NU Virus Raises Red Flag For Reflation Stocks | | Sponsored Content 5 Monthly Dividends to Buy NOW... Paying up to 7.7%! I'm tired of the so-called "experts" and endless media reports that say you need a million bucks to retire comfortably.

I've got a simple strategy that's helping thousands of readers retire on a lot less... and it doesn't involve trading options, betting on risky penny stocks or playing crypto games.

We're talking about a fully paid-for retirement, with an income stream that outstrips the average wage of the typical working American, on as little as just $500k or $600K.

Click here for my free retirement report, including 5 incredible monthly payers to get started! | | | What a difference a day makes. Black Friday turned into Red Friday after the pandemic took a new turn for the worse.

Is it déjà vu all over again? Do we have control over COVID-19, or does the coronavirus have control over us?

The narrative for the pandemic finally coming to an end just went south, and with it, short-term investor sentiment. The market doesn't trade well against heightened levels of uncertainty, including all the protocols, mandates, restrictions and new forms of vaccines coming at a time when investors were increasing equity exposure into what was shaping up to be a very bullish close to 2021.

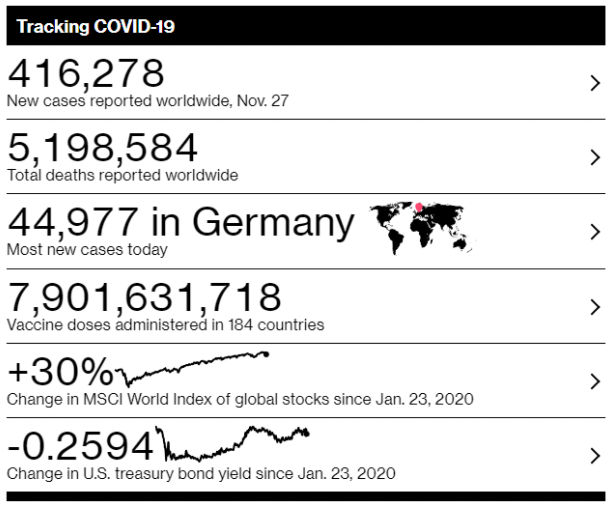

Source: Bloomberg.com, Nov. 28, 2021

The only person who I suspect had a clue about this story breaking and the ugly market reaction was Microsoft (Nasdaq:MSFT) CEO Satya Nadella, who sold 839,000 shares of stock Nov. 22-23 for proceeds of roughly $285 million, representing nearly half his current holdings. His previous sales have typically been averaging 42,000 shares per quarter. Why the monster trade? I think inquiring minds would like to know. It deserves a response. | | What You Must Do Now to Protect and Grow Your Income Today Analysts at Goldman Sachs estimated dividends for S&P 500 stocks will decline by 25%… with companies globally laying off workers, cutting expenses and slashing dividends.

If you don't get out of these stocks now, you'll find the stock market is a better place to lose your fortune than to make one. Click here now to watch this special presentation. | | | Merck Covid Pill Set for Authorization Despite Concerns, MS Says

World governments are taking swift action against the newly discovered Omicron COVID-19 strain that is already popping up in other countries outside South Africa, where it first emerged. Dr. Fauci believes it inevitably will be in the United States, and may already be present, just not yet reported. Looking at Bloomberg headlines over the weekend:

WHO Warns of 'No Information' on Severity of Omicron

Airlines Scramble as Restrictions Return

NYC May Be at Start of Winter Surge

Swiss Vote to Keep Covid Health Pass

Botswana Identifies More Cases

Fauci Stresses Need for Vaccination

Germany Has More Suspected Omicron Cases

Dutch Cluster Suggests Omicron Foothold in Europe

Moderna Vaccine for Omicron May be Ready in 2022 | | How To Use Technical Indicators (The Right Way) Predictive analysis is revolutionizing the trading space as we know it. With high-accuracy forecasting, traders can dodge losses and squeeze the most out of gains.

Our experts want to empower you with the knowledge and education to trade intelligently. Check out today's deep dive into cutting-edge, predictive technical indicators to see the tricks and tips you may not know about.

Click here to register for free. | | | Given the World Health Organization (WHO) taking its usual wait and see approach, claiming it doesn't have enough information to come to any near-term conclusions or action plan, it suggests to me that the market will remain in flux until much more is known about the new variant. The only thing the WHO has made its mind up on is what name to call it -- NU, for new virus. How about WU -- for Wuhan?

So, now the market has to contend with inflationary pressures and what is likely to be an array of anti-COVID measures that could stifle growth heading into 2022. This being a growing likelihood scenario, it stands to reason that capital flows targeting income generation will increase into short-term corporate bonds and into equities of companies in stay-at-home, telecom, consumer staples, utilities, health care and real estate.

Sources of funds, at least over the very short term, will be energy, financials, consumer discretionary, industrials, materials, metals and mining. Once the smoke clears from the initial wave of selling, technology stocks should recoup most of their losses, as that sector led the market to new highs every time there was a COVID-flareup-related sell-off, and there is little evidence to suggest this will be different going forward.

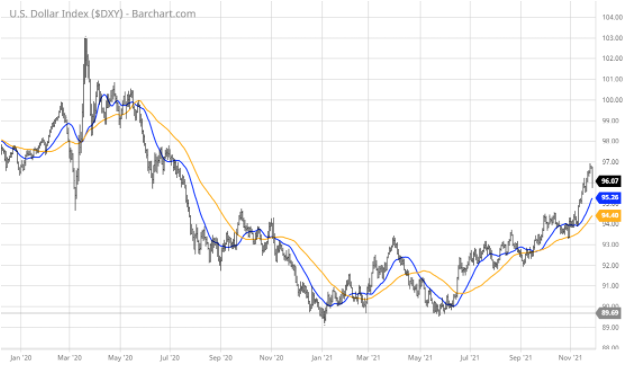

A couple observations should be noted that will continue to characterize the market landscape. The first is that the strong dollar will likely get stronger as investors seek safety in dollar-denominated assets. The greenback was hit by sellers on Friday as knee-jerk logic kicked in and the Fed's plan to taper would now be put on hold. The dollar index (DXY) was clearly overbought, but will probably find strong support at the $94.00 level, roughly 2% below where it closed Friday.

A strong dollar is a negative force for multinational corporations that conduct more than 50% of sales outside the United States. Hence, fourth-quarter profits are likely to reflect the impact of foreign exchange (forex) headwinds and pinch S&P 500 earnings growth forecasts for Q4 2021 and Q1 2022. On the plus side, oil prices tumbled last week, with WTI crude ending Friday's session down 13.06% to $68.15/bbl. Natural gas was unaffected, closing up 7.1% to $5.48/MBtu as shortages in Europe heading into winter are providing a strong bid.

Here, too, investors seeking inflation-hedged income should look at some of the natural gas producers and pipeline operators that are pure plays on natural gas, as this is where strong fundamentals exist for U.S. energy companies with domestic operations serving domestic markets that won't have their profits impacted by a strong dollar. What was the growingly attractive global reflation trade is now rapidly reverting to the hunker down local and regional economy trade, at least until the U.S. Centers for Disease Control and Prevention (CDC) gives the "all clear" sign. That signal, sadly, is probably several weeks or a few months off. | | Sincerely,

Bryan Perry

Editor, Cash Machine

Editor, Premium Income

Editor, Quick Income Trader

Editor, Breakout Profits Alert

| | About Bryan Perry:

Bryan Perry specializes in high dividend paying investments. This weekly e-letter combines his decades-long experience in income investing with a simple, easy-to-read format that investors of all stripes can work into their portfolios. Bryan Perry specializes in high dividend paying investments. This weekly e-letter combines his decades-long experience in income investing with a simple, easy-to-read format that investors of all stripes can work into their portfolios. | | | | | |

Tidak ada komentar:

Posting Komentar