Forget Inflation… Big Short Legend Michael Burry Warns of “Disinflation” (And He's 100% Right!) If there is one person you, me, and every investor should listen to during a bear market, it is Michael Burry – the esteemed hedge fund manager of Big Short fame who correctly predicted the subprime mortgage market meltdown in 2008.

He’s a certified bear market genius. No one knows how to navigate turbulent markets better than him. And he just issued a shocking warning to his 875,000 Twitter followers about the current bear market – a warning that you may miss a monster rally of epic proportions over the next 6 months if you don’t buy growth stocks today!

That’s right. The bear market genius Burry himself is suddenly sounding a bullish tone.

So, what exactly did Burry say? How is it bullish for growth stocks? And is he right?

Let’s take a deeper look. The Tweet On June 27, Michael Burry sent the following tweet, which linked to an article about how retailers like Walmart (WMT) and Target (TGT) are so overstocked these days that they’re contemplating paying you to just keep items you would otherwise return to the store.

Burry is basically saying that the macroeconomic environment is going to do a complete 180-degree turn over the next six months.

In other words, over the past 18 months, supply shortages have coupled with the unleashing of pent-up consumer demand and pandemic-juiced savings accounts to create a situation of super-low supply and super-high demand. We simply had too many dollars chasing too few goods. Consequently, inflation soared.

But all those dynamics are now reversing course, according to Burry.

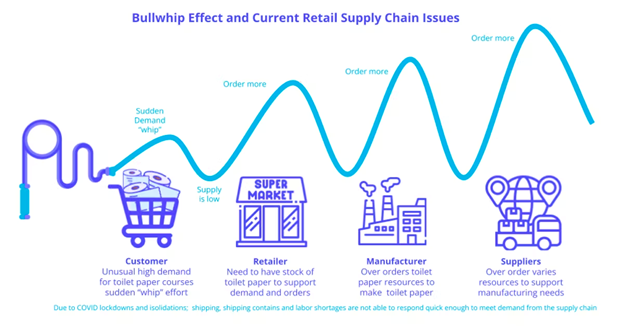

Retailers incorrectly forecasted that the pent-up consumer demand of 2021would persist into 2022, so they over-ordered a bunch of products for those consumers to buy. That led to an over-ordering of supplies from manufacturers to make those products, which led to an over-ordering of raw resources from suppliers to make the supplies for those products.

This is the “bullwhip effect” Burry is referring to – like a bullwhip, a slight change on one end of the supply chain (an increased demand forecast) leads to exponentially larger changes further down the supply chain (bulk overordering at the manufacturer and supplier levels).

The result is that even a small demand overestimation can create sizable supply gluts. The problem with the current situation, Burry says, is that every retailer overestimated demand, so we have what amounts to a pretty big demand overestimation – and that’s leading to an unprecedentedly large supply glut.

Retailers are now rushing to clear those supply gluts. That means deep discounts. But it’ll happen against the backdrop of a consumer who is cutting back on discretionary spend due to recession fears. The result will be a round of deep price cuts on tons of items.

According to Burry, this will lead to disinflation in the back half of 2022, which will in turn force the Fed to pause rate hikes and end quantitative tightening.

In short, the past 18 months have been defined by too many dollars chasing too few goods, breakaway inflation, and higher rates. But Burry is saying the next 6 months will be defined by too few dollars chasing too many goods, startling disinflation, and lower rates.

If true, then that means growth stocks are due for an epic rally in the back half of 2022. Is It Time to Buy Growth Stocks? Burry is calling for disinflation and a dovish Fed policy pivot over the next six months. If he’s right, growth stocks are set to soar.

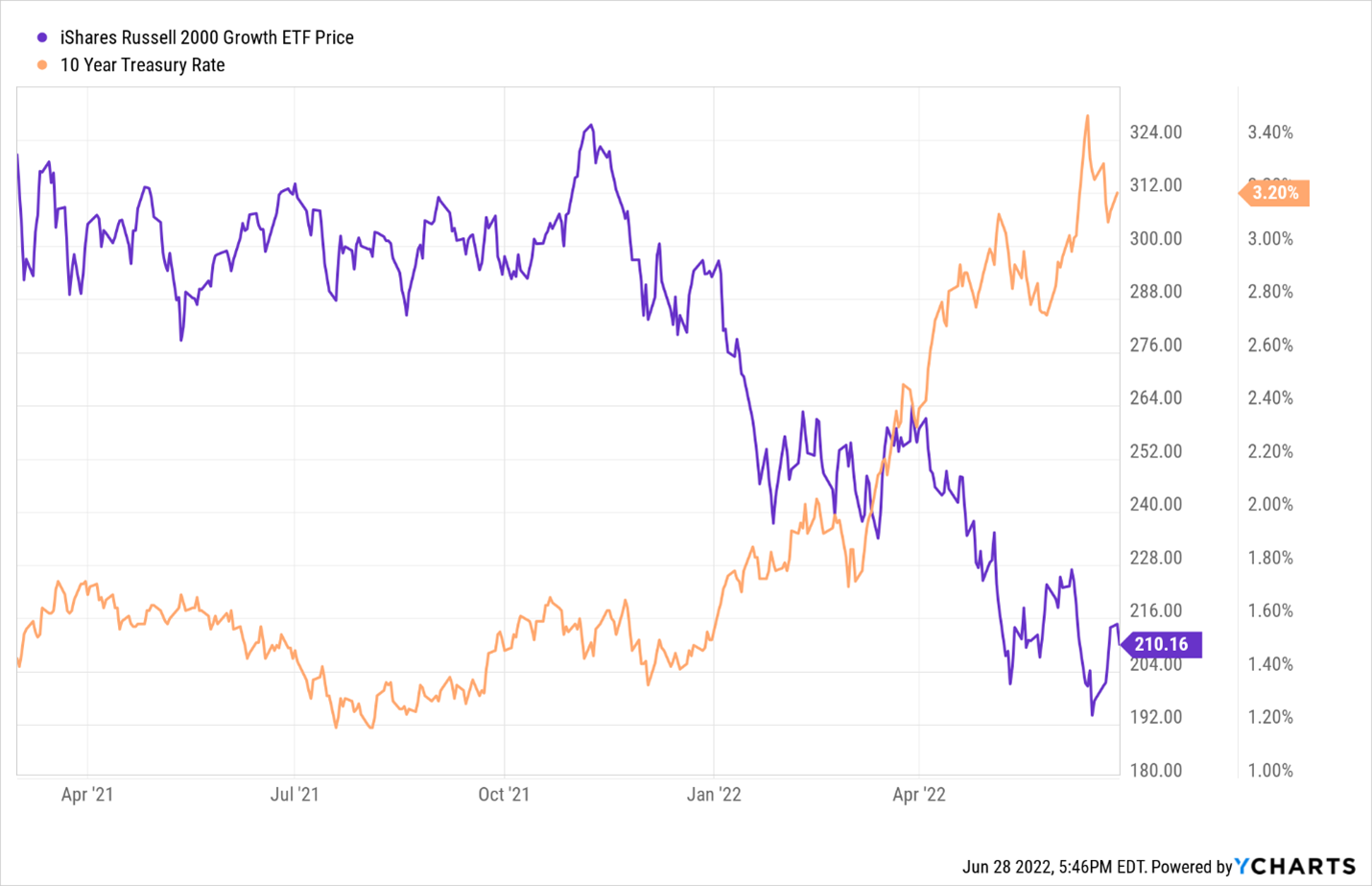

When inflation is running hot, the Fed hikes rates to curtail economic demand to bring inflation down. When the Fed is hiking rates, Treasury yields tend to rise to account for higher risk-free borrowing rates.

When Treasury yields rise, growth stocks fall.

This goes back to Valuation 101. The value of a company is equal to the net present value of all its future cash flows, plus its current book value. For growth stocks, the bulk of the valuation is tied up in the net present value of future cash flows, which goes down when Treasury yields go up. Therefore, when Treasury yields rise, growth stock valuations are disproportionately impacted.

This has been very true over the past 16 months. When yields were mostly flat throughout 2021, growth stocks traded sideways. But when yields started marching higher in late 2021, stocks started falling. Throughout all of 2022, yields have been soaring while growth stocks have been crashing.

If yields suddenly reverse course and start crashing, it reasons that growth stocks will start soaring.

If Burry is right, that’s exactly what will happen.

Disinflation will force the Fed to either pause rate hikes or even cut rates, which will lead to a sharp decline in Treasury yields that will spark an equally sharp rally in growth stocks.

Fortunately for growth stock bulls, we think Burry is 100% right.

Why Michael Burry Is Right The bulk of evidence today suggests that the bear market king is right yet again: Disinflation is on the way.

Walmart. Target. Best Buy. Gap. American Eagle. Urban Outfitters. All those retail giants reported quarterly numbers over the past two months. All of them said they have too much inventory, and that they need to clear it.

“There is a surplus of inventory… across the board at retail right now,” said Urban Outfitters CEO Richard Hayne on a conference call with analysts.

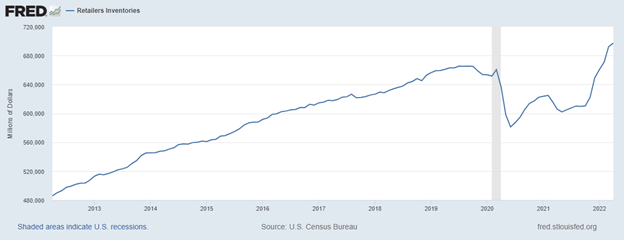

This surplus is clear in the data. Retailers Inventories dropped well-below “trend” during 2020. But they started to rebuild in 2021, and now they are back to their trendline in mid-2022 – while consumer confidence has plunged to record lows and gas prices have soared to more than $5 a gallon.

In other words, we are rapidly shifting from a “too many dollars chasing too few goods” environment, to a “too few dollars chasing too many goods” environment.

The result? Inflation will turn into disinflation. Rate hikes will become rate cuts. Spiking Treasury yields will turn into plunging Treasury yields. And crashing growth stocks will become soaring growth stocks. |

Tidak ada komentar:

Posting Komentar