| The Inflation Reduction Act is a massive tailwind for the renewable energy mega trend.

We’re talking about $370 billion injected into clean energy efforts over the coming years. That’s going to help many industries, such as solar and wind power, energy storage and electric vehicles (EVs).

We can leave the debate as to whether or not the act reduces inflation for another day. I’m more interested in the investment implications, given that I consider renewable energy to be one of the greatest mega trends of our lifetimes.

One of the provisions of the law gets a lot of airplay: the $7,500 tax credit for buying an electric vehicle.

That should boost stocks like Tesla Inc. (Nasdaq: TSLA) and Ford Motor Co. (NYSE: F).

But I’m more excited for this corner of the renewable market.

P.S. Today’s your last chance to put your name on the guest list for my Max Profit Alert. I’m telling all tomorrow at 11 a.m. Eastern! Click here to sign up for my free presentation and get ready to turn the market’s maximum pessimism into maximum profits. Suggested Stories: “Strong Bullish” Stocks Shrug Off Extreme Bearishness — Stay Invested

Poll: How Bullish or Bearish Are You Now?

| “I’m getting OUT of this supposedly ‘SAFE’ asset … and YOU should too!” | |

Chart of the Day Markets tend to move ahead of global events.

There’s no explanation for how this happens.

It can’t be insider trading because many of the events are unpredictable.

In hindsight, we understand the market’s warnings.

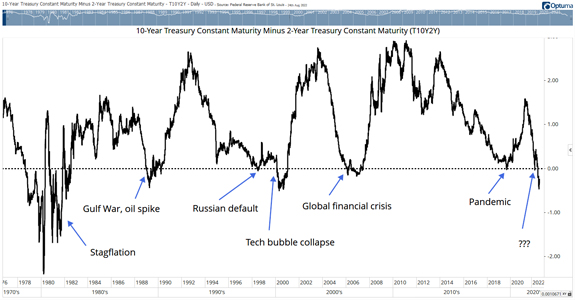

A reliable indicator of an upcoming global crisis is the spread between 10-year and 2-year Treasury notes.

Click here to see why we need to pay attention to this indicator again.  Suggested Stories: 96-Rated Power Stock Profits Off Mining Industry Boom — Buy Now!

Recession Red Flag: PMI Warns of Weaker Demand

| Andrew Keene came close to losing it all … but he discovered something that, in just two years, helped him earn back 10 TIMES more than he lost.

Now, in the midst of global chaos, he’s revealing his secret to the investing public, so they can sidestep inflation, protect their savings and emerge on the other end unscathed. | |

|

2005: Hurricane Katrina made its second and third landfalls as a Category 3 storm and devastated the Gulf Coast, from the Florida panhandle to Louisiana. The storm’s damages totaled around $115 billion, but the emotional loss can’t be measured. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | | |

Tidak ada komentar:

Posting Komentar