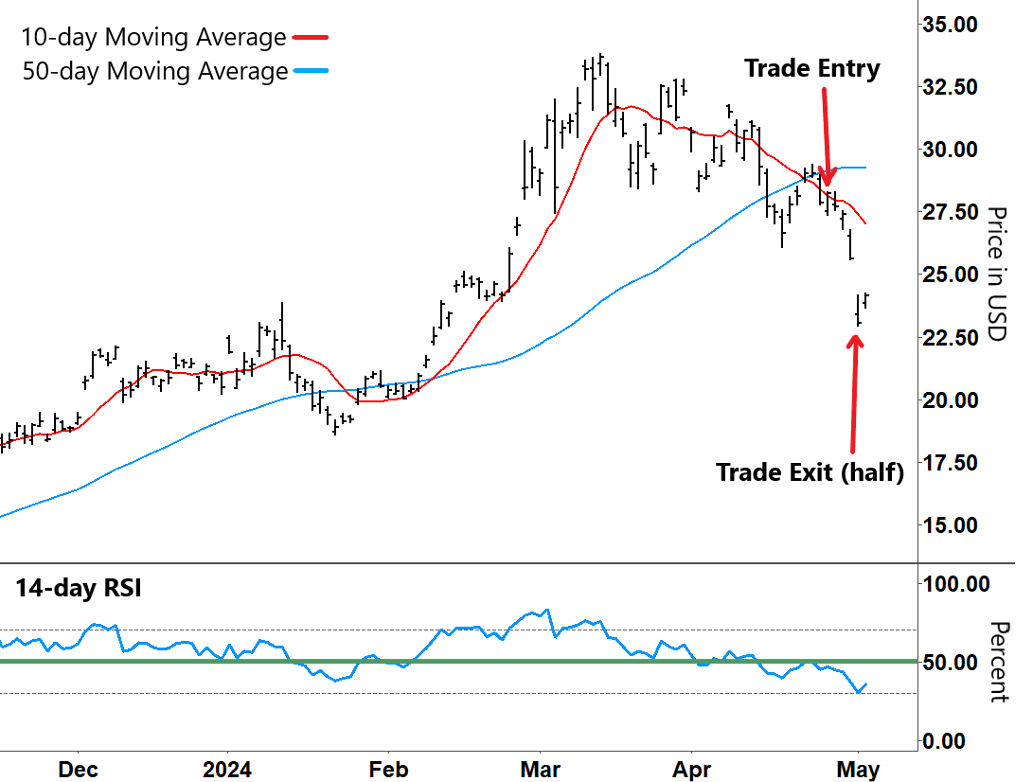

A Bitcoin Win as We Shape Up for Another Big Month By Larry Benedict, editor, The Opportunistic Trader Hi traders, welcome to this update for The Opportunistic Trader in what has been a busy week. Not only have we seen increasing volatility in stocks, but there have also been some big moves in cryptos. The good news is that we saw a sharp sell-off in the ProShares Bitcoin Strategy ETF (BITO). That enabled us to exit half of our put option position for a gain of around 63%. Even better, we booked this first-half profit in less than a week. We’ll keep the remaining half position open. That will allow us to capture any potential further downside in BITO. One of the major reasons behind all the volatility has been the nonstop debate about interest rates. Yet the Federal Reserve’s widely anticipated meeting on Wednesday didn’t provide much more clarity. The Fed is still leaning toward possible rate cuts this year. But it gave no clue as to the timing. The market’s bet is now November. It also indicated that rate rises are unlikely. The caveat, as usual, was that the Fed would let economic data dictate its actions. So the market is going to scrutinize each piece of economic news closely. That’s especially the case for the nonfarm payroll and unemployment data due out today. Chair Jerome Powell stated that it would take a “meaningful” jump in unemployment to provide the basis for rate cuts. So we’ll keep a close eye on the next Consumer Price Index inflation and retail sales prints that come out on May 15. And Personal Consumption Expenditures inflation data (the Fed’s preferred measure) is due out on the last day of May. We’re also in the midst of a mixed earnings season. As we discussed last week, stocks that disappointed such as Netflix (NFLX) and Meta Platforms (META) have seen their share price take a big hit. On the other side, Alphabet (GOOGL) gapped higher off its big earnings beat. Today, we’ll be able to see the follow-through from Apple’s (AAPL) better-than-expected Q2 earnings. The company also announced a huge $110 billion stock buyback. And given its leading role in the artificial intelligence rally, Nvidia’s (NVDA) earnings on May 22 will draw a lot of attention as well. Add all those factors up, and it’s shaping up to be an active month. We’re likely to get some tradeable swings. Now let’s look at the first half of our BITO trade… Taking Profits on Half of Our Position We took profits on half of the put option trade on the ProShares Bitcoin Strategy ETF (BITO)… Trade: BITO June 21 $26 Put BITO had fallen around 16% from its March 13 high, and the chart still looked bearish. So we opened a short position by buying a put option. And the trade has gone our way right from the start, as you can see in the chart below: ProShares Bitcoin Strategy ETF (BITO)

Source: e-Signal (Click here to expand image) Bitcoin continued to sell off heavily after entering our trade. Our trade was in good profit, and the Relative Strength Index (RSI) touched oversold territory (the lower gray dashed line). So we decided to close out half of our position and bank our profits. We’ll now keep the other half open as we look to capture any more potential downside. In the meantime, if you have any questions, you can send them to feedback@opportunistictrader.com. I’m always glad to interact with readers. Regards, Larry Benedict

Editor, The Opportunistic Trader Download the Opportunistic Trader Mobile App To make sure you don’t miss any alerts or updates, please download the free Opportunistic Trader Mobile App for iOS or Android. The app enables you to get notifications whenever we publish something new. Make sure push notifications are enabled through your phone settings to receive alerts from the app. You can also access all of your subscriptions and view portfolios. And if you use the app and find it valuable, consider leaving us a review on the App Store or Google Play page. | |

Tidak ada komentar:

Posting Komentar