In This Issue:

• Remembering My Sweet Prince

• ETF Talk: Seeking Some 'QUALity' ETFs

• Wisdom of a Philosopher Child

• The Last Unicorn

| | Remembering My Sweet Prince | | Sponsored Content Make This $3 Trade the Instant the Opening Bell Rings This stock checks all the boxes for Warren Buffett's time-tested investment formula. In a world where stocks like Deere and Costo and Boeing and Tesla all trade between $320 and $460 per share...This stock trades for less than $3.00 – making it an immediate buy.

See Why This $3.00 Stock Could Hit $15.00 | | | Remembering My Sweet Prince

"Now cracks a noble heart. Good night, sweet prince, and flights of angels sing thee to thy rest."

--Shakespeare, "Hamlet"

It's been exactly one year since I spoke the final words, "Good night, sweet prince," to my majestic chow chow, Hemingway.

Although it seems like just a moment ago, it's been one full trip around the sun since I was forced to let my noble companion of a dozen years enter his final rest, as his body had shut down due to illness.

In the weeks thereafter, my friends who knew him and knew of our affection and bond repeatedly told me that his loss would get easier over time. Well, I must say that my friends, as well-intentioned as they were, got it wrong.

A year has passed, and the loss isn't any easier. In fact, I think it's even greater now. Yes, I've attempted to summon the courage to put on my bravest face, as I know that sadness, loss and pain are just part of the human condition. And if we want to be fully developed humans, we must be able to embrace the pain of that condition.

Yet despite this awareness, the loss lives large in my psyche, growing as time passes and making its presence known nearly every day. That's especially true today, as the anniversary of his departure is digging a deep hole in my otherwise benevolent sense of life.

Now, if you have experienced the loss of a devoted pet, you know how I feel. You were also likely just reminded of that loss as a result of my admission, and for that, I apologize. Of course, if you were also reminded of the love and joy they brought to your life, then I shall also proudly claim credit.

So it is with life. The dueling forces of pain and joy seem locked in an epic battle for our souls. And while I want more joy than pain in my final ledger, I am not afraid of experiencing the pain. I just wish it wasn't as forcefully present as it is today.

Then again, maybe I actually do want this painful presence to continue.

You see, it is through the embrace of the contents of consciousness -- be those contents happy or sad, ebullient or heartbreaking, exalted or disparaged, joyful or heart-breaking -- that we discover who we are, what we are and what it means to be human.

Moreover, the more aggressively we embrace the contents of consciousness, the fuller, more integrated and more complete we can be.

Finally, today, I have decided to do what I did nearly one year ago in this column, and that is to honor my sweet prince by presenting you with a recollection of one of my fondest memories of him, a memory I wrote about in May 2021 in an article titled, "Get Yourself a Chow Chow."

I think you'll find it an enjoyable read, and I think you'll see that the lesson here is that everyone needs to build a good team around them that "has their back."

So, good night, sweet prince. May you continue to always be by my side, and in my painfully blissful heart.

Get Yourself a Chow Chow

We all know the cliché that a dog is "man's best friend."

Well, let me tell you something, man needs best friends. In fact, as social animals, building a network of close friends and trusted associates is imperative to a life well-lived. Of course, finding those you can trust and that "have your back" isn't always the easiest of propositions.

Yet, when it comes to canines, generally speaking, if you treat a dog well, he/she will treat you even better. Like humans, dogs are social "pack" animals, and they are hardwired by nature to help protect their pack. That means they are hardwired by nature to be your friend and ally, and to have your back.

I saw this trait play out firsthand this past week, as my canine, a chow chow named "Hemingway," put the smackdown on a most unwanted intruder.

You see, I live on a small horse ranch in Southern California. In addition to horses, there is a barn, and around the barn, there are many feral cats and kittens. Yes, I feed them all, and so I am not surprised they keep coming around. But I like cats, so I choose to make sure they have plenty of food. Yet while I choose to feed and welcome the cats, I definitely do not welcome the coyotes that come around to try and make a meal of the felines.

A few days ago, Hemingway was barking rather aggressively, wanting me to let him outside. It was about 3 a.m., which is an unusual time for him to want to go outside. Still, I obliged his request, and as soon as I opened the back door, Hemingway sprinted outside and ran full speed toward the barn.

I had a flashlight handy, and as I shined the beam in the direction he ran off, I saw that Hemingway had cornered a full-grown coyote. Both sets of fangs were out, and I was about to witness some canine combat.

The next moment Hemingway bolted toward the coyote and knocked him against the side of the barn with a body blow reminiscent of a tackle from the great Baltimore Ravens linebacker Ray Lewis. After bouncing hard off the side of the barn, the coyote sprinted away from my property and into the cover of the early morning darkness.

I have seen no signs of its return since.

Your editor with Hemingway and my good friend/veterinarian extraordinaire Dr. Aiden Ables.

This incident reminded me of the importance of putting people, or in this case a chow chow, on your "team" that can help you get through difficult, even combative situations. And while my chow was just being a chow, i.e., an aggressive and strong breed known for its powerful build and protective nature, he nevertheless lived up to his nature by kicking that coyote's butt.

Because you see, in life, sometimes we need to kick a coyote's butt.

Sometimes we have problems that require tough, no-B.S. action that must be taken to achieve a result. Many times, these are business problems, and at other times legal problems. Sometimes those problems are medical, relationship-oriented or family-oriented. And sometimes those problems are about investing.

That's why it's imperative that you build your own personal network of tough chow chows who have your back when the coyotes come calling.

So, make sure you have good friends, real friends, that can help pull you through the tough times. And in turn, be a good friend to them when they require some assistance. Because guess what: we all require some assistance at some point in our lives.

You also should make sure you have a cadre of professionals on your team who you trust to get you through the tough times.

For example, have a great lawyer on your team. I can tell you that I have never regretted spending money on a good lawyer, and you won't either. Also have a good certified public accountant (CPA) or tax person on your team. Pay extra for them, because I guarantee you it will save you money in the long run.

Next, cultivate a personal relationship with your physician. A physician who knows you personally is likely to give you a little extra attention, attention that is required as we get older and as our medical needs accelerate.

And, of course, if you are having trouble with your finances, and especially if you are having issues getting the results you want from your investments, well, that's what my newsletter advisory services are all about.

Finally, if you are in need of a protective dog that will fight off intruders, but will sleep lovingly at your side each night, while also looking like a real-life teddy bear, then do yourself a favor and get yourself a chow chow.

It might be the best investment you'll ever make. | | China's Global Conspiracy to Destroy the American Dollar China is nearing the end of its 40-year plan to dominate the world's economy. Only one obstacle remains: The U.S. dollar. But not for long... because China has enlisted many co-conspirators to sink the dollar: Russia, India, Brazil, Argentina, Germany and even Canada. And -- no surprise -- the International Monetary Fund (IMF) wants to jump in to help China win.

This means China now has the power to crush the dollar almost overnight... and bankrupt America, along with most of your investments. But there's still time to protect your money and retirement. Click here now to find out how... before it's too late. | | | ETF Talk: Seeking Some 'QUALity' ETFs

"Quality is never an accident; it is always the result of intelligent effort." -- John Ruskin

Quality is a standard measure we use in many areas of life. Quality represents the merit, strength, character or degree of excellence possessed by someone or something.

We measure the quality of our lives, the goods we buy and services we use, our relationships with others, our performance on the job and, you guessed it, the stocks and funds in our portfolios.

Quality is one of five characteristics, or factors, used to determine the success of a stock, bond or fund in "factor" investing. A quality-focused, single-factor strategy is considered defensive, as it aims to seek out heavy-keeled companies with stable balance sheets and healthy financials.

Why choose the slower, full-keeled cruiser and not the racing yacht?

As I discussed in this week's Eagle Eye Opener, the market assumptions that pushed stocks higher recently are still broadly in place, but we'll need to continue to watch growth, earnings and global and domestic politics, which have seen some deterioration that could cause stocks to drop.

While expectations for the economy are tentatively positive, it never hurts to build some stability into your portfolio. So, let's consider a solid, high-quality exchange-traded fund (ETF): iShares MSCI USA Quality Factor ETF (U.S. Cboe BZX: QUAL).

QUAL is the largest quality factor ETF in the market by a wide margin and is the "easiest" way to allocate to the quality factor. It tracks the underlying MSCI USA Sector Neutral Quality Index and has 125 large- and mid-cap holdings that are screened for profitability, low leverage and earnings consistency. The underlying index is rebalanced on a semiannual basis, using a representative sampling indexing strategy that reduces risk and keeps portfolio turnover low.

Currently, the fund's top two areas of exposure are Information Technology and Financials. As we have seen in the market's recent performance, technology companies continue to lead the positive stock market news as the artificial intelligence (AI) boom thunders, with strength and stability across the value chain.

Information Technology accounts for the majority of QUAL's sector exposure at 30.66%. Financials and Healthcare follow at 12.35% and 12.07% of QUAL's portfolio, respectively.

Top holdings include technology heavyweights Nvidia Corporation (NASDAQ: NVDA), Apple Inc. (NASDAQ: AAPL) and Microsoft Corporation (NASDAQ: MSFT), alongside major financial companies Visa Inc. (NYSE: V) and Mastercard Incorporated (NYSE: MA).

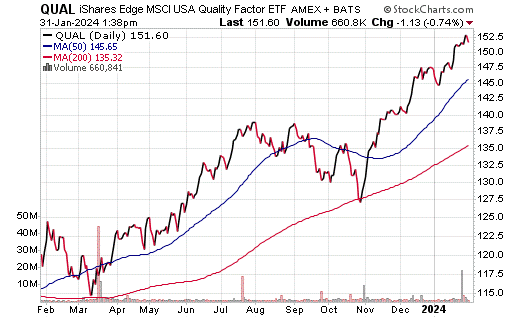

Chart courtesy of Stockcharts.com

QUAL is a $36 billion fund with a 0.15% expense ratio and a 1.23% yield. As of Jan. 31, the fund is up 4.80% over the past month, up 12.16% over the past three months and up 30.84% for the year to date. QUAL has outperformed the S&P 500 (NYSEArca: SPY) over the past year, rising 28% versus 23% for SPY.

To affirm the quote above, this ETF did not come about by accident; it is the result of smart observation and selective screening to create a stable and successful high-quality fund.

Aiming for the highest quality investments, investors should do their due diligence before adding any stock, fund or ETF to their portfolio.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to email me. You may see your question answered in a future ETF Talk. | | Join Jim Woods at the Las Vegas MoneyShow on February 21-23, 2024 Join Jim Woods live at the Las Vegas MoneyShow from February 21-23, 2024. Jim will have one discussion on "Always Know When to Sell Your Stocks". Click here now to reserve your spot! | | | In case you missed it…

Wisdom of a Philosopher Child

In our last issue, I told you about my dinner party experience answering the provocative question: "Life is… (fill in the blank)." (Note: the provocative question "Life is…" is the brainchild of my friend and Fast Money Alert co-editor Dr. Mark Skousen, who wanted The Deep Woods readers to know whose idea the "Life is…" question was. So, full credit to the brilliant economist!)

That article elicited some great responses from many of my readers, and from many of my close friends and business associates. One of those friends and business associates is Brandon Brison, creative director for the extraordinary firm CDMG Inc.

Brandon told me that he was home trying to think of a clever response when his 5-year-old son, Finn, asked him what he was doing. He told Finn, "I'm trying to fill in the sentence 'Life is…' with an answer." Then he asked the precocious boy what he thought life is.

Finn replied, "Life is what's real, and not pretend. So we have to not let the pretend things scare us."

Mic drop!

What an incredibly deep and profound point for anyone to make, let alone a human who has only been on the planet for a little more than 1,800 days.

Unknowingly, Finn stumbled on an idea in academic philosophy known as, "The primacy of existence." This idea, which dates back to Aristotle, is that existence exists, i.e., that the universe exists independent of consciousness (of any consciousness), that things are what they are and that they possess a specific nature and identity.

Like I said, pretty deep stuff for a 5-year-old philosopher child.

Then Brandon shared with me his own most-excellent response to the "Life is…" question.

I found the response so poignant and so spot-on that I felt impelled to share it with The Deep Woods audience today. So, with permission from the author, here you go…

"Life is a chain we forge a day at a time, that binds our present to our past and our past to our future.

Like the blacksmith in front of the forge, moment by moment we transform the raw material of circumstances and environment into another link in the chain, and every decision, big or small, adds strength and resilience… or weakness and fragility.

Every moment spent moaning about the resistance of the iron or the heat of the forge is a moment wasted.

Whether we like it or not, what we create every day connects to what's been created by those who have gone before us, back into the infinite past, and it connects us to those who will follow after us.

We can never truly extricate ourselves from the chain we're a part of. Everyone has a past; everyone will leave a legacy.

The good news is, in the daily forging, we get to choose what we take and what we leave.

And, as we forge, we also decide how to put the chain to work.

The chain can be shackles that hold us down.

It can be an anchor that keeps us secure and grounded.

It can be a lifeline that hoists us out of our darkest pits.

It can be an unbreakable bond uniting people we care about.

The world serves up fire and iron daily, and through our decisions, actions and attitudes, we daily transform what's served up into another link in the chain.

And if we screw it up… well, we get to try again tomorrow. And that's an encouraging thought."

I don't think I can, or need to, add anything to these brilliant insights. The only thing I will say is that if you are able, try to cultivate friendships with people who think like this and who can write like this and who can express their thoughts like this.

Doing so will enhance your own thinking, and it will make you a better person. I know that's what it's done for me.

*****************************************************************

The Last Unicorn

"Real magic can never be made by offering someone else's liver. You must tear out your own, and not expect to get it back."

--Peter S. Beagle, "The Last Unicorn"

If you want to make a significant impact on the world, you are going to have to do something significant. But doing something significant is never easy. In fact, you might say that in order to do something impactful, you're going to have to metaphorically tear out your own liver and not expect to get it back.

And so it is with life. If we want to do great things, we have to be willing to make tough decisions and do some damn tough things that are going to hurt. Will it be worth it? There's no guarantee. Is this a worthy goal? What goal could be more worthy?

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you'd like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim. | | In the name of the best within us,

Jim Woods

Editor, Successful Investing & Intelligence Report

| | About Jim Woods:

Jim Woods has more than 25 years experience in the markets, as a stock broker, hedge fund money manager, author, speaker and independent analyst. Today Jim serves as editor and investment director of the long-running newsletters Successful Investing, the Intelligence Report, Bullseye Stock Trader and a new Live Coaching service offered exclusively to his readers. Jim Woods has more than 25 years experience in the markets, as a stock broker, hedge fund money manager, author, speaker and independent analyst. Today Jim serves as editor and investment director of the long-running newsletters Successful Investing, the Intelligence Report, Bullseye Stock Trader and a new Live Coaching service offered exclusively to his readers.

His articles have appeared on many leading financial websites, including StockInvestor.com, InvestorPlace.com, Main Street Investor, MarketWatch, Street Authority, and many others. | | | | | |

Tidak ada komentar:

Posting Komentar