June 20, 2024

Crypto Says: Don't Pay the Cost of Centralized Convenience

Dear Subscriber,

|

| By Jurica Dujmovic |

Last week, I delved into the privacy risks inherent in central bank digital currencies, or CBDCs.

I covered how a cashless economy can offer convenience and efficiency … at a cost. And it could be rather expensive, as CBDCs are a path to unprecedented government surveillance and control over your financial activities.

This week, I want to explore another critical piece of this dangerous puzzle: Digital identity, or digital ID, systems.

The Rise of Digital Identity Systems

Digital ID systems are designed to streamline and secure online transactions by providing a reliable method of verifying an individual's identity.

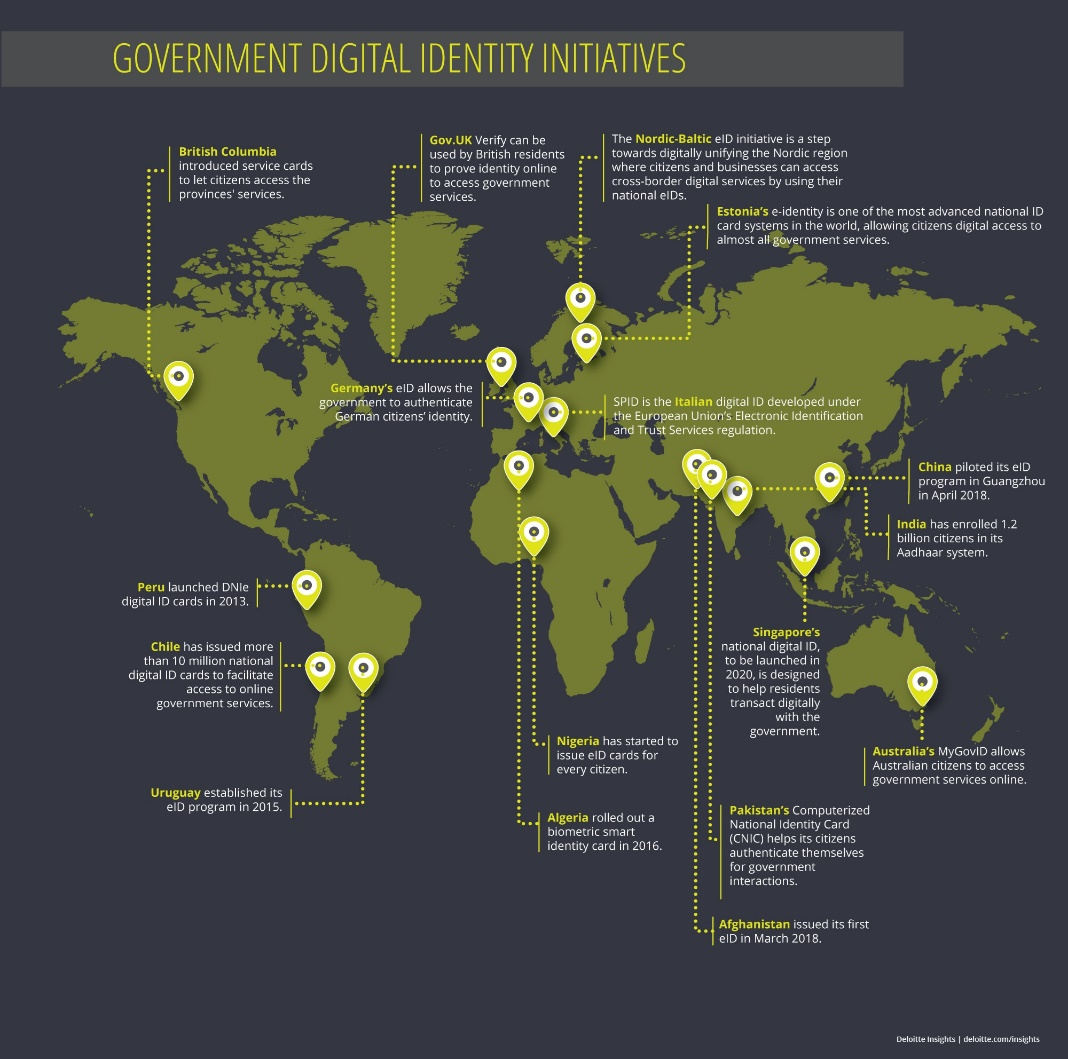

And they’re rapidly gaining traction worldwide, with numerous countries implementing or expanding their programs to streamline identification processes.

Source: Deloitte.

Click here to see full-sized image.

As of 2024, over 150 countries have embraced digital ID programs, driven by the promise of increased efficiency and security in both public and private sectors.

Including …

- India’s Aadhaar system. It assigns a unique biometric ID to residents for various services, from banking to public distribution systems, and has already enrolled over 1.3 billion people.

- Estonia’s e-Residency program allows non-residents to establish a digital identity for business and banking purposes.

- Germany, which is expanding its digital ID capabilities by enabling citizens to store their national ID on their smartphones.

-

The U.S. is jumping in on this trend by moving forward with digital driver’s licenses and exploring broader digital ID frameworks through legislative initiatives like the Improving Digital Identity Act of 2023.

In fact, the last time my colleague Beth Canova traveled by plane within the U.S., she didn’t have to show her boarding pass or ID at the security check. She merely had her picture taken, and her information came up on the screen.

-

And the EU is making significant strides with its European Digital Identity (EUDI) Wallet, an initiative aimed at providing citizens with a “secure, convenient way” to access public and private services online.

This wallet allows users to store and manage their identification documents digitally, facilitating cross-border transactions and interactions within the EU. The EUDI Wallet is part of the broader eIDAS regulation, which mandates cross-border recognition of national digital identities.

Looking at these initiatives, it’s not hard to see the benefits.

Digital IDs can help reduce identity fraud through advanced authentication methods, like biometrics and blockchain technology.

It can also streamline access to essential services, especially in regions where traditional identification methods are inefficient.

But what most people are likely to appreciate is that digital IDs offer unparalleled convenience. With just a click on your smartphone, you can access multiple services quickly and easily.

The Cost of Centralized Control

To me, digital IDs bring up that ever important question: How much of your freedom are you willing to give up for convenience and security?

Because the threat to individual freedom is the overarching concern underlying all these programs.

Digital IDs enable unprecedented levels of surveillance and control. And when combined with CBDCs, governments will be able to track every transaction and interaction, posing severe threats to personal privacy and autonomy.

And this power imbalance goes far beyond just tracking your transactions. The combination of digital IDs and CBDCs could also be used to …

1. Monitor and Control Behavior

The Chinese Social Credit System is a great example.

In China, the Social Credit System uses extensive surveillance — including facial recognition and data from millions of state-controlled cameras — to monitor and score citizens based on their behavior. Those with low scores face severe restrictions, such as being banned from travel or accessing certain services.

Indeed, in June 2019, 524 people were prevented from buying train tickets and another 871 from booking flights over lackluster scores.

And repercussions can have more severe impacts, including affecting a person’s ability to secure loans, jobs and even housing.

2. Enforce Compliance

When combined with corrupt or authoritarian regimes, the combination of digital IDs and CBDCs can enforce acceptance of and compliance with government policies. This could limit if not outright remove avenues of legitimate opposition.

For example, political dissidents may not have their freedom of speech outright denied. But they may find their ability to access basic services enrolled in digital ID systems limited.

3. Centralize Data … and Security Risks

Just as concerning, though not as evident, is the security of all this personal data.

Digital IDs naturally centralize your sensitive data. That makes it an appealing target for hackers. After all, it’s less effort to break into one system than several. And if successful, they’ll have access to all the most important personal data they can use to bleed people dry.

A breach in this system could lead to widespread identity theft and financial fraud.

There you have it.

The integration of digital IDs and CBDCs poses an existential threat that cannot be ignored. While advocates tout enhanced security and efficiency, the bargain we strike is relinquishing fundamental freedoms to an all-seeing government apparatus.

Realistically, fully resisting this trend will be an uphill battle.

The forces driving the adoption of these technologies — from administrative convenience to national security interests — are powerful and well-funded. And the public's willingness to trade privacy for ease-of-use cannot be underestimated.

However, that does not mean we simply surrender.

Advocacy groups, civil organizations and citizens who value freedom must apply relentless pressure on lawmakers to implement robust privacy safeguards and decentralized models that limit overreach.

Already we’re seeing some signs of moving in the right direction. The U.S. House of Representatives recently passed a bill prohibiting the Federal Reserve from creating a CBDC. That still has to pass the Senate before it can become law. But as I said, it’s a start.

Further legal protections can include …

- Regulatory firewalls between these systems and CBDCs, and

- The enshrinement of financial privacy as a fundamental right.

At the same time, it’s not a leap to see the crypto market — an economic system outside the control of central governments — as a safe haven. That means the development and adoption of decentralized cryptocurrencies and blockchain-based payment rails is vital.

And the push for decentralized digital identities, or DIDs, is already taking shape on the blockchain. My colleague Mark Gough wrote about them last week, in fact.

By removing the possibility of centralized control, DID systems offer the convenience of digital IDs … but with the additional security and anonymity of decentralization.

Look, the looming threat of government control via digital IDs and CBDCs is a multifaceted challenge. It requires a multipronged approach from civil societies, advocacy groups, legislators and the technology community to promote progress while preserving our freedoms.

So, what can YOU do to protect yourself?

First, and most important, is to stay informed. And this is your first step. Stay alert when new government-sponsored programs are rolled out. Study up on their pros and cons.

Second, speak up. The wheels of bureaucracy move slow. But supporting an advocacy group or reaching out to your legislators directly about your concerns can be the start of a wider, grassroots movement.

Third, keep your crypto education going. As I said, crypto offers an alternative financial system. The ability to navigate the decentralized crypto market will come in clutch if you ever need to lessen your exposure to the traditional system. And you don’t want to realize you need more lessons when that moment comes.

For that, I urge you to learn how to …

These will be the building blocks for your crypto education. And they’re the start to being more in control of your financial future than any centralized government should be.

Best,

Jurica Dujmovic

P.S. Not only does DeFi offer protection from government overreach. It also has yield opportunities that blow what’s available in TradFi out of the water.

At the time of writing, a 10-year U.S. Treasury note is offering 4.3% APY. And remember, you have to wait years to see that return — and pray that inflation doesn’t wipe out your earnings.

But this month alone, my colleague and DeFi expert Marija Matic found two yield opportunities that offered 183% APY and 73% APY on investment funds and a 30% APY opportunity in just stablecoins!

And that’s just the tip of the iceberg.

To learn how she finds these opportunities and the strategy she uses to supercharge DeFi yields, I urge you to watch her latest briefing here.

Tidak ada komentar:

Posting Komentar