In a recent Money & Markets team meeting, Adam shared an article from Tom McClellan, who stated the bear market wouldn’t bottom out until 2024. It got the whole office talking … some said we’ve already hit it, while others said we haven’t seen it yet. So next week, Adam, Charles and I will share the indicators we’re using to track the bear market and see what they say about the expected bottom. And we want to get you in on the action with one simple question: What’s the exact day you expect the bear market to bottom out? The person who calls it the closest will get a $500 gift card. Click here to email your prediction to Feedback@MoneyandMarkets.com.— Matt.

| | With the broader market turning lower, I want to hit on how I use systems to find value stocks to avoid.

On Friday, I wrote about how my Stock Power Ratings system helps us separate true value stocks from dreaded value traps.

And if you’ve ever been stuck in a value trap, you know why this is important.

We’ve all been in this situation.

You buy a stock believing it to be a real steal … only to watch it get even cheaper due to deteriorating fundamentals.

Today, we’re going to look at two examples. The first is what I consider a solid value play.

The second is a potential value stock to avoid. Suggested Stories: Look Beyond Texas: High-Growth Energy Co. in No. 2 Oil State

Bear Markets Reveal Value — but Watch Out for Traps!

| The lithium-ion battery transformed Tesla from the laughingstock of the auto industry into the biggest car company in history. But according to Bloomberg… This new battery technology “could eat lithium’s lunch.” To get in on the ground floor of this opportunity… Former Goldman Sachs executive Nomi Prins is recommending this tiny $4 company that’s backed by billionaires Bill Gates, Jack Ma, Richard Branson, Michael Bloomberg, & Jeff Bezos. | |

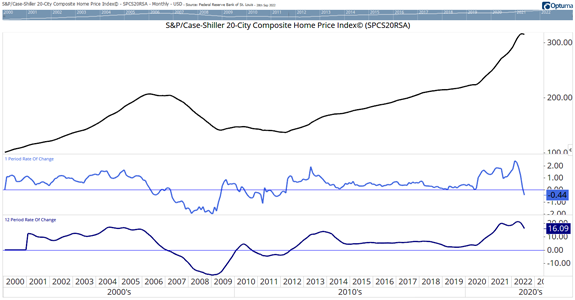

Chart of the Day A headline caught my eye: “Home prices cooled in July at the fastest rate in the history of the S&P Case-Shiller Index.”

That sounds like a bear market.

But the chart below doesn’t look like a bear market.

There is a small dip in the most recent data.

Prices in July fell 0.4% compared to January.

But home prices are still up 16% (dark blue line) compared to a year ago.

Click here to see why it's all about the rate of change.  (Click here to view larger image.) Suggested Stories: Strong Dollar Reveals Imminent Crisis in Global Economy

The Surprising Winner of the Inflation Reduction Act

| Mysterious Tech Could Soon “Delete” Diseases From Your Body … and Make a Tiny Silicon Valley Company Soar High | |

|

1995: One of the most sensationalized trials in U.S. history ended with an acquittal. A jury found O.J. Simpson not guilty of murdering his ex-wife Nicole Brown Simpson and her friend Ronald Goldman. The verdict led to mixed reactions from the public. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | | |

Tidak ada komentar:

Posting Komentar