The S&P 500 just crossed below the 200 day moving average…

The Nasdaq is bleeding out… Are we headed for a recession?!

If you've been in the stock market the last few months, it hasn't been fun…

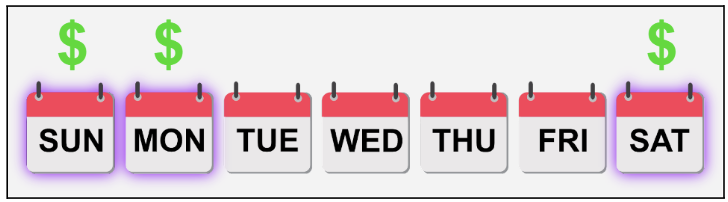

But what if I told you there was a way to target "BONUS" income just by doing a unique type of trade over the weekend?

By clicking the link above you agree to periodic updates from Diversified Trading Institute and its partners (privacy policy)

When the markets are closed. And volatility is minimal.

Seriously… Thanks to a little known move by the CBOE… these three days have become one of the most lucrative days for stock market pro's

All you need to do is set this type of trade before the weekend hits…

By clicking the link above you agree to periodic updates from Diversified Trading Institute and its partners (privacy policy)

And if it all works out… Close it out on Monday to collect your "BONUS" premiums.

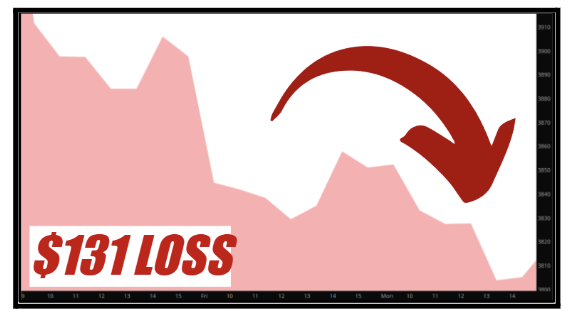

For example, in the back half of December 2022… The stock market took a terrible hit.

Now, let's say someone had $5k invested in the trusty S&P 500… here's how that would have worked out:

But if folks would have followed along with the Weekend Side Hustle, they could have seen a much different story…

By clicking the link above you agree to periodic updates from Diversified Trading Institute and its partners (privacy policy)

While the S&P 500 was plummeting, you could have walked away with an extra…

Of course, there's nothing guaranteed in the markets…

And you should never invest more than you could afford to lose.

Luckily, we've been able to win 12 out of the first 15 weekend trades so far…

Click here and I'll give you all the details.

By clicking the link above you agree to periodic updates from Diversified Trading Institute and its partners (privacy policy)

All the best,

TBUZ

Performance Disclosure: The published service launched to subscribers beginning June 2023. For the period June 2023 to May 2024, we have issued 62 alerts with 46 winners and 16 losers (74% accuracy rate), with the winners and losers generating an average return of $236.46 (including winners and losers). The average hold time is 3.39 days. Total P/L based on a $5k risk per trade is at $14,423.94. We cannot guarantee any specific future results, as there is always high degree of risk involved in trading. See our Terms on the DTI homepage for more information.

Tidak ada komentar:

Posting Komentar