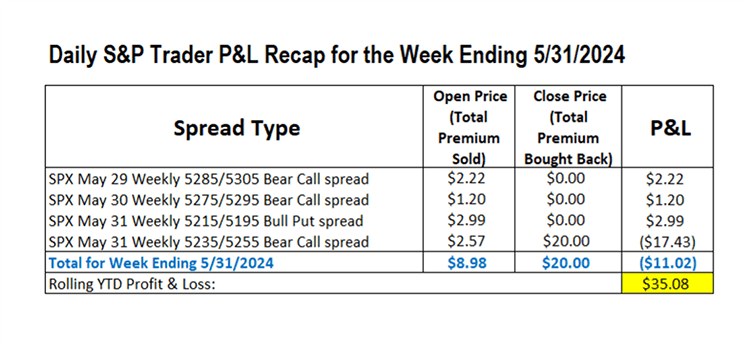

This Busy Week Could Deliver Plenty of Profits By Larry Benedict, editor, The S&P Trader Hey traders, Larry here with your weekly update… Last week, we had three winners from four trades. But that single losing trade saw our returns finish the week in the red. The spike in the S&P 500 (SPX) during the last half-hour of trading on Friday undid what would’ve been another profitable week. But as you know, there are no excuses in trading. In the end, only the results count. We finished the week down -$1,102 on a one-contract basis. But we’re still up $3,508 year-to-date (YTD). It’s worth noting that of the 103 trades we’ve made this year, 84% have been winners. And we’ve averaged a 2.0% gain on capital committed per trade. Our average holding period is just one day. So if we repeated that 2.0% gain over the 252 trading days in the year, we’d be up 504%. Of course, there’s no such thing as a good loss. But it reinforces how crucial risk management is. It has played a major factor in my long-term success going back over many decades. I’ll come back to that in just a moment. But first, here’s a recap of our trades last week…

(Click here to expand image) As I mentioned, the spike in the last half-hour on Friday put us behind for the week. That sharp rally went up through both legs of our 5235/5255 bear call spread. The $257 premium we received reduced the overall loss to $1,743 per contract for that trade. And the $641 combined premium from our three winning trades cut our overall weekly loss to $1,102 per contract. Still a loss, mind you… But the upper leg of our losing spread capped that loss. SPX closed out the day trading at 5280. That’s 25 points higher than our bought 5255 call. Without that upper leg, we would've had a further $2,500 loss per contract. That’s why the second leg is so important for managing your risk. It locks in your maximum loss. (Remember that the max loss from a spread trade is the difference between the options’ strike prices minus the premium you received.) So you know exactly how much you could lose before you place your trade. And that helps you determine exactly how big a position size you’re comfortable trading. This Week Could Be a Real Doozy Given all the economic data coming out, the week ahead looks like it could be a real doozy… Today, we have the latest manufacturing data. The Institute for Supply Management's manufacturing purchasing managers’ index for May fell to 48.7 from 49.2 in April. This was the second month in a row that U.S. manufacturing activity contracted. On Tuesday, we have total job openings. They’ve been in steady decline since their peak in March 2022. That’s followed by services data on Wednesday. And on Thursday, we’ll learn the latest initial jobless claims. Last week’s data showed a small move back higher. But the real test will come on Friday. That’s when the Bureau of Labor Statistics announces nonfarm payrolls and the unemployment rate. After a series of blowout numbers, April’s nonfarm payroll data came in lower than expected (175,000 versus the 243,000 forecast). And it was down a lot from the previous month’s 315,000 new jobs. Unemployment also ticked 0.1% higher back to 3.9%. Any deterioration in jobs data will set off calls for earlier interest rate cuts. And that could support an SPX rally. It’s shaping up to be a busy week. But rest assured, that means the potential for plenty of profits. If you have any questions, you can send them to feedback@opportunistictrader.com. I’m always glad to interact with readers. Regards, Larry Benedict

Editor, The S&P Trader Download the Opportunistic Trader Mobile App To make sure you don’t miss any alerts or updates, please download the free Opportunistic Trader Mobile App for iOS or Android. The app enables you to get notifications whenever we publish something new. Make sure push notifications are enabled through your phone settings to receive alerts from the app. You can also access all of your subscriptions and view portfolios. And if you use the app and find it valuable, consider leaving us a review on the App Store or Google Play page. | |

Tidak ada komentar:

Posting Komentar