What's wrong with gold? Inflation in the U.S. and around the rest of the world is soaring. Yet the price of gold is mostly flat. The annual inflation rate in the U.S. grew to 6.8% in November — that was the highest recorded level since June 1982. Meanwhile, in the Euro area, inflation increased to 4.9% in November 2021 — the highest level since the early 1990s. According to convention, the price of gold should be soaring. But the yellow metal will likely end the year in the red. Gold Price — One Year

Meanwhile, most economists agree inflation will only continue increasing in 2022 — and that the omicron COVID variant will continue to disrupt labor and supply chains next year, suggesting sluggish economic growth. So why isn't gold moving much higher? Well, the truth is, gold has been moving much higher — just maybe not as fast as most people would like. If we take a look at a longer-term gold chart we see gold prices were moving steadily higher for two years before pulling back and leveling off in 2021. Gold Price — Five Years

Gold increased from $1,300 an ounce in 2018 to a record high of over $2,000 just two years later. In 2021 the price of gold was held back for many reasons. But the main reason was strength in the U.S. dollar. The U.S. dollar had a good 2021. As measured by the USD Index, the greenback has increased by more than 6% for the year — and currently sits at 52-week highs. USD Index — One Year

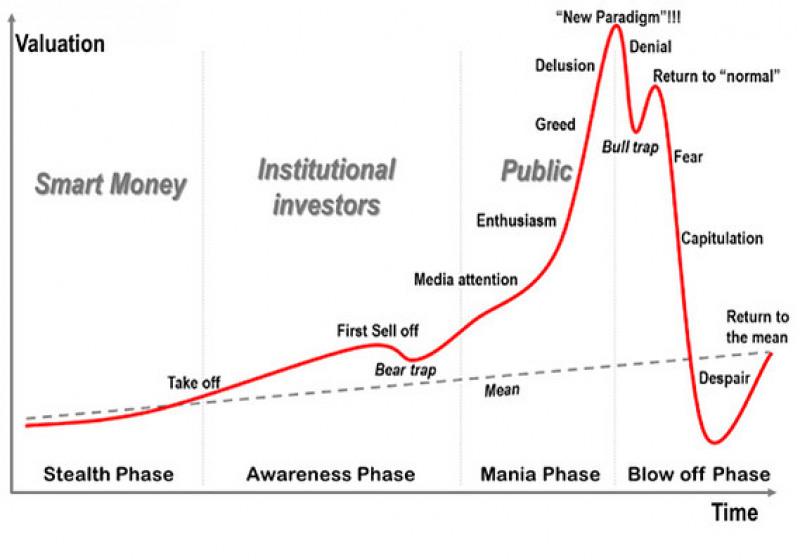

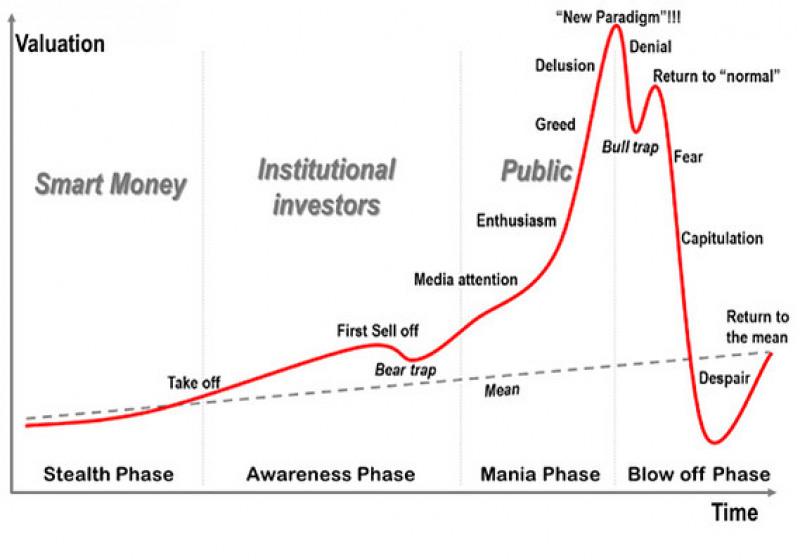

So despite the yellow metal's cold performance this year, there's nothing wrong with gold at all. In fact, all the conditions still exist that could drive gold prices to the stratosphere in 2022. But for now there's just one ingredient missing: hype. If you've been around the Outsider Club long enough, you've heard me refer to the final stage of a bull market as “the mania phase.” This is the stage of a bull market when hype and greed take over. Once it all plays out, a long-term chart of prices will look something like this:

Just consider Bitcoin or any popular cryptocurrency. Bitcoin failed as a currency. In 2015 it was estimated over 100,000 businesses accepted Bitcoin as payment. Today that number is closer to 15,000. Bitcoin failed as a safe asset. Safe assets are stable. Bitcoin is the essence of anti-stability. Bitcoin failed to be either anonymous or secure. Spending Bitcoin is one thing, but buying it requires proof of identity. And 80% of all cybertheft in the past decade — worth some $2 billion — has involved Bitcoin. Plain old-fashioned cash is both more anonymous and more secure than Bitcoin. Yet despite all of these fundamental failures, one Bitcoin is the price of an entry-level BMW. Point is, even an asset like Bitcoin can absolutely soar given the right conditions and hype. And I think the hype around gold will grow in 2022. Truth is gold prices have been flirting with a major breakout for a while. Going back to pre-COVID times, the price of gold has been steadily on the rise since 2015. Gold Price — 12 Years

And that breakout might occur in 2022. Basically...

So gold bugs need not fret. Nothing is wrong with gold. Until next time,

Luke Burgess

|

The Key Technology to Elon Musk and Tesla’s Downfall

Elon Musk has been making headlines again, but this time for selling large amounts of his Tesla shares and it reflects in Tesla’s price. What should really be making the headlines, though, is the details of Tesla’s secret test drive. Musk and company have been quietly implementing brand-new technology into their fleet of Teslas and testing them on the roads. But it’s not the only company taking advantage of this breakthrough technology.

It’s called LIDAR and the small company that creates the sensors pictured above is poised to experience exponential growth over the next few months and years. Some of the biggest Fortune 500 companies are already scrambling to get their hands on this tech and get it into their vehicles. We’re talking about big-name automakers such as Honda and Mercedes-Benz. They’re ALL relying on this one small firm’s patented technology. And early investors of this small company could see quadruple-digit gains. I’ve broken down this small company and its technology in a completely free presentation. Learn how you can get in on this ground-floor opportunity right here. |

|

Tidak ada komentar:

Posting Komentar