up. That translates to bigger premiums for option sellers, and we’re taking full advantage. Last week, we had a total of 11 trades, of which 10 were winners. We collected $2,200 in premiums on a one-contract basis. That brings our year-to-date total to $7,974 per contract. (For example, if you’re trading two contracts for each trade, last week’s profits were $4,400, and the year-to-date return is $15,948.) Let’s have a look at last week’s trades:

(Click here to expand image) As of Friday, we’ve now done 190 trades since the start of the year with an 83.2% win rate. We’re also averaging a 1.97% gain on capital committed per trade. That’s not 1.97% a year… our average holding period is just one day. If you made 1.97% a day and repeated that over the 252 trading days in the year, you’d be up 496.44%. Why We Roll Trades More volatility means big premiums – even when we open a spread trade far away from where the S&P 500 is currently trading. And we’re collecting nice premiums while still keeping risk tighter with a 15-point spread instead of the typical 20-point spread. By choosing 15-point spreads, we limit our max loss to $1,500 per contract minus the premium we earn. We can also control risk and collect more premiums by rolling our trades. A couple of readers have asked why we roll some of our trades and what happens to the premium. So I want to address that today. Rolling a spread trade means closing an open spread and reopening a new one of the same type (e.g., closing a bull put and opening a new bull put). To roll the spread, we incur a “debit” to close the old spread. So instead of collecting income, closing a spread trade costs us. I typically only close a spread trade when it’s working in our favor. The cost to close the trade is small compared to the credit we received to open it. So we still keep the credit we earned when we opened the trade, less the cost to close it. For example, last week on August 1, we opened the 5555/5570 bear call spread for an average credit of $6.68. We rolled that spread, and it cost us $0.10. So overall, we netted $6.58 on that spread trade. And here’s why I roll the spread by closing one and opening another… It comes down to controlling risk. If I recommend a bearish call spread, and the S&P 500 drops sharply, I have the option of selling another call spread. But that would mean I now have two open call spreads. Markets can be unpredictable, and crazy things can happen. The possibility of the S&P 500 jumping higher above both strikes we sold on the call spreads is a lot of risk to bear. By closing out our existing spread, we lower our risk. And since rolling a spread means we’re opening a new trade, we collect more income. That income can help offset any market moves against our other open positions. Remember: Controlling risk is how you stay in the game. If you have any questions you’d like me to address in a future update, be sure to send them to feedback@opportunistictrader.com. Happy Trading, Larry Benedict

Editor, The S&P Trader P.S. If you haven’t already, please consider taking a moment to rate The S&P Trader on Trustpilot. It means a lot and helps spread the word about the benefits of becoming a subscriber. Download the Opportunistic Trader Mobile App To make sure you don’t miss any alerts or updates, please download the free Opportunistic Trader Mobile App for iOS or Android. The app enables you to get notifications whenever we publish something new. Make sure push notifications are enabled through your phone settings to receive alerts from the app. You can also access all of your subscriptions and view portfolios. And if you use the app and find it valuable, consider leaving us a review on the App Store or Google Play page. | |

Tidak ada komentar:

Posting Komentar