It’s Time To Start Moving Beyond… After more than two years of a pandemic, the world is ready to move beyond the challenges and the chaos towards a brighter future.

American manufacturing is in the process of moving beyond the COVID era, making its way back to where we once were. But can the nation’s industries escape the “new normal” and get back to just being “normal” again?

Chevron, one of the biggest names in oil production, is moving beyond the challenges of war and supply problems, announcing an $100 BILLION stock buyback ahead of projected growth. With gas prices only increasing as time passes…maybe it’s time for investors to jump on board as well.

Beyond Meat, the eco-friendly meat alternative, is trying to help the world move beyond beef consumption…but burger-lovers around the world might just move beyond Beyond Meat instead! Was the past success of this promising food venture all sizzle and no steak?

Are you ready to breathe yet?

I know I am.

In fact, I think the whole world is ready to breathe again.

And while I mean that figuratively, there’s also excitement for literal breathing easily, because all signs point towards us getting closer and closer to the end of COVID.

We don’t need to get into all the arguments about what happened in the last two years. All the missteps, all the restrictions that should have never happened, all money spent on this or that…

We all lived it, so we don’t need to rehash the mess that 2020 and 2021 turned out to be.

Though, with the way that 2022 is going right now, we may find ourselves WISHING for the troubles of the past two years. What we’re facing with Russia invading Ukraine could make COVID look like a pleasant experience…

But that’s a conversation for another day.

Let’s talk about breathing easy.

Let’s talk about letting go of uncertainty and anxiety as we get back to a semblance of “normal” life.

Let’s talk about why you’re reading this article in the first place…

In the post-COVID future, businesses are recovering… and those businesses offer opportunities to investors. American Manufacturing Starting To Breathe Again Fears are starting to subside…

And as those fears fade away, people are more and more willing to get back out into the world. That means one thing and one thing only: people need to get back to work.

But as businesses open up, issues with supply chains and contact with foreign suppliers are causing one aspect of American business to see a surge.

Manufacturing.

While it’s true America and the rest of the world are starting to open back up, that doesn’t mean we’re “back” yet. In actuality, we’re far from it.

However, what we can say is that, according to a recent report by the Institute for Supply Management (ISM), US manufacturing is on its way back to where we were two years ago when the economy was humming.

Of course, before we get into those manufacturing numbers, I want us to keep in mind that while manufacturing may be on the comeback trail, the economy we had at the end of 2019 and beginning of 2020 is VERY different from the inflation-riddled economy we’re experiencing now.

While a manufacturing surge is good to see–GREAT, in fact–it’s not a magic bullet. We still have some work to do if we want to fix what’s going wrong with our current economy–but it IS a good start.

However, all that being said, US manufacturing picked up more than expected in February as COVID infections dwindle.

This is a good thing…

However, it’s also a mixed bag, because while manufacturing is picking up, hiring at factories has slowed to a crawl, which simply won’t help supply chain issues or bring down prices. A Few Hurdles To Overcome The ISM recently revealed that its index of national factory activity increased to a reading of 58.6 last month. That’s up a full point from the 57.6 it was sitting at in January, which is the lowest it’s been since the middle of the lockdowns in November 2020.

What we want to see is a reading above 50 because that number tells us that there’s growth in the industry–and since manufacturing accounts for 11.9% of the US economy, we want to see those numbers go up.

The good news is that we’re still doing pretty well. Many economists polled by Reuters had forecast the index rising to 58.0, and we surpassed that number.

That means American manufacturing is starting to get a little steam behind it. Not enough for the sector to go on a hiring spree, but there does seem to be a light at the end of the tunnel.

The ISM survey's forward-looking new orders sub-index increased to 61.7 last month from 57.9 in January, which was the lowest reading since June 2020.

Goods spending has surged as the pandemic curbed demand for services like travel, but economists expect demand for those goods to remain strong.

But the ISM survey does hold some concerns, such as the measure of factory employment slipped to a reading of 52.9 last month from a 10-month high of 54.5.

A gauge of unfinished work at factories rose to 65.0 from a reading of 56.4 in January. The order backlog index dropped 6.4 points in January - the largest decrease since April 2020.

All are points of concern.

February's gains in factory activity suggest that global supply chains remained a little worse for wear. That was also evident in the survey's measure of supplier deliveries, which rose to 66.1 from 64.6 in January. A reading above 50% indicates slower deliveries to factories.

Look, we get it…

We’re not “back” yet, and we didn’t need an ISM report to tell us that –but in a time where any good news is GREAT news, it’s encouraging to see that things COULD be looking up.

Do we have a few hurdles? Absolutely…

But they’re not insurmountable.

This report is good news, and we’re going to take it as such and hope we keep the momentum going forward.

Fingers crossed!!

So, gas prices are high. This is a Captain Obvious-worthy quote, I know.

With the war in Ukraine disrupting the Russian oil market, things are going to get worse before they get better.

Sorry to be the bearer of bad news, but those are the facts, Jack.

Unless real-life Bond villain Vladimir Putin changes his mind and pulls his forces back from Ukraine—which is highly unlikely— oil and gas prices are going to remain high.

As of this writing, the US oil benchmark jumped to $106.29 a barrel and the international Brent crude benchmark climbed to $107.

But don’t worry, gang, the International Energy Agency has announced that they are going to release 60 million barrels of oil…which amounts to a six-day supply.

Wow! Thanks, guys!

This is what happens when you don’t produce enough of your own oil. A foreign dictator gets you over a barrel (pun intended) for supplies of a commodity.

But I will go no further with my opinions on U.S. energy production. This is a financial publication (and a mighty fine one at that, if I say so myself), so we’ll put aside politics and discuss the numbers as they are.

But with these high oil prices comes a slew of new buying opportunities for investors.

So hooray for investing opportunities, boo to high gas prices!

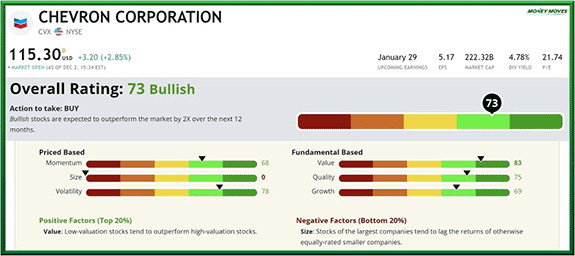

Chevron is one such company that offers a great buying option in these dark times.

At its annual investor day on Tuesday—which sounds like one heck of a fun party— Chevron announced that it expected to continue to improve cost efficiency and deliver higher returns.

But the big news from Tuesday’s party…er, I mean investor meeting…was that Chevron was planning on buying back up to $10 billion in stock, which is a good sign that the company expects to continue to grow revenue and profits.

And as of this writing, Chevron stock is killing it. Shares for the oil giant are up 40% across the past year relative to a 12% increase in the S&P 500.

And most importantly, as always, our super-duper Green Zone Fortunes rating system is “strong bullish” on shares of Chevron, which means we expect the stock to grow 3x over the next 12 months.  (Click here to view larger image.) So, don’t fret about the market being down lately. There are always good buys even when it appears that all is lost. You just have to know where to look.

And thanks to our Green Zone Fortunes rating system, you know where to go.

To learn more about Green Zone Fortunes and to sign up, click here. You will be glad you did.

Raise your hand if you were raised on meat and potatoes.

If you could see me right now, you’d see my hand up.

I grew up in an Italian household, so you might think a meat-and-potatoes combo wouldn’t be a staple, and to an extent, that’s correct.

Pasta and meat, for sure, but potatoes rarely enter an Italian’s kitchen.

Luckily, I had a dual upbringing, and I would spend most of my summers with my German-Scot grandparents, for whom meat and potatoes were a staple almost nightly.

Now, while I do love me some pot roast, I’m more of a burger guy. Sure, steaks are great, and it’s rare to see me turn one down…but I’ll happily take a burger every day of the week. Give me some kind of a potato dish to accompany it, and you’ll see a big ol’ grin across my face.

But despite my carnivorous inclinations, I’ve got NOTHING against vegetarianism.

I’ve gone without meat through a couple of fasts, and I know I can sustain myself just fine on veggies and beans.

However, that doesn’t mean I want to.

I fully believe that humans are meant to eat meat. We have the tooth structure for it, and if you look at our closest relatives in nature, the apes, they’ll eat meat if they can get it.

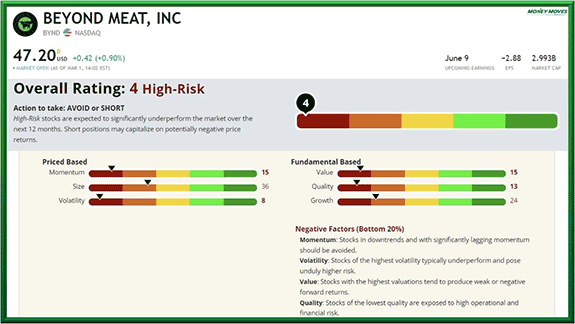

But, that said, I recognize there’s a HUGE market for non-meat substitutes. I’m just not convinced it’s as big as some people want us to believe. Beyond Meat’s Trouble Begins I say that because the biggest name in the non-meat substitute industry, Beyond Meat (BYND), reported worse-than-expected results late last week.

The whole angle behind Beyond Meat is that it tastes just as good as the genuine article.

That may very well be the case–I’ve yet to try it myself–but it’s hard to convince millions of people that this plant-based meat substitute is as delicious as the real thing.

We’re a nation raised on meat and potatoes, and it’s going to take a huge shift in the paradigm to get people to accept a meal of meat-shaped plants.

Beyond Meat seems to have run into a wall convincing people to buy their product.

Right now, Beyond Meat makes more than half of its revenue from selling its beef, pork, and chicken-free burgers, sausages, and patties. Unfortunately for them, weak demand, higher discounts, and more competition from other plant-based brands created the perfect storm of a crush for BYND, and now the company’s retail sales revenue is down 20% from the last quarter of the year prior.

What makes this surprising is that Beyond Meat sold MORE products internationally and in the US restaurant market than ever before.

But it wasn’t enough to offset the loss of their market share in grocery stores–and that means that Beyond Meat’s overall revenue shrank by 1% last quarter.

That’s bad…but it gets worse. More Bad Luck For Beyond Meat Supply chain issues and higher costs caused the company’s losses to actually TRIPLE last quarter, which is why investors said they’ve enough and the stock tanked more than 10%.

And here’s where the story takes an even bleaker turn: Beyond Meat’s outlook for 2022 missed expectations.

As I said, trying to get millions of people off beef and onto plants isn’t the easiest of jobs and the growth of the plant-based meat market is slowing down at an alarming rate.

In fact, US sales of plant-based meat–which grew 46% in 2020–fell 0.5% last year.

The prevailing theory behind this is that consumers just don’t actually like the taste of meat alternatives–and at a higher price point, it’s just easier, cheaper, and TASTIER to stay on beef.

But here’s what may be the nail in Beyond Beef’s coffin…

The war between Russia and Ukraine can easily disrupt the 25% share of global wheat trade as well as 20% of the corn supply given that both crops are produced extensively in both countries.

With the war taking precedence over food production, how much do you think it’s going to affect food supply overall, let alone the supplies to make non-meat alternatives that people don’t want?

And, just to make matters a little bit worse, this company has a terrible StockPower rating. Beyond Meat (BYND) is coming in at a “High-Risk” score of 2.  (Click here to view larger image.) It’s as if the world is conspiring against them.

Maybe it’s just not time for this food innovation.

Maybe the world isn’t ready for plant-based meat alternatives.

But what we do know is that things are NOT looking good for this company–and as we move on through 2022, it seems that things will only get worse.

We still wish them luck.

We hate to see any company go the way of the Dodo–but if there were a company I could see going extinct, it would be this one.

People just aren’t ready to relinquish their burgers yet…

And I don’t know if we ever will be.

For more quality content like this, and to learn more about the Money Moves team, visit us at https://moneyandmarkets.com/category/money-moves/ |

Tidak ada komentar:

Posting Komentar