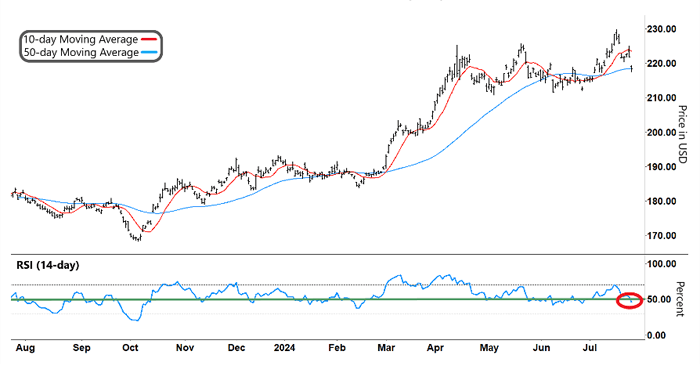

Two New Trades Ahead of a Volatile Week By Larry Benedict, editor, The Opportunistic Trader Yesterday, we opened two new trades… The first is a call option on the SPDR Gold Shares ETF (GLD). Gold saw a failed breakout to fresh highs earlier this month. Since then, prices have fallen back. But it looks like the sell-off has become overdone. That’s providing the basis for a mean-reversion trade. We’re aiming to capture GLD’s rally back to new highs. For that to happen, we’re looking for GLD to regain buying momentum. Take a look: SPDR Gold Shares ETF (GLD)

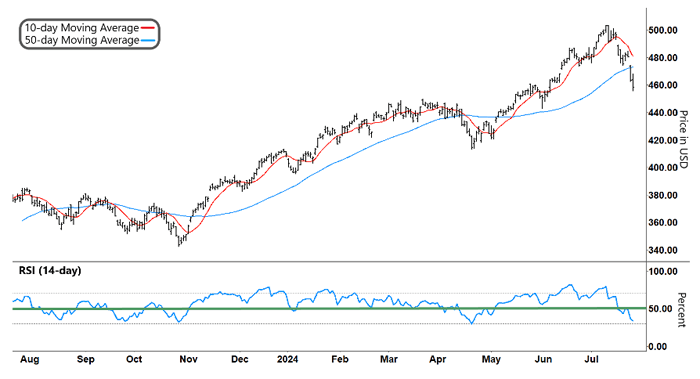

Source: eSignal (Click here to expand image) Our momentum indicator, the Relative Strength Index (RSI), has recently been testing support (red circle) – just as it did in June before rallying and sending GLD higher. The RSI rebounding into the upper half of its range would likely see GLD retest its highs from earlier this month. And that would put our trade into good profit… The second trade we opened was a put option on the Invesco QQQ Trust Series 1 (QQQ). In this trade, we’re aiming to capture continued weakness in the Nasdaq. As you can see in the chart below, QQQ has retraced strongly from its July 10 all-time high. It had lost 7% prior to us entering the trade. Invesco QQQ Trust Series 1 (QQQ)

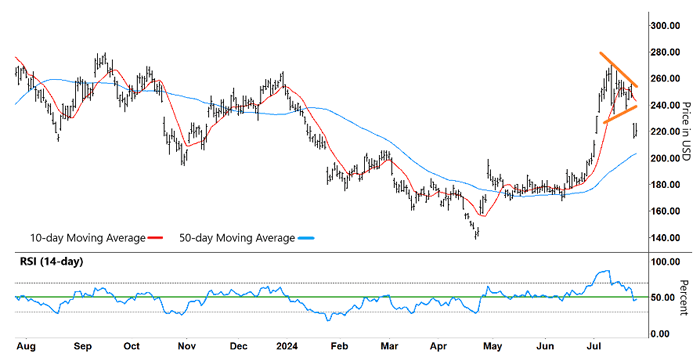

Source: eSignal (Click here to expand image) For that down move to develop further, buying momentum (RSI) should remain weak. QQQ has a heavy weighting of the mega-cap tech stocks (like Nvidia, Alphabet, and Meta), and I’m seeing bearish patterns on their charts. So I’m expecting more downside from QQQ’s July 10 high. Of course, within that Big Tech stock group, we also have open put positions on Apple (AAPL) and Tesla (TSLA). Those trades have had a challenging start. But as I covered in last week’s update, both trades are coming back our way. AAPL’s pullback has continued this past week, putting our position close to square. It’s a similar story with TSLA, although we’ve still got some ground to make on this trade. Last week, I wrote how TSLA was consolidating in a triangular pattern (orange lines in the chart below). I noted that we’d need to see the RSI track lower from overbought territory to set off another leg down. As the TSLA chart shows, that’s how things played out. And TSLA gapped lower. Tesla (TSLA)

Source: eSignal (Click here to expand image) The RSI is now pushing down against support (green line). And we’ll want to see it remain stuck in its lower band. Expiration isn’t until September 20. So we still have time on our side. Volatility Could Kick Higher Looking forward, on top of Q2 earnings, there’s plenty of economic action ahead… After today’s important Personal Consumption Expenditures inflation data, the market’s attention will swing to jobs data next week. The Federal Reserve will watch that closely. On Tuesday, we’ll see the latest Job Openings and Labor Turnover Survey numbers. Then on Friday, there’s nonfarm payrolls and unemployment data. Of course, the major story next week will be the Fed’s interest rate decision on Wednesday. The market will eagerly await any update by Chair Jerome Powell on the timing of rate cuts. No matter what, it’s all likely to add volatility in another busy week. Don’t forget that if you have any questions, suggestions, or any other comments, you can reach out to me at feedback@opportunistictrader.com. Happy Trading, Larry Benedict

Editor, The Opportunistic Trader Download the Opportunistic Trader Mobile App To make sure you don't miss any alerts or updates, please download the free Opportunistic Trader Mobile App for iOS or Android. The app enables you to get notifications whenever we publish something new. Make sure push notifications are enabled through your phone settings to receive alerts from the app. You can also access all of your subscriptions and view portfolios. And if you use the app and find it valuable, consider leaving us a review on the App Store or Google Play page. | |

Tidak ada komentar:

Posting Komentar