In partnership with | | Welcome Back! After a crazy Friday, we now find the stock market on a lot shakier footing…Currently, Nasdaq and S&P futures are down -1.6% and -1.0% respectively. Let's get you all the information you need to get ready for the week… | Btw…if you're a Fantasy Football guy - here's our latest newsletter on Running Backs you need to draft. | The Week Ahead Of Us 🔍 | Here's a look at the earnings coming up next week. There's still several big names reporting, but we're starting to move onto some companies that have good readthrough into the broader market. | Monday: CSX, Palantir, Williams, Realty Income, Simon Property Group, Diamondback Energy, Tyson Food, Carlyle Group, Summit Materials, Vornado Realty. Tuesday: ZoomInfo, Amgen, Caterpillar, Uber, Airbnb, Transdigm, Zoetis, Diageo, Super Micro Computer, YUM Brands, Vulcan Materials, GlobalFoundries, Fox, Rivian, Hyatt Hotels, Toast, Celsius, Molson Coors, Reddit. Wednesday: Novo Nordisk, Disney, Shopify, CVS, Equinix, Monster Beverage, Hubspot, Warner Bros, Robinhood, Brookfield, UHaul, Zillow, Wix.com, New York Times, Duolingo. Thursday: Eli Lilly, Alibaba, Gilead, The Trade Desk, Datadog, Cheniere, Take-Two, Restaurant Brands, Vistra, Expedia, News Corp, US Foods Holding,, Dropbox, Liberty, Unity Sofware.

| | | |

Where Sophisticated Investors Access Private Markets | | 10 East is a co-investment platform where sophisticated investors access private market investments alongside a veteran team with a decade+ track record of strong performance. | The firm is led by Michael Leffell, former Deputy Executive Managing Member of Davidson Kempner. | Members have the flexibility to participate on a deal-by-deal basis across private equity, credit, real estate, and venture capital. | Benefits of 10 East membership include: | Flexibility – members have full discretion over whether to invest on an offering-by-offering basis. Alignment – principals commit material personal capital to every offering. Institutional resources – a dedicated investment team that sources and diligences each offering.

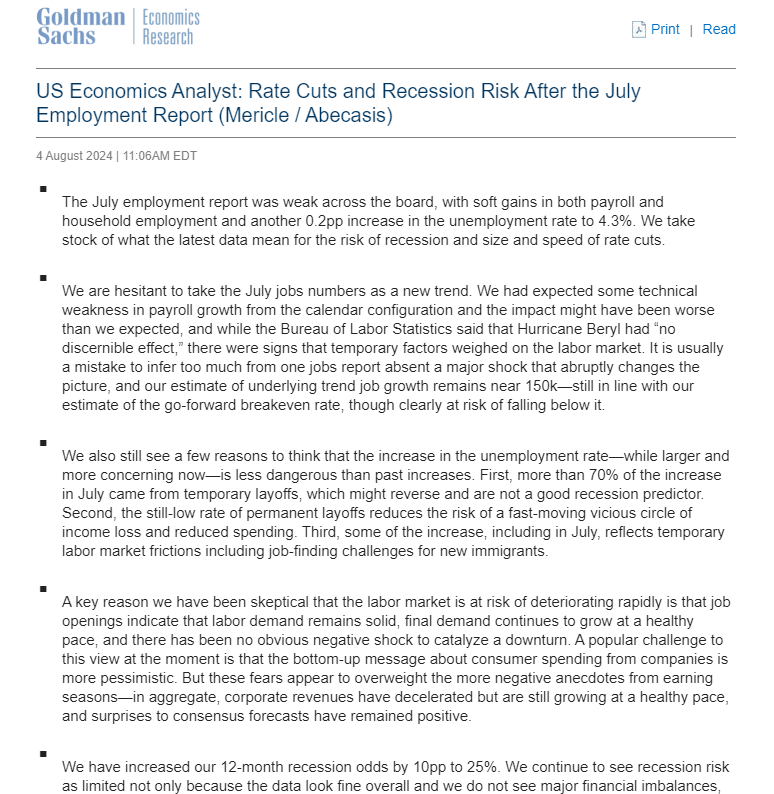

| Plus, there are no upfront costs or commitments associated with joining 10 East. | Wall Street Rollup readers can join 10 East with complimentary access here. | | The Main Stories 🔍 | Unemployment increased from 4.1% to 4.3% and jobs of 114k came in worse than expected (175k) - tanking stocks and calling into question a soft landing: Literally only two days after market participants were praising Fed Chair Jay Powell, we quickly saw unemployment and jobs surprise for the worse. Markets ended Friday with the S&P down -1.84% and the Nasdaq down -2.43%. Some people are already calling for an emergency cut, but even if that's less likely, it seems likely that a 50bps cut is now on the table. While only two datapoints, we might have a tense wait until the Fed's meeting in six weeks. | The Fed got most of the 2010s wrong, they got 2020 wrong, they got 2021 wrong, and now it looks like they got 2024 wrong. It seems like they should've started cutting rates sooner, but of course, the jury is still out. | Goldman has come out raising their recession odds to 25%, but they still lay out a case on how there's still hope that this bump in unemployment was just a blip: |  | Mike Zaccardi, CFA, CMT 🍖 @MikeZaccardi |  |

| |

Goldman: We have increased our 12-month recession odds by 10pp to 25%. |  | | | 3:47 PM • Aug 4, 2024 | | | | | | 157 Likes 37 Retweets | 7 Replies |

|

| Warren Buffett dumped 50% of his Apple stake: Wow, this was a shocker. Berkshire Hathaway now owns $84.2B worth of Apple as of 6/30/24, a big cut from $135.4B as of 3/31/24. | Why are they trimming Apple going into the AI revolution? Does Berkshire think Apple will actually be an AI loser? Or is it more Macro related? It's a fair question to ask, as Apple does seem less urgent with AI than other big tech players, plus the Vision Pro debacle earlier this year seems to shed light on Apple having an unclear future product roadmap. Whether it's Apple specific or not, Buffett has acknowledged lately that he prefers cash over most equities. | Berkshire and Apple are both certainly cash rich though with Berkshire having $277B in cash and Apple having $162B in cash. We'll have to see whether Buffett's sale spooks the market on Monday. | | More Headlines 🍿 | DraftKings is introducing a surcharge starting next year on winning bets in states with multiple betting operators and where the tax rate is above 20%. That includes big states like Illinois, New York, Pennsylvania and Vermont. It sounds scarier than reality though - in Illinois for example it's supposed to be around a low-single-digit to mid-single-digit percentage of total winnings Goldman Sachs gets roasted for their new logo Snapchat results missed on revenue, sending shares down -26% Activist Hedge Fund, Elliott, has a settlement offer to Starbucks that allows the CEO to keep top job, CNBC reports The Big Guy wins - the NFL's Sunday Ticket $4.7B lawsuit was tossed Elon Musk was sued by ex-CNN anchor Don Lemon over his canceled X deal Intel earnings last week were horrific, sending shares down -26% on Friday, and now Intel's CEO's recent tweet is alarming investors:

|  | dalibali @dalibali2 |  |

| |

Intel down so bad CEO resorts to praying |  Pat Gelsinger @PGelsinger Pat Gelsinger @PGelsinger

"Let your eyes look straight ahead; fix your gaze directly before you. Give careful thought to the paths for your feet and be steadfast in all your ways" Proverbs 4:25-26 |

| | | 5:22 PM • Aug 4, 2024 | | | | | | 2.33K Likes 172 Retweets | 27 Replies |

|

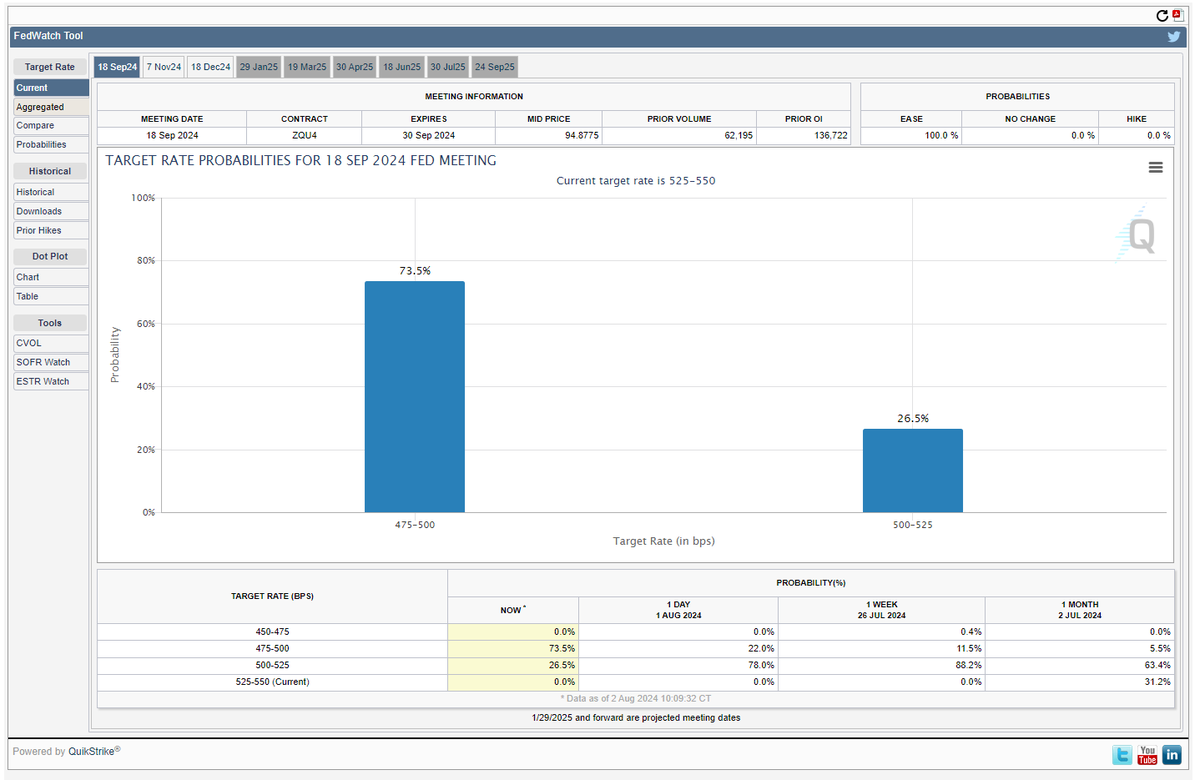

| | M&A Transactions💭 | California Bank of Commerce, a bank holding company, was acquired for $233.6M by Bank of Southern California (NAS: BCAL). Keefe, Bruyette & Woods advised on the sale. | Adventus Mining (TSX: ADZN), a copper-gold exploration and development company, was acquired for $145.8M by SilverCorp Metals (TSE: SVM). Cormack Securities and Raymond James advised on the sale. | US Assurre, provider of construction and property insurance services, has reached a definitive agreement to be acquired for $1.48B by Ryan Specialty Holdings (NYS: RYAN). Dowling & Hales advised on the sale. | Stavola Contracting, manufacturer and provider of highway and street construction, has reached a definitive agreement to be acquired for $1.2B by Arcosa (NYS: ACA). | R1 RCM (NAS: RCM), provider of technology-driven solutions, has entered into a definitive agreement to be acquired for $5.46B by TowerBrook Capital Partners, and Clayton and Dublier & Rice. Qatalyst Partners advised on the sale. | OpNet, provider of design, construction and management of networks, was acquired for $526.6M by Wind Tre. Barclays advised on the sale. | One Network Enterprises, developer of a cloud business platform, was acquired for $839.0M by Blue Yonder. | The Cable Business Unit of nVent Electric has entered into a definitive agreement to be acquired for $1.7B by Brookfield Asset Management (TSE: BAM). | Nobis Assicurazioni, provider of insurance products, has reached a definitive agreement to be acquired for $519.0M by AXA (PAR: CS). | Mirus Bio, provider of gene transfer technologies, was acquired for $600.0M by Merck (ETR: MRK). Jefferies advised on the sale. | Macatawa Bank (NAS: MCBC), holding company for Macatawa Bank, was acquired for $510.269M by Wintrust Financial (NAS: WTFC). Morgan Stanley advised on the sale. | Lok'nStore, operator of real estate, was acquired for $486.74M by Shurgard Self Storage (BRU: SHUR). Cavendish Financial, Peel Hunt, and Goldman Sachs advised on the sale. | kSARIA, manufacturer and supplier of mission-critical connectivity products, has reached a definitive agreement to be acquired for $475.0M by ITT (NYS: ITT). BMO Capital Markets and Guggenheim Partners advised on the sale. | Jnana Therapeutics, developer of a drug discovery platform, has reached a definitive agreement to be acquired for $800.0M by Otsuka Pharmaceutical. | Inchcape UK, operator of a car retailer, was acquired for $375.67M by Group 1 Automotive (NYS: GPI). Rothschild & Co. advised on the sale. | Hearsay Systems, developer of a client engagement platform, was acquired by Yext (NYS: YEXT). Union Square Advisors advised on the sale. | Hauck Aufhauser Lampe Privatbank, provider of financial advisory and banking services, was acquired for $729.63M by ABN AMRO Bank (AMS: ABN). | Gravotech, manufacturer of systems and machines, was acquired for $130.29M by Brady Worldwide (NYS: BRC). | The Global Surgical Solutions Business Unit of Ecolab was acquired for $950.0M by Medline Industries. | Fomento Economico Mexicano (MEX: FEMSAD) reached a definitive agreement to acquire The Retail Business of Delek US Holdings (NYS: DK) for $385.0M. Raymond James advised on the sale. | CrownRock, developer, explorer and acquirer of oil and gas properties, was acquired for $12.0B by Occidental Petroleum (NYS: OXY). Perella Weinberg Partners, Goldman Sachs, Tudor, Pickering Holt & Company advised on the sale. | Citybus, operator of a bus service company, was acquired for $348.28M by Hans Energy Company (HKG: 00554). Anglo Chinese Corporate Finance advised on the sale. | Cerevel Therapeutics, a company dedicated to unraveling the mysteries of the brain to treat neuroscience diseases, was acquired for $8.7B by AbbVie (NYS: ABBV). Centerview advised on the sale. | Altium, a technology company, was acquired for $6.07B by Renesas Electronics (TKS: 6723). JP Morgan advised on the sale. | The US Midcorp And Entertainment Insurance Business Unit of Allianz Global Corporate & Specialty was acquired for $450.0M by Arch Capital Group (NAS: ACGL). JP Morgan advised on the sale. | Noble Resources Trading Holdings, operator of a global supply chain portfolio, has reached a definitive agreement to be acquired for $208.9M by Vitol. | The Mortgage Arm of Iress was acquired for $109.56M by Bain Capital. GP Bullhound advised on the sale. | D'Or Consultoria, provider of insurance and benefits services, was acquired for $134.99M by MDS Group. | Beat Capital Partner, operator of a venture capital firm, was acquired for $282.0M by Ambac Financial Group (NYS: AMBC). Evercore advised on the sale. | Private Placement Transactions💭 | Yodel, provider of parcel delivery services, has raised $109.45M of venture funding led by PayPoint. | GCash, developer of a digital payment planform, has raised $391.39M of venture funding led by Ayala and MUFG Bank at a pre-money valuation of $4.5B. | Bilt, developer for a rewards platform, has raised $347.52M of venture funding led by Ontario Techers' Pension Plan at a pre-money valuation of $3.1B. | | Noteworthy Chart 🧭 | A 50bps rate cut is now heavily favored… |  | Joe Weisenthal @TheStalwart |  |

| |

Now nearly 75% chance of a 50bps rate cut |  Joe Weisenthal @TheStalwart Joe Weisenthal @TheStalwart

WOW! Nearly 70% chance of the Fed cutting by 50 bps in September. Two days ago it was 11% |

|  | | | 3:20 PM • Aug 2, 2024 | | | | | | 140 Likes 19 Retweets | 9 Replies |

|

| | Best of YouTube ⌚️ | 'Positioning unwind' is behind the overreaction to the job report, says NewEdge's Cameron Dawson: |  | 'Positioning unwind' is behind the overreaction to the job report, says NewEdge's Cameron Dawson |

|

| | Meme Cleanser 😆 |  | 🅿️ @the_P_God |  |

| |

|  Stamford Sam @Stamford_Sam Stamford Sam @Stamford_Sam

Imagine being the investment banker on the Louisiana Purchase |

|  | | | 3:52 PM • Aug 3, 2024 | | | | | | 11.5K Likes 361 Retweets | 17 Replies |

|

|  | High Yield Harry @HighyieldHarry |  |

| |

|  | | | 3:21 PM • Aug 2, 2024 | | | | | | 1.26K Likes 62 Retweets | 13 Replies |

|

|

|

Tidak ada komentar:

Posting Komentar