June 22, 2024

What to Do as Rates Trend Lower

Dear Subscriber,

|

| By Jim Nelson |

You may not pay attention to this. In fact, you may even think this doesn’t matter.

But indirectly, this is a crucial indicator …

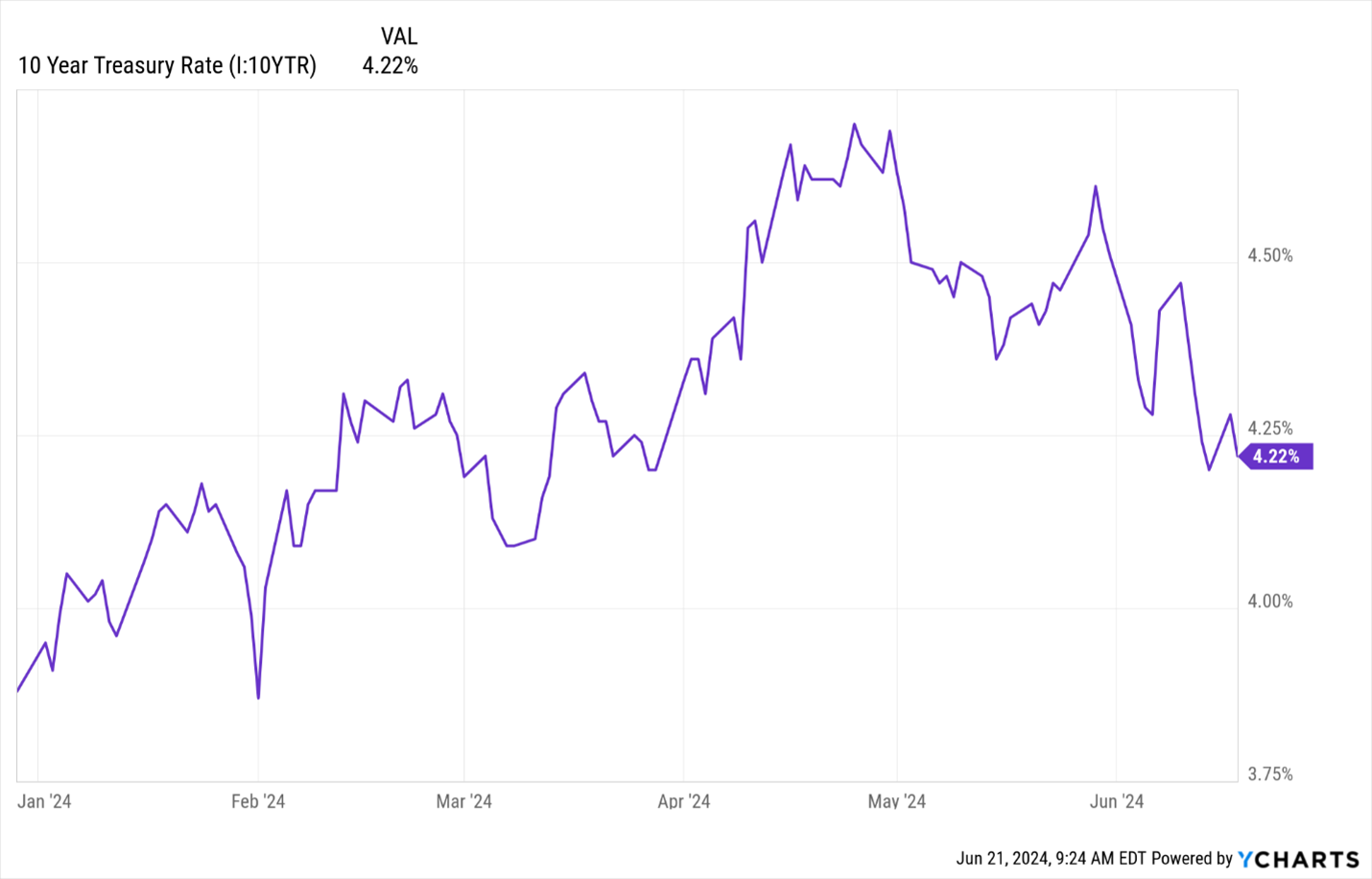

The 10-year Treasury rate currently sits at 4.22%.

That’s still up from where it started the year, below 4% … but is a full 50 basis points below its peak in late April.

In fact, the past two months have started the 10-year rate on a downward trend.

Year-to-date chart of the 10-year Treasury rate.

Source: YCharts.

Click here to see full-sized image.

As you can see, this broke the steady climb it was on to kick off 2024.

Why does this matter? Because almost every other interest rate — for your mortgage, your savings account and your credit cards — is related to this one.

So, when it changes direction, it’s important.

According to the Fed, inflation continues to cool. So, those hypothetical Fed rate cuts are back on the table. That’s a major reason for this reversal.

How many times will the Fed cut rates? Tough to tell. It was likely to be three when the year started. Recently the Fed signaled just one likely cut.

A recent Reuters poll found that forecasters are now predicting two.

But what the Fed does and where interest rates are today are not as important as where they end up.

Our Director of Research & Ratings Gavin Magor points this out through the stylings of Bruce Springsteen:

“I'm goin' down

I'm goin' down

Cause you ain't around baby

whole world's upside down”

—Bruce Springsteen

I am quite certain “the Boss” Bruce Springsteen wasn’t talking about interest rates in his famous song but rather a troubled relationship … but it seems that interest rates are finally going to start coming down later this year.

So, in that context, we’ll agree with the Boss.

We here at Weiss Ratings want all investors to be prepared for what’s on the financial horizon just as a musician wants to know the next note.

The main reasons for the Federal Reserve anticipating a rate cut later this year? New slightly lower inflation reports and a cooling labor market are at the top of the list.

At this point, I’m not sure if I would exactly call it a “soft landing.” But it’s a lot better than expected considering how high inflation was last year.

It is very encouraging to see inflation finally start to come down. And in general, I am still optimistic about the market … while staying cautious.

I do have two ways for investors to take advantage of this likely economic path.

You can read on and find out what those are here …

Of course, Gavin wasn’t the only one with insights … or ways for investors to take advantage this week. Here’s what the rest of your editors had to say:

AI Breathes Life Back Into 3D Printing

3D printing went from the hippest of all fads to a dead industry. But just when most gave up hope, AI has injected new life into it. In fact, now this niche industry is expected to grow by 36.5% over the next decade. Senior Investment Writer Karen Riccio has the scoop and the ways to play it.

Profit From America’s New ‘Population Bomb’

When Paul Ehrlich published “The Population Bomb” in 1968, he didn’t account for science, technology and innovation to basically make his argument obsolete. So, where do we turn for our own modern-day “Population Bomb?” Sean Brodrick has the answer.

Roaring Kitty vs. Nancy Pelosi

Congress likes to rail against investors even if what they do is perfectly legal and fair. But they don’t like you or I digging into their own investments. Nilus Mattive has some shocking news on this front.

Don’t Miss this Addictive Money-Making Opportunity

One of the fastest-growing industries is digital advertising. Don’t believe me? Take it from our Tech & Biotech Investing Strategist Michael A. Robinson. He found a company with an advertising marketplace that handles more than 10 million queries per second. And he thinks this is a great chance to get in on this ride.

Have a great weekend!

Jim Nelson

Managing Editor, Weiss Ratings Daily

Tidak ada komentar:

Posting Komentar