| Last month was brutal. It was the second-worst January for the Nasdaq ever after the index lost almost 9%. Now, I don’t believe that as goes January, so goes the rest of the year. But the numbers don’t look great. In years where the Nasdaq started with a negative return in January, the average return over the remaining 11 months was less than inspiring at 4.5%. Rushing to buy the dip in beaten-down tech isn’t the best move right now. If the dot-com bust of 2000 is any guide, we’re better off allocating our cash to boring, old-economy blue chips until the market downturn runs its course. Click here to see why my dividend stock this week fits the bill.  Suggested Stories: Crash-Proof Your Portfolio With These Tax-Free 5% Dividends Buy Into Old Energy’s Maximum Momentum With One Stock

| Despite the circus of distractions you're hearing on the news... The lies and the misdirections... There's one former CIA and Pentagon insider revealing the TRUTH behind the inflation numbers in America. A story so shocking and so powerful that it could bring the Biden Administration to its knees. You might have known something strange was going on in America, but I can guarantee you weren't expecting this. | |

Chart of the Day

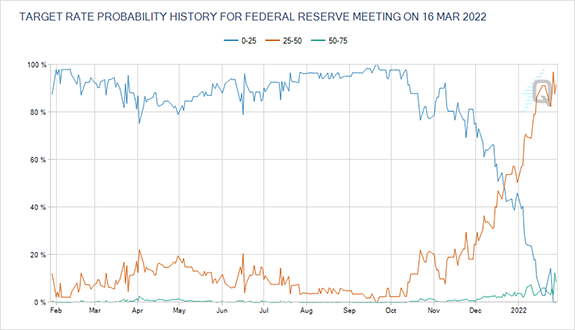

With Federal Reserve policy set to change in the coming months, we should consider whether the Fed plans to lead or follow the market. If the Fed leads with a much larger interest rate hike than traders expect — like 1% — it should create a large move in the stock and bond markets. Higher interest rates and changes to the Fed’s balance sheet will surprise traders. Fortunately, as today’s chart shows, it doesn’t appear that the Fed plans on leading.  Suggested Stories: 2022 Economy: Inflation Meanders; Growth Slows “Dr. Copper” Tells Us Inflation Will Ease

|

1922: James Joyce published Ulysses, one of the greatest works of modernist literature. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Tidak ada komentar:

Posting Komentar