In This Issue:

• A Four-Way Assault on the Bulls

• ETF Talk: Raising Our Glasses with a Hearty 'Skol' to This Bullion Fund

• Ask Me Anything, Bridge and Bitcoin Edition

• More Viking Wisdom

| | A Four-Way Assault on the Bulls | | Sponsored Content 7 Powerhouse Stocks to Buy and Hold Forever Every investor I know is worried about the same thing right now…

Will this incredible market rally continue, or are we about to see a massive correction? Look, the honest answer is nobody knows. But I DO know a way to stop worrying about the market's next move…

Own a select group of stocks that can weather whatever the market has in store. These 7 stocks fit the bill and I'm making the full list available completely FREE for a limited time in our new report, "7 Stocks to Buy and Hold Forever."

Get it now. | | | A Four-Way Assault on the Bulls

On Tuesday, April 2, all of the major domestic equity indices fell sharply. And while the most-cited reason for the decline was higher yields, that's not the real reason the S&P 500 declined by more than 1% intraday.

Instead, the declines were driven by what we described to subscribers of our Eagle Eye Opener daily market briefing as a "four-way assault on the bullish mantra" that's pushed stocks higher since late October.

Specifically, here are the four reasons stocks declined Tuesday.

Higher Rates: This absolutely contributed as the 10-year yield hit a multi-month high of 4.40% and appears to be trying to break out of the "stock positive" 3.75-4.25% trading range. The higher rates were driven by markets reducing expectations for a June rate cut by the Federal Reserve (now just above 60%).

Warning Signs from the Consumer: PVH (formerly Phillips-Van Heusen) is a clothing company that owns brands such as Tommy Hilfiger, Calvin Klein and others. Its guidance was not good (in fact, it was bad) and the primary reason for the soft guidance was concerns about the consumer (and if the consumer restrains spending, hard landing concerns will rise, sharply).

Oil: Very quietly, oil prices have risen to multi-month highs on a combination of optimism towards Chinese growth and rising geopolitical tensions (Iran may execute a retaliatory strike on Israel following the Israeli strike in Syria, which killed a high-ranking Iranian official). Rising oil isn't necessarily an inflation issue (the Fed will look past it), but it is a growth issue if oil prices stay elevated.

Tech and Health Care Weakness: Tesla, Inc. (NASDAQ: TSLA) posted horrible vehicle deliveries (its worst in years) and while Tesla isn't an artificial intelligence (AI) company, it is a tangential tech company, and the weakness in electric vehicles (EVs) weighed on tech. Meanwhile, Medicare Advantage pricing didn't increase, so managed care insurance companies such as Humana Inc. (NYSE: HUM) (a big and widely owned stock) got hit hard as that's a problem for margins.

Each of these is an attack on a certain part of the bullish mantra argument. Higher rates challenge the idea of looming Fed rate cuts, the horrid PVH guidance challenges the idea of a resilient economy, higher oil challenges the idea of falling inflation and solid growth and the TSLA/EV results attack tech more broadly.

So, what does this mean for markets?

Importantly, none of these items materially alter the market narrative and none of them are bearish gamechangers. But with the S&P 500 trading above 21X earnings, none of them have to be gamechangers to cause a correction.

The S&P 500 has risen more than 25% in five months, and it is trading at 21X earnings. It is entirely reasonable to expect a pullback, and if we get more headlines like we saw Tuesday, we will absolutely get a 5%-ish pullback -- although that's a pullback that we'd likely look to buy as long as the four bullish factors are still in place.

Moreover, this type of volatility is why it might be good to look at lower-beta equity allocations, because the chances of a 5-10% pullback remain greater in the near term than the chances of a 5-10% rally. So, being tactically overweight in lower-beta sectors such as defensive sectors (utilities/staples/healthcare) and focused on quality factors is a good way to weather any correction and take advantage of any pullback.

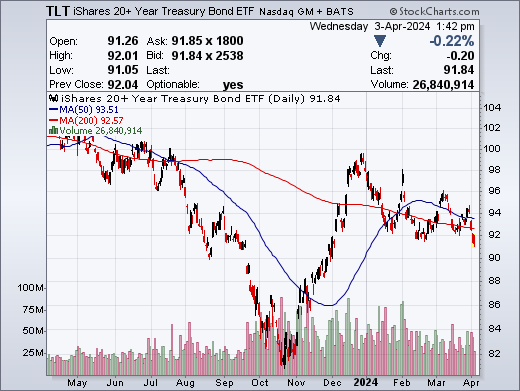

Another area to look at is longer-duration Treasury holdings and potentially increase them if you are underweight in the segment, as this increase in yields presents an opportunity to leg in. However, that's only if your equity allocations and the accompanying volatility are too much for your comfort level. The iShares 20+ Year Treasury Bond ETF (TLT) remains one of the easiest ways to quickly add duration to portfolios.

Bottom line, Tuesday's negative news wasn't a bearish gamechanger, but it is a reminder that there is ample room for disappointment in this market. More broadly, slowing growth and disappointing earnings remain the No. 1 risks we need to monitor (and we are doing just that for you in the Eagle Eye Opener) and Tuesday's headlines only reinforced our vigilance.

Want analysis like this in your inbox every trading day by 8 a.m. ET, all for the price of your morning cup of coffee? If the answer is "yes," (and why wouldn't it be?) then I invite you to check out my Eagle Eye Opener, right now. | | China's Global Conspiracy to Destroy the American Dollar China is nearing the end of its 40-year plan to dominate the world's economy. Only one obstacle remains: The U.S. dollar. But not for long... because China has enlisted many co-conspirators to sink the dollar: Russia, India, Brazil, Argentina, Germany, and even Canada. And – no surprise – the International Monetary Fund (IMF) wants to jump in to help China win.

This means China now has the power to crush the dollar almost overnight... and bankrupt America. But there's still time to protect the money and retirement of investors. Click here now to find out how... before it's too late. | | | ETF Talk: Raising Our Glasses with a Hearty 'Skol' to This Bullion Fund

"Always rise to an early meal, but eat your fill before a feast. If you're hungry you have no time to talk at the table."

– Hávamál, (Book of Viking Wisdom)

As any reader of The Deep Woods knows, this is a publication that takes a step back from pure investment dialogue and allows me to share brief personal vignettes and pearls of Renaissance Man wisdom. And while this particular segment does indeed concentrate on exchange-traded funds (ETFs), there is no reason it cannot raise a toast to history.

The Vikings were a people centered around perceived righteous battles, astute strategy and a sense of fearlessness -- all in the name of Valhalla, the ultimate Viking heaven. And, while we may not be centered around entrance into Valhalla, astute strategy is indeed the name of the investment game. Keeping that in mind, the above quote can act as a reminder to investors that if we squander time waiting for the market to look the way we want it to, we may miss out on potentially fruitful investment opportunities, such as abrdn Physical Gold Shares ETF (SGOL).

With a sufficiently whetted appetite, let's discuss SGOL as an opportunity that may deserve a hearty "Skol!"

The term Skol has several loose translations dating back to the deep-seated traditions of the Vikings and Norse people. While we now use it as a substitute for "cheers" when toasting, its more literal translation means "your bowl and my bowl."

So, let's toast "Skol!" to SGOL, the abrdn Physical Gold Shares ETF, as a choice on the investing menu that may very well help to fill all of our bowls.

Once again, investors are bracing themselves for Fed rate cuts -- not a novel concept, but one that undoubtedly leads to market shifts and strategic investment shuffling. In times of market shift, changing headwinds and general malaise, wise investors may seek out asymmetric trading opportunities -- simply meaning investments that have greater upside potential than downside loss.

One such trading opportunity can be found in gold bullion, and more specifically, SGOL, a personal favorite of mine. The goal of the fund is to provide investors with an efficient and cost-effective way of making an investment like buying gold. While not exactly the equivalent of gold, SGOL gives investors an alternative that allows a level of participation in the gold market via the securities market.

One of the perks of the fund is its grantor structuring -- which is a type of structuring that is held to stricter regulatory measures than open-ended funds. Grantor trusts must meet certain requirements set forth by the Investment Company Act of 1933 and 1934. Because of this, ETFs with this structure must provide additional financial disclosures, and tax-wise, the investors of these ETFs are seen as direct shareholders of the investments within the fund. Therefore, investors are taxed directly and needn't deal with extra tax vexations, such as the dreaded K-1 form.

Further, the fund has more than $2.7 billion in net assets and roughly $3 billion in assets under management. If this isn't tempting enough to pique one's interest, SGOL's infinitesimal expense ratio of 0.17% just might.

Courtesy of stockcharts.com

Currently, SGOL is trading at $21.78, which is near its 52-week-range high of $21.83. As the chart shows, the fund saw a steep decline in October, but in a "Viking-esque" fashion, it righted itself and has continued to climb since then. Its immense liquidity, with an average of more than 3 million shares traded per day, may have something to do with the fund's rapid rebound.

Ultimately, the abrdn Physical Gold Shares ETF (SGOL) may be just the asymmetrical trading component that interested investors are seeking. Not only is the fund's strategy astute, but the reasons behind owning it may be as well.

So, let's raise a toast, and cry "Skol!" to SGOL.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to email me. You may see your question answered in a future ETF Talk. | | Learn to Trade Like Interest Rates Don't Matter As February overflows with interest rate headlines, here's a fresh perspective for you: Learn to trade like interest rates don't matter. Whether you're a stock trader, options trader, swing trader, or day trader, this A.I. "Brain" is predicting market movements days in advance.

Don't Miss This FREE Live Class to Learn How > | | | In case you missed it…

Ask Me Anything, Bridge and Bitcoin Edition

Since the terrible maritime accident that caused the near-instant collapse of the Francis Scott Key bridge in Baltimore last week, I've fielded multiple questions about this from readers concerned about the potential economic aftereffects of this tragedy.

Because of these questions, as well as a slew of recent questions on Bitcoin, this week, I decided to do another edition of "Ask Me Anything." First, let's start with the Baltimore bridge collapse.

Here is the essence of the inquiries posed to me by multiple readers on this subject: "Jim, do you think the Baltimore bridge collapse and subsequent shipping disruptions it will cause will have a big impact on supply chains, and could this lead to a bounce back in inflation?"

As we wrote last week in my Eagle Eye Opener regarding this situation, there is unlikely to be a big impact on global supply chains that leads to inflation, and that's due to two main reasons.

First, as of 2021, Baltimore was the 17th-largest port in the U.S. based on total tonnage, according to Bureau of Transportation Statistics. However, the port does rank near the top in terms of volume of automobiles and light trucks it handles and for vessels that carry wheeled cargo, including farm and construction machinery. Because the port is somewhat specialized, it's not large enough to cause a material supply chain disruption that leads to broader inflation. Additionally, many of the port's major imports are specialized automobiles, and that disruption will be partially absorbed by ports in Charleston, Savannah and New York/New Jersey.

Second, there aren't major energy imports into the port that could lead to an inflationary spike in energy prices. Coal is a major export from the port and that will cause short-term disruptions, and that's why we saw the coal names down sharply last Tuesday, such as CONSOL Energy Inc. (CEIX) and rail operator CSX Corporation (CSX), which slid 6.8% and 1.9%, respectively. Yet, in early trading last Wednesday, CEIX was up nearly 3% while CSX was up some 1%, so each had recaptured about half of the last day's declines.

But while it will take a long time to rebuild the bridge, this isn't a material negative for either company. However, if we do see declines in these and related stocks, that will likely be a long-term buying opportunity.

So, while the bridge collapse is both a human tragedy and a short-term negative for specific companies (Northeastern coal and rails, autos due to delayed imports) it's unlikely to alter the outlook for inflation or growth and it's not enough to disrupt the bullish mantra I've written about in detail in my newsletters of 1) Stable growth, 2) Falling inflation, 3) Looming Fed rate cuts and 4) AI enthusiasm.

Michael C. writes: "Jim, can you explain what's going on with Bitcoin, and specifically the Bitcoin halving?"

Subscribers to my Successful Investing and Intelligence Report newsletters were treated to a full explanation of the reason for Bitcoin's latest move, and it has a lot to do with the upcoming "halving." So, Michael, if you were a subscriber, you would already know the answer. But since you are a reader of The Deep Woods that values my advice on these matters, I will gladly give you the essential answer right now.

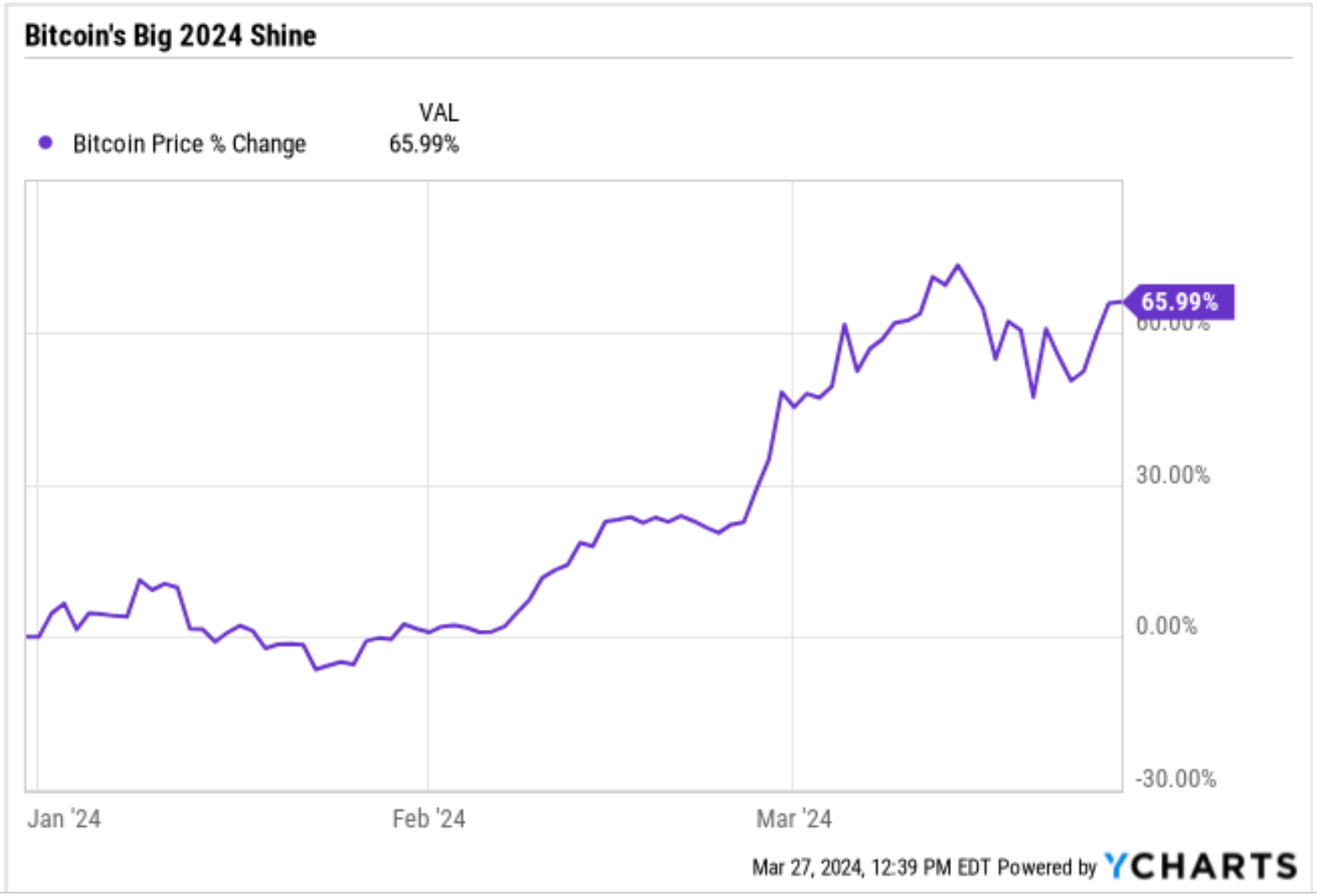

One reason for the big move higher in Bitcoin is that the recent approval of the spot Bitcoin ETFs has helped the cryptocurrency vault firmly in the minds of even casual observers of markets. The other big reason is "the halving."

You see, Bitcoin's "anonymous" creator, Satoshi Nakamoto, wanted Bitcoin to stand out from all paper currencies (i.e., dollar, euro, franc, etc.). Satoshi wanted Bitcoin to hold its value (or gain in value) over time, so he built an "anti-inflationary mechanism" into its code.

Per its code, the "block subsidy is cut in half every 210,000 blocks, which will occur every four years." Therefore, every four years, there's a 50% reduction in the number of new Bitcoins that come to market. This continuous four-year cycle -- built into Bitcoin's code -- is fixed and can't be altered. This is what's known as "the halving."

The 2024 halving will reduce the number of new Bitcoins mined (the "block reward") from 6.25 to 3.125 per block -- or from 900 Bitcoins produced each day to 450 Bitcoins produced daily. Eventually, the number of Bitcoins will hit its maximum supply of 21 million coins -- expected to be by the year 2140. There are roughly 19.6 million Bitcoins in existence today.

Now, Bitcoin has gone through three of these cycles so far. The first was in November 2012. The second was in July 2016. The third was in May 2020. And every time, Bitcoin's price has rallied substantially.

Although nowhere near the gains after the halving occurs, there's also typically a considerable bump in price leading up to the halving like we've seen this year, with Bitcoin breaking $73,000 and surging nearly 66% since the year began.

So, why does this predictable event result in these outsized gains? It's pretty much Economics 101: As supply decreases and demand remains constant (or increases), the only thing left to move is price.

The next halving is projected to take place around April 19-20, 2024. So, if past is prologue, some of these gains have been driven by halving anticipation, but I suspect there is more to come.

Would you like to find out my thoughts on topics such as the economy, markets, investing, social issues, pop culture issues, literature, music, fitness or anything else I'm into?

If so, just email me. I welcome all inquiries, but I ask that you keep it all respectful, and in the name of the very best within you.

*****************************************************************

More Viking Wisdom

"Cattle die, kinsmen die, all men are mortal. Words of praise will never perish, nor a noble name."

-- Hávamál

In keeping with this week's Viking theme, I thought it appropriate to include one of my favorite quotes from the Hávamál. You see, while all creatures that inhabit the earth will one day be no more, our deeds persist and reverberate throughout eternity. Remember that the next time you have an opportunity to issue a word of praise, or to act in line with your noble name.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you'd like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim. | | In the name of the best within us,

Jim Woods

Editor, Successful Investing & Intelligence Report

| | About Jim Woods:

Jim Woods has more than 25 years experience in the markets, as a stock broker, hedge fund money manager, author, speaker and independent analyst. Today Jim serves as editor and investment director of the long-running newsletters Successful Investing, the Intelligence Report, Bullseye Stock Trader and a new Live Coaching service offered exclusively to his readers. Jim Woods has more than 25 years experience in the markets, as a stock broker, hedge fund money manager, author, speaker and independent analyst. Today Jim serves as editor and investment director of the long-running newsletters Successful Investing, the Intelligence Report, Bullseye Stock Trader and a new Live Coaching service offered exclusively to his readers.

His articles have appeared on many leading financial websites, including StockInvestor.com, InvestorPlace.com, Main Street Investor, MarketWatch, Street Authority, and many others. | | | | | |

Tidak ada komentar:

Posting Komentar