Sponsored by |  |

| The Main Story | Movie theaters posted an alarmingly weak MDW, marking the worst performance for this holiday in decades. The top film, "Furiosa," grossed only $32 million over the four-day period, the lowest for a No. 1 Memorial Day release since 1995. "The Garfield Movie" also underperformed, earning $31.9 million, despite being a family-friendly animated film. A few possible reasons for the slump: A nice Holiday weekend means people may have preferred to be outdoors instead of sitting inside in a movie theatre After-shocks of the WGA and SAG-AFTRA strikes, which caused production delays and pushed back the release of more popular movies like "Snow White" and "Fantastic Four" Streamers are winners. A new poll found that 2/3 of American adults would rather wait to wait to watch at home than go to theaters…It doesn't help when The Fall Guy, the Ryan Gosling movie that came out a few weeks ago, is already available to purchase at home! Films are certainly going from the box office to streaming quickly…

| Headlines 🔍 | Salesforce fell🔻 16% in after-hours trading yesterday after revenue of $9.13B was a slight miss and next quarter's forecast for $9.2-$9.25B of revenue missed estimates of $9.37B and would be the slowest quarter of sales growth in company history. While Benioff touted their AI offering, Einstein Copilot, even Cramer wasn't convinced about this quarter's results Jamie Dimon *hates* Private Credit: JPM CEO Jamie Dimon said "there could be hell to pay" if private deals go south and was worried about how retail investors may be impacted. Dimon also compared some of these private credit deals to global financial crisis mortgages. He did however describe some industry participants as "brilliant", while describing some as "not good" What's really going on: Dimon is talking his book. Private Credit is not an equivalent to mortgage backed securities, it's a significantly different borrower profile…This more so stems from banks like JPM losing share to private credit This is a "Watch what i do, not what I say" moment - as it has been reported for the bulk of this year that JPM is looking for a Private Credit partner. Jamie is talking his book, but the traditional media is running with the headline that gets the most clicks

Another FTX Exec goes down: Former FTX Digital Markets CO-CEO Ryan Salame was sentenced to 7.5 years in prison, plus 6 million in forfeiture and 5 million in restitution. This compares to SBF getting 25 years in prison. While Salame plead guilty, he didn't cooperate the same way others like co-founder Gary Wang, chief engineer Nishad Singh and Alameda Research CEO Caroline Ellison did. It will be interesting to see what type of punishment the next three get.

|  | Tiffany Fong @TiffanyFong_ |  |

| |

WOAH former FTX executive Ryan Salame was just sentenced to 7.5 years in prison… MORE than the government's recommendation of 5-7 years. Ryan Salame pleaded guilty in September 2023, but he didn't cooperate with prosecutors. Oooof. | | | May 28, 2024 | | | | | | 306 Likes 35 Retweets 50 Replies |

|

| Ryan wasted no time in taking to Twitter…. |  | Molly White @molly0xFFF |  |

| |

FTX's Ryan Salame has returned to Twitter for the first time since FTX collapsed — hours after he was sentenced to 7.5 years in prison for his role in the FTX fraud and for his illegal campaign contributions 💀 |  | | | May 28, 2024 | | | | | | 162 Likes 20 Retweets 16 Replies |

|

| The Subway Securitization: Private Equity firm Roark Capital, who specializes in restaurant buyouts, is conducting their LBO of Subway in a unique way. They're issuing a $3.35B asset-backed-security (ABS) to finance the $9B deal. This is also known as a whole business securitization (WBS) and is the largest on record now. WBS and ABS transactions are a potential share stealer from the traditional leveraged loan market since they offer higher ratings, with attractive spreads, and strong collateralization for institutional lenders T+1 is official: The SEC is speeding up settlement dates, meaning stock purchases and sales are now settled in one day instead of two days. Brokers are required to post collateral (margin) from when a trade is executed and settled – looking back to the 2021 meme stock craze, Robinhood had to restrict trading of GameStop and BB&B because it couldn't maintain margin requirements through the 2-day settlement period. The resulting backlash helped push the SEC to move towards the shortened timeline, which hopefully reduces default risk.

Hess gets the go ahead from shareholders for the $53B merger with Chevron. The deal had been bogged down for months by Exxon over Hess' ownership in the recently discovered Guyana oil treasure trove. The Leveraged Loan Market remains hot: Higher quality high yield issuers are taking the market by storm, with a large supply of repricings. Companies pricing < S+300 include Qualtrics, Gates Industrial, Iridium, and Simply Good Foods. UiPath reported a terrible earnings outlook…and the CEO will leave after just months on the job. He'll be replaced the co-founder and former CEO of the Company. Shares are down over 28% after hours. This is a Cathie Wood favorite, and a name she recently loaded up on. Read more here Palantir was awarded a $480 million deal by the Pentagon for their new AI computer offering Elliott has taken a $2.5B activist position in Texas Instruments. David Faber at CNBC broke the news. Elliott (led by legendary Paul Singer, aka "the Doomsday investor") has advised Texas Instruments to increase free cash flow by reducing capex…a novel idea… Hertz is downgraded by Moody's. The spiraling of the "unlucky lemon" of Wall Street comes after the recent news that Hertz is trying to offload its 30k Tesla fleet Warning signs are flashing for key Florida and Texas housing markets: Orlando, Tampa, Miami, and Houston are among the cities seeing rising insurance premiums, rising property taxes, and rising interest rates that are driving a significant bump up in foreclosures The Humanization of Pets continues: Introducing Bark Air, where you spend $6,000 a ride to hop on a private jet with your pet. There's other pet parents on the flight too…making it a pretty pricey and potentially chaotic scenario for the good boys A month after a bankruptcy judge approved a SoftBank backed restructuring plan, Adam Neumann abandoned his campaign to buy back WeWork. Neumann called the post re-org restructuring as "unrealistic and unlikely to succeed." KKR said to consider $1 Billion acquisition of Healthium Medtech

| A Message from our Sponsor | | | Invest before this company becomes a household name | What if you had the opportunity to invest in the biggest electronics products before they launched into big box retail, would you? | Ring changed doorbells and Nest changed thermostats. Early investors in these companies earned massive returns, but the opportunity to invest was limited to a select, wealthy few. Not anymore. RYSE has just launched in 100+ Best Buy stores, and you're in luck — you can still invest at only $1.50/share before their name becomes known nationwide. | They have patented the only mass market shade automation device, and their exclusive deal with Best Buy resembles that which led Ring and Nest to their billion-dollar buyouts. | Learn how you can become a shareholder. | | M&A Transactions💭 | Withnix, distributor and seller of home appliances, was acquired for $2.2B by DongKook Pharmaceutical Company (KRX: 086450). | Princes Group, provider of tuna processing services, has reached a definitive agreement to be acquired for $882.1M by Newlat Food (MIL: NWL). Houlihan Lokey advised on the sale. | GHL Systems (KLS: 0021), a payments services provider, has reached a definitive agreement to be acquired for $153.09M by NTT Data Group (TKS: 9613). | Yellow Jersey Therapeutics, producer of pharmaceutical substances, has reached a definitive agreement to be acquired for $1.25B by Johnson & Johnson (NYS: JNJ). | West Texas Gas, operator of natural gas distribution, has reached a definitive agreement to be acquired for $3.25B by Energy Transfer (NYS: ET). Jefferies advised on the sale. | Sociedade de Atividades em Multimidia, provider of multimedia communications, has reached a definitive agreement to be acquired for $194.85M by Megatelecom Telecomunicacoes. | Raptor Scientific, manufacturer of engineering, testing, and measuring products intended for aerospace, has reached a definitive agreement to be acquired for $655.00M by TransDigm Group (NYS: TDG). | Hauck Aufhauser Lampe Privatbank, provider of financial advisor and banking services, has reached a definitive agreement to be acquired for $ 725.36M by ABN AMRO Bank (AMS: ABN). | Atrion Corporation (NAS: ATRI), develops and manufactures products for medical applications, has reached a definitive agreement to be acquired for $800.00M by Nordson (NAS: NDSN). | Atlantica Sustainable Infrastructure (NAS: AY), owns, manages, and acquires renewable energy, conventional power, electric transmission lines and water assets, has entered a definitive agreement to be acquired for $2.56B by Energy Capital Partners. Citigroup advised on the sale. | EyeBio, developer of a vision therapy intended to protect, restore and improve vision, has reached a definitive agreement to be acquired for $1.3B by Merck & Co. (NYS: MRK). | Private Placement Transactions💭 | Koios Medical, developer of an ultrasound image analysis platform, raised $130.00M of venture funding in the form of convertible debt from an undisclosed investor. | Cloover, developer of an online portal, raised $114.00M of Seed funding in a deal led by Lowercarbon Capital and Chriss Sacca. | Noteworthy Chart 🧭 | Is Robinhood actually back? These stats are pretty surprising… | | A Message from Vinovest | SOLD! Bourbon Generates 23% Return For Investors | | Vinovest sold its bourbon casks for $1,850 each resulting in a 23.3% return for clients over 1 year. This is Vinovest's third whiskey exit. (Quite a track record.) And with Barron's projecting that whiskey investing is "a global phenomenon that shows no signs of slowing down," now could be a perfect time to add casks of whiskey to your portfolio. | Vinovest is the all-in-one platform that allows you to capitalize on this lucrative asset class in just minutes. Schedule a call with a whiskey advisor today. | Get started. | Best of YouTube ⌚️ | How the US Is Destroying Young People's Future - from Scott Galloway |  | How the US Is Destroying Young People's Future | Scott Galloway | TED |

|

| Meme Cleanser 😆 |  | Inverse Cramer (Not Jim Cramer) @CramerTracker |  |

| |

Nvidia is now worth more than Meta, Tesla, Netflix, AMD, Intel, and IBM combined |  | | | May 28, 2024 | | | | | | 2.11K Likes 171 Retweets 51 Replies |

|

|  | Masa Capital @MasaSonCap |  |

| |

Software investors in 2021 | Software investors in 2024 |  | | | May 29, 2024 | | | | | | 12 Likes 0 Retweets 0 Replies |

|

|  | High Yield Harry @HighyieldHarry |  |

| |

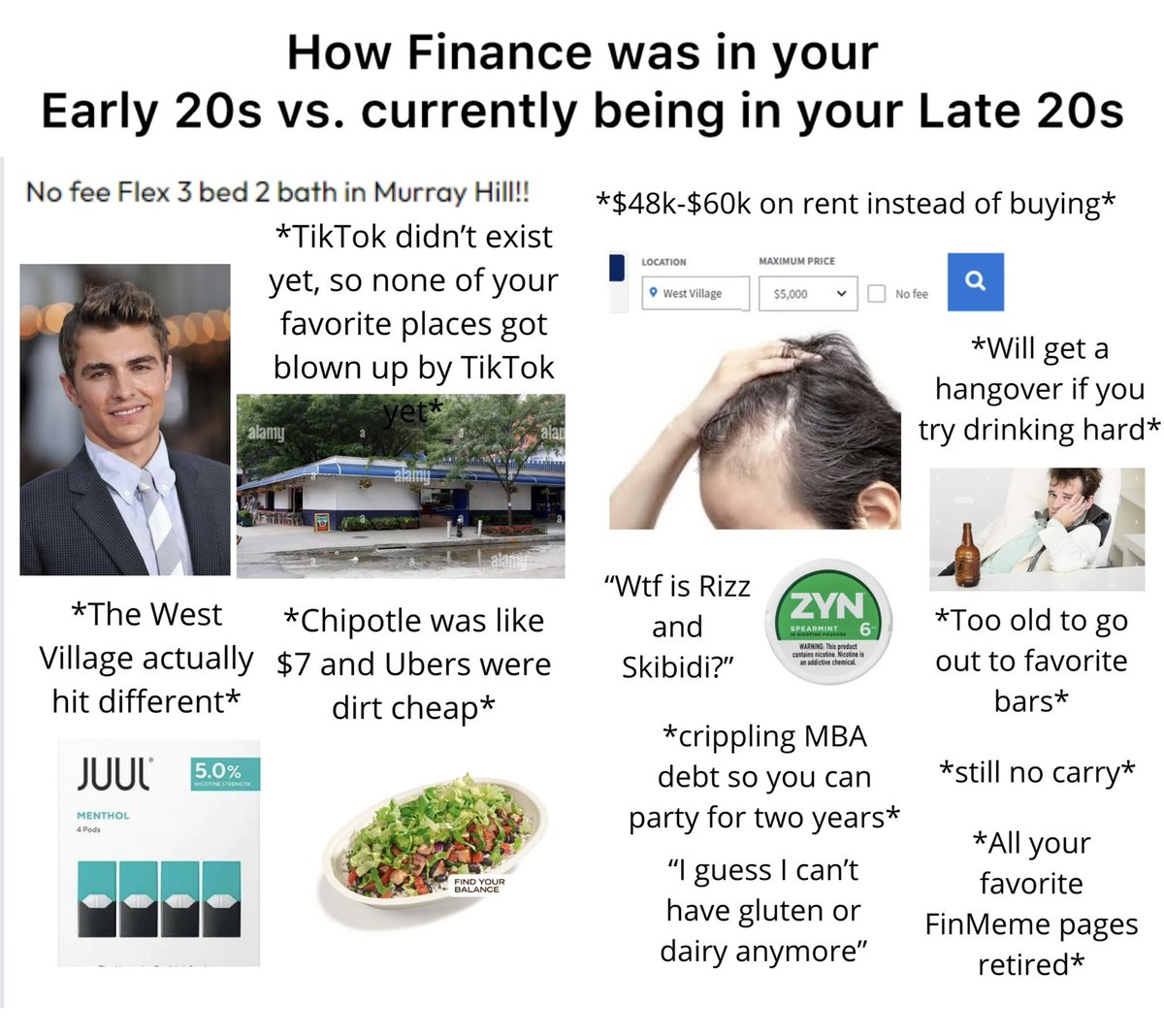

Rare Starter pack to address late 20s dread |  | | | May 27, 2024 | | | | | | 802 Likes 29 Retweets 22 Replies |

|

|  | 🅿️ @the_P_God |  |

| |

Me: only interested in opportunities in the north east. Recruiters: but have you thought about Texas? |  | | | May 29, 2024 | | | | | | 156 Likes 0 Retweets 9 Replies |

|

| In Other News | Have you checked out Mainstreet yet? They allow individuals to invest in curated venture capital funds for low minimums. Subscribe to their Newsletter Automatically Here. Want to learn more about Private Credit? High Yield Harry has an interview with an anonymous Private Credit VP dropping next week. Subscribe Automatically Here to make sure you get Monday's Newsletter.

|

|

Tidak ada komentar:

Posting Komentar