Choose Your Own… Investor In this example, let’s consider a range of investment options the stock market offered on March 31, 2000.

Let’s imagine that, on that exact date, “Investor A” spends $10,000 to buy a three-stock portfolio that holds equal amounts of Amazon.com Inc. (AMZN), Microsoft Corp. (MSFT), and Apple Inc. (AAPL). We’ll call this the “Future Leaders Portfolio.”

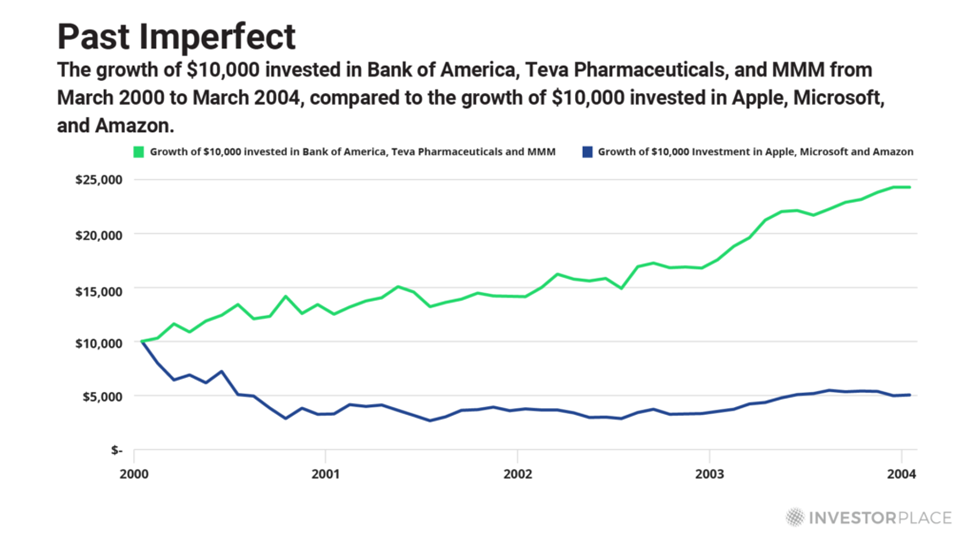

On that same date, “Investor B” spends $10,000 to buy a three-stock portfolio that holds equal amounts of Bank of America Corp. (BAC), Teva Pharmaceuticals Industries Ltd. (TEVA), and 3M Co. (MMM). We’ll call this the “Current Leaders Portfolio.”  Four years later, Investor B’s $10,000 would have grown to $24,261 in the Current Leaders Portfolio, while Investor A’s $10,000 would have shriveled to $5,058 in the Future Leaders Portfolio.

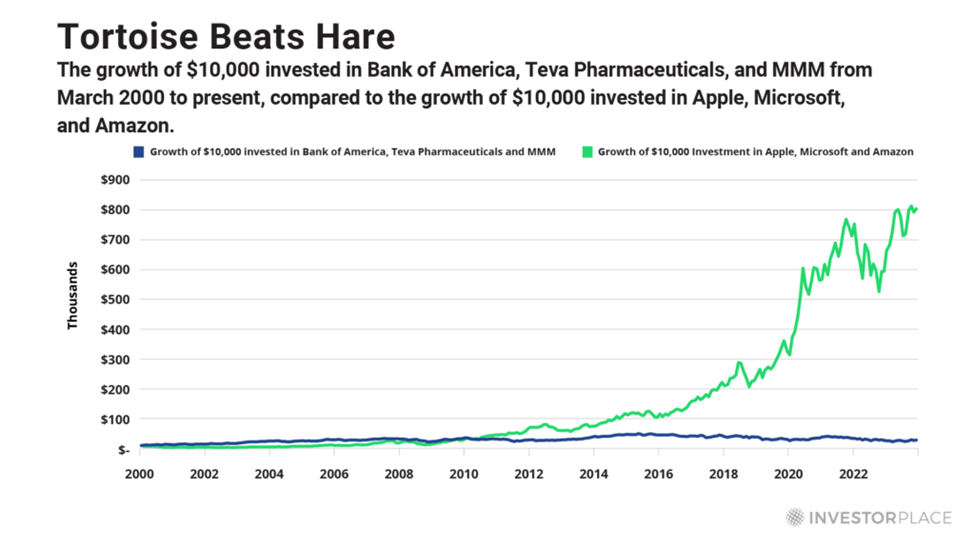

But this illustration does not end in 2004. Look what happens when we extend the analytical time frame another 20 years to the present day.  Over the entire time frame – from March 2000 to March 2024 – $10,000 grows to just $27,832 in the Current Leaders Portfolio, but skyrockets to $804,489 in the Future Leaders Portfolio.

But during the dark days of 2004, a result like this would have seemed unimaginable. In that miserable moment, the Future Leaders Portfolio had spent the previous four years slashing a $10,000 investment in half.

Investor A would surely have felt like a fool at that point. Even though the companies in the Future Leaders Portfolio were producing strong financial results, their share prices were tumbling. The Underperformer That Could This scenario isn’t just hypothetical. Let’s take a look back at Amazon’s history.

From March 2000 to March 2004, for example, Amazon’s financial performance was brilliant. Its revenues tripled, while its annual net income flipped from a negative $1.5 billion to a positive $156 million.

The stock market didn’t care… Amazon’s share price tumbled as much as 90% during this period.

In the world of professional investing, any money manager who dared to allocate heavily to stocks like Microsoft, Amazon, and Apple during the early 2000s would have been fired long before 2004, if not also sued for daring to buy such pathetic “underperformers” like those.

Does that statement sound like an exaggeration? Consider this news story from the dot-com era.

During the late 1990s, a Wall Street analyst named Henry Blodget gained notoriety as a die-hard fan of Amazon and many other dot-com stocks. But Blodget’s notoriety became ignominy, as these stocks imploded during the dot-com bust.

A wave of lawsuits followed, like the one a New York doctor named Debasis Kanjilal brought against Blodget’s employer, Merrill Lynch. Kanjilal’s alleged that his stock market losses were Blodget’s fault. The doctor claimed he lost his life savings by following Blodget’s advice.

Merrill disagreed but settled the case anyway. In July 2001, Kanjilal received a $400,000 settlement from Merrill Lynch.

Interestingly, if the disgruntled doctor had taken the $400,000 settlement he received in July 2001 and invested in the “horrible” Amazon stock Blodget had recommended, he’d be sitting on a fortune today of more than $80 million.

So, like I said before, short-term setbacks are not foolproof indicators of future results. Become a Master in Trading If you’re not sure how to handle today’s market, regardless of which direction it’s headed…

How about trading it with the guidance of a 20-year market veteran, who walks you through trades on a daily basis?

Well, that’s what you get with Jonathan Rose’s Masters in Trading: Live.

It’s a free livestream at 11 a.m. Eastern time, offered each day the market is open. Jonathan talks about market action, highlights potential trade setups, and issues a “Trade of the Day.”

These livestreams are short – usually about 15 minutes. You’re able to get in and out without it eating up a huge chunk of your day.

This is a fantastic way to see the markets through the eyes of an expert. So, even if you don’t make any trades, you’ll come away as a more informed investor.

To check out Jonathan’s livestream, just click here.

Regards, |

Tidak ada komentar:

Posting Komentar