Six Income-paying Cloud Infrastructure Stocks to Purchase for Artificial Intelligence Inroads 06/30/2023 | | | As market conditions shift and evolve, certain types of strategies can become more or less effective and staying up to date on what is (and isn't) working is a crucial skill for anyone involved in their own financial wellbeing. That's why it's so important that you attend the July Wealth365 Summit (July 10th-15th), so you can hear from the experts about how they are adapting their strategies and approaches to the latest market conditions.

Wealth365 Summit is the premier multi-speaker event in the industry with 60+ professionals over the course of six full days. If you can only attend one event this summer, make this the one. Click here to register now. Click Here... | | | | Six income-paying cloud infrastructure stocks to purchase for artificial intelligence inroads feature technology titans.

The six income-paying cloud infrastructure stocks to purchase for artificial intelligence growth opportunities are positioned to profit from a pivotal technology breakthrough. Dividend-paying technology companies that once appeared to have passed their peaks are regaining luster as their share prices power ahead.

Regardless of inflation, tight Fed money supply and a budding banking crisis after several recent financial institution flops, the NASDAQ Composite's tilt toward technology has led to a 28.68% year to date gain, as of the market's close on June 29. So far in 2023, the technology sector moved into bull-market territory -- generally defined as a rise of at least 20% -- after falling in 2022.

Mark Skousen, PhD, an economist who serves as a Presidential Fellow at Chapman University and heads the Forecasts & Strategies investment newsletter, has been an unabashed proponent of technology investing in 2023. Skousen, a descendant of founding father, diplomat and inventor Benjamin Franklin, used to work as a consultant in the early 1980s for International Business Machines (NYSE: IBM), of Armonk, New York, an early developer of both business machines and personal computers.

Mark Skousen, head of Forecasts & Strategies, meets with Paul Dykewicz.

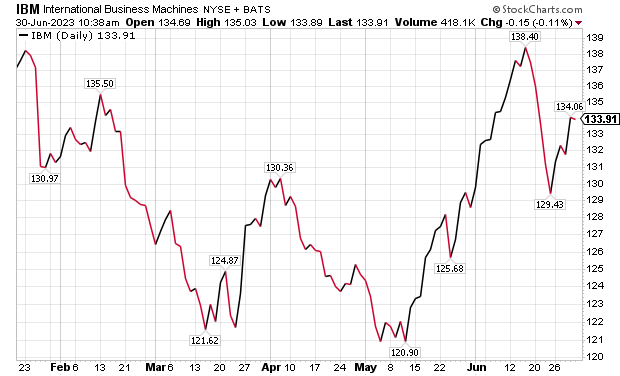

Skousen Selects Cloud-Savvy IBM as a Good Way to Tap into Artificial Intelligence Advances

Now, IBM is introducing cloud-related artificial intelligence (AI) capabilities. In fact, the company's management held IBM's Think 2023 event in Orlando, Florida, on May 9, with Chief Executive Officer Arvind Krishna, Chief Financial Officer Jim Kavanaugh and other senior leaders discussing many of their AI initiatives.

"The firm helps businesses and governments reconfigure their IT departments for the cloud era," Skousen recently wrote to his Home Run Trader subscribers when recommending the stock. "It also ensures that technological systems are not only faster and more efficient, but far more secure."

IBM allows organizations to boost innovation, productivity and resilience, as well as enables them to scale up and cut costs, Skousen continued. Investors who can accept the ups and downs of volatility may be best suited for purchasing stocks like cloud- savvy IBM that are gaining a lift from artificial intelligence advances.

Skousen, who also heads the TNT Trader advisory service that recommends both stocks and options, as his Home Run Trader does, instructed subscribers to take a profit on May 25 of 323.96% by selling call options in Nvidia Corp. (NASDAQ: NVDA) that he recommended on May 2. The stock rose 34% in just a few months during the time Skousen recommended it, while the options sold in parts at varying levels to produce an average gain during the same time of 196%.

"The bears are on the run," Skousen quipped to his Forecasts & Strategies subscribers. As they say on Wall Street, "Bull markets climb a wall of worry," wrote Skousen, quoting his own "Maxims of Wall Street" book (www.skousenbooks.com).

I plan to speak with Skousen July 12-15 at the annual FreedomFest conference that he organizes, featuring investment, political and social opinion leaders who include former presidential candidate Steve Forbes, current presidential prospects like former radio host Larry Elder and anti-political establishment podcaster Robert F. Kennedy Jr., as well as skilled trades advocate Mike Rowe, host of the unique "Dirty Jobs" TV series. Rowe, who I have requested to interview about topics such as how AI may affect skilled trade workers, taped an amusing video about some of the reasons why he plans not only to attend FreedomFest but serve as a keynote speaker. For a discount, use code EAGLE50. I invite you to meet and to talk me in the exhibit hall at the Eagle booth.

Six Income-paying Cloud Infrastructure Stocks to Purchase Include Innovative IBM

IBM recently announced its WatsonX Platform featuring generative AI, offering a development studio, data store and governance toolkit. The company's management expects to monetize AI first through services and later in software as adoption of the technology scales, according to a recent report from BofA Global Research.

BofA maintains a "buy" recommendation on IBM due, in part, to the defensive nature of the business and attractive current dividend yield that should limit downside. IBM intends to offer the WatsonX Platform on top of RedHat OpenShift to provide portability, modernization and standardization of workloads, BofA added

"IBM's horizontal incumbency across enterprises gives it an opportunity to monetize the adoption of AI across workloads," BofA wrote in a recent research note.

Courtesy of www.StockRover.com. Learn about Stock Rover by clicking here.

IBM's foundational models -- tested for the last several years on large GPU clusters using IBM data -- let business customers skip a significant part of the training phase of AI that otherwise can be expensive and time consuming, BofA noted.

Chart courtesy of www.stockcharts.com

IBM Leads Four Large Income-paying Artificial Intelligence Stocks to Purchase

IBM's management expressed interest in AI largely automating back-office functions, such as data entry, human resources (HR) process automation and repetitive jobs, BofA wrote. The IBM leaders estimated that 30% of such 28,000 current back office jobs at the company ultimately can be replaced by AI.

Companies that have vertical business models that provide a single function are most at risk of either being automated through AI, BofA wrote. IBM officials said AI can enhancing both consulting growth and margins, BofA added.

"On the one hand, the increased interest in AI will drive more consulting deals focused on digital transformation and with relatively quick payback periods," according to BofA. "On the other hand, in some areas IBM will be able to improve margins through utilization of less labor for certain types of deals: business process optimization. In these instances, resources will need to be re-skilled." | | | Congress is spurring on the most dangerous retirement threat of the last 50 years. America's top retirement researcher reveals the deadly truth behind this government move…

Plus the ONLY way to fully protect your wealth in the coming months.

Click Here for the Full Story. Click Here... | | | | Economic Uncertainty Should Not Deter Technology Investors

"Monetarists like Steve Hanke and Timothy Congdon are predicting a severe recession in 2023-24 due to the Fed's tight money policy," Skousen opined. "The broad-based money supply (M3) is actually declining."

The U.S. economy is resisting recession, but is "flashing red" as business spending (B2B) has dropped 9% in real terms -- after accounting for inflation -- during the last two quarters, Skousen wrote in a report yesterday when the the federal Bureau of Economic Analysis (BEA) released first quarter gross output (GO), the top line in national income accounting that measures spending at all stages of production. Real GO rose 2.7%, compared to 2.0% in real gross domestic product (GDP), the bottom line that only considers final production such as cars, not the many parts used to make vehicles.

"Consumer spending is still robust, rising over 6% during the past two quarters, but business spending is floundering," Skousen cautioned. "Nominal B2B spending has been flat since September, and in real terms, is down 9%. Recession is still in the near future."

For now, the technology bull market remains intact, aided by "robust corporate earnings" and a gradual decline in price inflation, especially gasoline prices, Skousen added.

Ride the AI Wave, Seasoned Stock Picker Says

"When a tech wave like this is roaring into shore, it behooves investors to jump on it early," said Jim Woods, who heads the Intelligence Report investment newsletter and the Bullseye Stock Trader advisory service that offers both stock and option recommendations.

Paul Dykewicz meets with Jim Woods, head of Bullseye Stock Trader.

Woods has attained a record of success in recommending profitable stock and option trades in artificial intelligence stocks. For example, he recently reaped rewards from the rapid rise of C3.ai Inc. (NYSE: AI) and Rambus, Inc. (NASDAQ: RMBS). He produced a 167.20% gain on the AI July 21 $25 call options in just 31 days. Woods also achieved an 83.10% profit in RMBS Aug. 18 $50 call options in only 13 days. Both recommendations came in his High Velocity Options trading service. The High Velocity Options service recommends options aimed at producing quick profits.

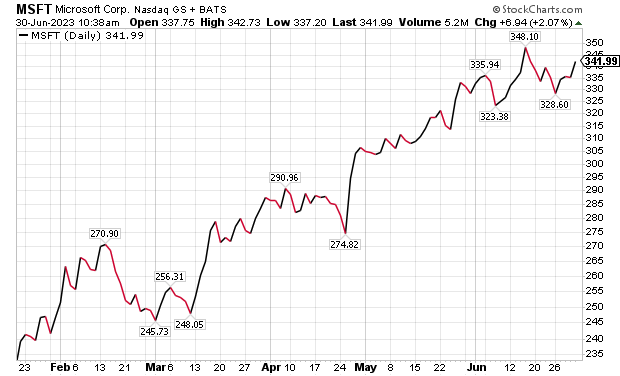

Microsoft Makes List of Six Income-paying Cloud Infrastructure Stocks to Purchase

AI is starting to drive revenue growth at Redmond, Washington-based Microsoft (NASDAQ: MSFT) and is boosting use of the company's many apps. One example is that Microsoft's Bing web browser has quadrupled its downloads since Microsoft added an AI-aided chatbot.

Microsoft reported better-than-expected results for its fiscal third quarter, with its Microsoft Cloud up 25%. Now in its fiscal fourth quarter, Microsoft faces pressure from the macro environment, according to the Chicago-based investment firm William Blair. Microsoft's management seemed more upbeat compared to prior earnings calls, the investment firm added.

Chart courtesy of www.stockcharts.com

Even though growth of Microsoft Azure is expected to keep slowing, it still should reach mid-20% gains in the fourth quarter, with demand for AI infrastructure providing a tailwind, William Blair wrote in a recent research note. Microsoft's tool consolidation sales pitch is "resonating" with cost-conscious customers who want to cut the number of products and vendors they use for collaboration, software development, security and workflow management, the investment firm wrote.

"While the company is not yet out of the woods in terms of a slowing demand environment, as it laps tougher comparisons from fiscal 2022 and demand for AI-based services grows, expect healthy growth ahead and upside potential for the stock," William Blair wrote.

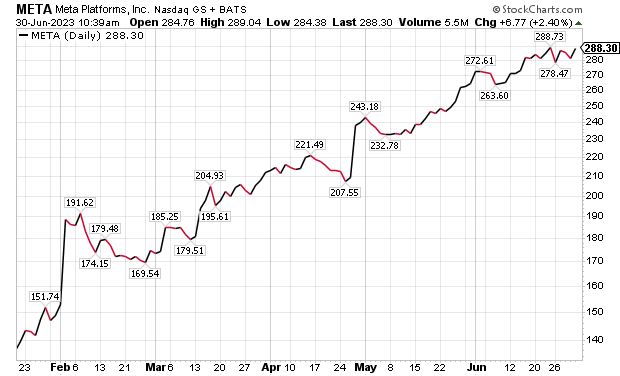

META Lands Among Six Income-paying Cloud Infrastructure Stocks to Purchase

Meta Platforms Inc. (NASDAQ: META), of Menlo Park, California, received a $320 price objective from BofA, based on 19x 2024 estimated Generally Accepted Accounting Principles (GAAP) earnings per share (EPS). BofA predicts the company's accelerating revenue growth and conservative expense management can lead to three-year EPS growth above the S&P 500.

Revenue drivers include a recovery in online advertising markets, an acceleration in Reels or messaging monetization and AI/machine learning (ML) benefits driving better content engagement and incremental ad spending, BofA wrote.

Additional risks to Meta are a possible decline in user activity from competition, such as TikTok, subscription video on demand (SVOD), privacy or data issues that impact revenue generation and potential for Wall Street to assign a negative value for Metaverse -- e.g., Reality Labs -- given massive investments and new regulations that impact monetization, according to BofA.

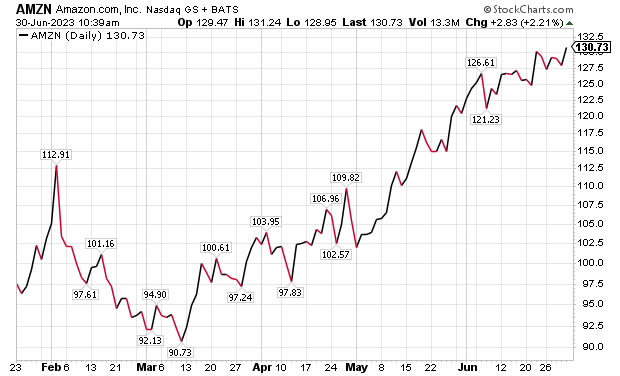

Chart courtesy of www.stockcharts.com | | | Would you rather read the news, or get a jump start on the markets by predicting trends up to 72 hours ahead with up to 87.4% proven accuracy? The future is here, and it wants a piece. Join the Training on A.I. 101 Live Session for Free. Click Here... | | | | Amazon.com Earns Place Among Six Income-paying Cloud Infrastructure Stocks to Purchase

Amazon.com (NASDAQ: AMZN), a technology company in Seattle, Washington, focuses on e-commerce, cloud computing, online advertising, artificial intelligence and digital streaming. BofA gave Amazon.com a buy rating and a price objective of $154, based on a sum-of-the-parts (SOTP) analysis.

"We think some conglomerate discount is warranted with elevated regulatory/antitrust risk, but long-term we believe that in-line-to-discount multiples are warranted given growth rates in excess of peers," BofA wrote in a recent research note.

Risks to Amazon.com achieving the BofA price objective include increasing competition from offline and local retailers, a "rich" P/E multiple, possible price cuts and regulatory pressure on the third-party marketplace. Another risk is investments in Amazon Web Services, Inc., a subsidiary of Amazon that provides on-demand cloud computing platforms.

"The stock has been subject to heavy volatility in the past, based on margin trends, and this volatility could increase due to economic uncertainty, BofA wrote.

Chart courtesy of www.stockcharts.com

Alphabet Included Among Six Income-paying Cloud Infrastructure Stocks to Purchase

Alphabet (NASDAQ: GOOG), a Mountain View, California-based technology company that also is the parent of Google, offers search, advertising, operating systems and platforms, as well as enterprise and hardware products. The company generates revenue primarily by delivering online advertising and by selling apps and contents on Google Play, as well as hardware products. Plus, Alphabet provides its products and services in more than 100 languages and in 190 countries, regions and territories.

The company received a buy rating and a price objective of $128 from BofA, based on 18x 2024 estimated core Google GAAP EPS plus cash. Alphabet has traded at an average multiple of 23x GAAP price-to-earnings (P/E) ratio over the last 10 years. BofA wrote that the multiple is reasonable, in light of the company's history and projections of reduced, but still 10%-plus revenue growth in future years.

BofA continued that Alphabet is well-positioned long term with leading search technology, Android and YouTube capabilities. Alphabet is an advertising industry leader, and the company should generate incremental revenue growth from increasing mobile usage, video usage, Google Play activity and connected device activity -- including in automobiles. Plus, Alphabet should trade at a premium to a media peer group due to its technology leadership, high margins and cash flow for buybacks, BofA wrote.

Risks for investors in Alphabet include an uncertain macro backdrop that may impact cloud and network business growth and margins. Plus, large language models (LLM) integration in search may take longer than expected or negatively impact search, BofA continued. Other risks encompass query share loss to Bing, concerns about a new regulatory framework in the European Digital Markets Act (DMA) and the U.S. Department of Justice's recent lawsuit challenging Google's ad exchange business and the importance of keeping Samsung and Apple search distribution deals.

Chart courtesy of www.stockcharts.com

Oracle Is Connell's Choice Among Six Income-paying Cloud Infrastructure Stocks to Purchase

Michelle Connell, who heads the Dallas-based Portia Capital Management, commented on a June 12 TDAmeritrade Network program about the recent rise of Oracle (NYSE: ORCL), a computer technology company headquartered in Austin, Texas. Connell assessed the company's latest earnings report when it beat projections.

"While Amazon and Microsoft are experiencing slowdowns in their cloud infrastructure businesses, that is not the case for Oracle," Connell said.

Oracle's infrastructure business revenue was up 76% when it reported results in May. Its cloud infrastructure business is taking market share in the AI space for two reasons: lower cost and superior features, Connell counseled.

"Larry Ellison has stated that his company's product is the number one choice in running AI generative workloads," Connell said. "Oracle wants to be the Netflix of AI."

Year to date (YTD), Oracle's stock has zoomed 45%. In the last year, it has soared 72%.

Oracle is aiming to unlock the potential for AI, while investing millions of dollars in AI company start-ups, continued Connell, who added it is not a bad idea.

"Most of these start-ups may eventually become customers of ORCL's cloud infrastructure products as well," Connell counseled.

Chart courtesy of www.stockcharts.com

"Two-thirds of Oracle's revenues come from their cloud infrastructure products," Connell commented. "Companies that use AI or make AI software review millions of pieces of data. Having the ability to store that data in the cloud is critical and companies are bulking up on their capacity. Oracle is thought to have the most economic cloud infrastructure platform for AI."

Michelle Connell heads Portia Capital Management.

Since Oracle reported results on June 12, several Wall Street analysts increased their estimates and price targets. However, the new average price target is $120 per share, while the stock is hovering around that level. Thus, it seems overvalued -- especially over the next several months, Connell counseled.

Thus, the stock is "getting pretty expensive," Connell cautioned. Its current price-to-earnings (P/E) ratio is about 41, even though its average P/E is 26, she added.

"But now, it's a case of what we do not know," Connell said. "And what we do not know is ORCL's potential in the AI arena. It could be huge."

The stock looks compelling from a long-term view, Connell continued. Its estimated revenue for 2026 is in the $65 billion range. That's a 50% increase from the 42 million it produced in 2022, Connell added.

Investors should consider buying Oracle shares on pullbacks, Connell counseled.

"When the Federal Reserve stops ratcheting up interest rates, I would expect strong growth stories to continue to profit," said Connell. "On the other hand, forecasts that the Fed may raise rates further later this year warrant caution for technology investors, if those increases occur."

Belarus President Lukashenko Helps Putin Halt Civil War Threat within Russia

Political risk for investors heightened last weekend due to a conflict that briefly challenged President Vladimir Putin's regime in Russia. The Wagner Group, hired to help Russia with its invasion of Ukraine, rebelled against the country's military leaders last weekend, but agreed to stand down within 48 hours at the urging of Belarus President Alexander Lukashenko, who brokered a deal with Russia's President Vladimir Putin to give participants immunity from prosecution.

Wagner Group's leader Yevgeny Prigozhin agreed to seek safe haven in Belarus. His fighters, who include thousands of former prison convicts, were given the option to go home, sign contracts to fight with Russia's military or join Prigozhin in Belarus, which borders five countries: Poland to the west, Lithuania to the northwest, Latvia and the Russian Federation to the north, the Russian Federation to the northeast and east, with Ukraine to the south.

Baltic countries that border Belarus expressed concerns about the presence of potentially thousands of Wagner Group fighters across their borders undermining regional security. Parliament speakers in Estonia, Latvia and Lithuania issued a joint statement on June 28 urging the European Union to label Wagner a terrorist organization.

Risk of a budding civil war in Russia arose late on Friday, June 23, when Prigozhin claimed that Russian military personnel attacked Wagner camps in eastern Ukraine and caused the deaths dozens of his men who had been serving as mercenaries to back Putin's ongoing invasion of Ukraine. Prigozhin then led his men out of Ukraine and into Russia on Saturday, June 24, to take control of the government's military headquarters in Rostov-on-Don for the country's southern region. His forces were headed to Moscow but stopped about 125 miles, or 200 km, away when he agreed to go into exile in Belarus at Lukashenko's invitation to end the short-lived threat to Putin's government.

"The evil that the military leadership of Russia must be stopped," according to the translation of a Prigozhin Telegram post on June 23. "I ask no one to resist (!). Anyone who tries to resist - we will destroy. Justice for the troops will be restored, & after that, justice for all of Russia."

Putin praised Russian soldiers in June 27 remarks outside the Kremlin for preventing a "civil war" during Wagner's armed rebellion. A moment of silence was held for Russia's military pilots who were shot down and killed by Wagner troops as the conflict escalated. Pro-Kremlin bloggers wrote that Wagner forces killed at least a dozen pilots, but Putin did not specify a number. The controversial Wagner Group consists of entities that operate as a battle-hardened private military company that governments can hire for combat or security services.

"The state paid to the Wagner Group 86.262 billion rubles [approximately $1 billion] for salaries for fighters and incentive rewards between May 2022 and May 2023 alone," Putin said on June 27 during a televised meeting with members of law enforcement. Putin, adding that Prigozhin had received about the same amount of government money for his food and catering business to feed Russia's troops as he had from warfighting payments by Russia's Ministry of Defense, ordered a probe of the payments.

"I do hope that, as part of this work, no one stole anything… but we will, of course, investigate all of this," Putin said, without naming Prigozhin, who he reportedly granted immunity from criminal prosecution for his role in the fleeting uprising.

Russia's Short-lived Mutiny Does Not Stop Political Risk and Deadly Attacks Against Ukraine

The challenge to Putin's authority did not stop him from ordering new attacks against Ukrainian civilians. Russian missiles hit the center of Kramatorsk in eastern Ukraine on Tuesday, June 27, killing 11 people, including three teenagers, and injuring 61 others, Ukrainian officials said. A residential community and its citizens took the blow as a restaurant filled with diners and a shopping area were slammed by the strike. Kramatorsk is under Ukrainian control but close to Russian-occupied parts of Ukraine.

An ongoing catastrophe is that drinking water supplies could be harmed for more than 700,000 people after the destruction of the Kakhovka dam in southern Ukraine as the latest calamity that has accompanied Russia's unrelenting attacks. With the threat from Russia unabated, Ukraine's President Volodymyr Zelensky keeps rallying his country's people to defend their nation and freedom from the invaders, while seeking further weapons from allies to do so.

Russia reportedly has moved tactical nuclear weapons to neighboring Belarus as a potential launch site against Ukraine, which began a counteroffensive to push the attackers back to their own country. However, President Zelensky has acknowledged gains on the battlefield have proven to be "slower than desired."

With Russia's invasion of Ukraine fueling political risk for businesses in both nations, as well as countries that export and import with them, the ongoing conflict adds uncertainty for investors. As a result, investors may find the prospects of the six income-paying cloud infrastructure stocks to purchase offer profitable paths to benefit from artificial intelligence advances. | | | Sincerely,

Paul Dykewicz, Editor

DividendInvestor.com

| | About Paul Dykewicz: Paul Dykewicz is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul also is the author of an inspirational book, "Holy Smokes! Golden Guidance from Notre Dame's Championship Chaplain", with a foreword by former national championship-winning football coach Lou Holtz. Follow Paul on Twitter @PaulDykewicz. | | | | | |

Tidak ada komentar:

Posting Komentar