| In the great dividend debate of high-growth versus high-yield, there’s one metric that might help settle the score: yield on cost. Anyone keeping up with my weekly dividend analysis knows I value growth over yield 99 times out of 100. A stock with consistent, growing dividends that beat inflation year after year is the linchpin of a healthy income portfolio. It also leads to less heartburn while you maintain your retirement nest egg. Sure, a smattering of high-yield dividend payers is fine, but the vast majority of your dividend portfolio should be dedicated to stodgy companies that increase their payouts every year. With inflation rearing its ugly head again, those consistent dividend growers will come out ahead. And the yield on cost metric shows how powerful dividend growth is. Suggested Stories: How to Invest in Cryptos Like a Pro Fish-Farming Industry Is Ripe for Disruption

Marijuana Market Update

Editor’s Note: We can’t wait to offer more exclusive cannabis content on our YouTube channel later today. You’ll be able to join our premium YouTube community and gain access to insider interviews, stock analysis and more. And we’re even offering transcripts of all of our cannabis-related videos. Check out our YouTube channel later today to see how you can join!

Our Cannabis Watchlist will look a little different as today marks High Tide Inc.’s first day of trading on the Nasdaq Capital Market. And I have some exciting news for our future on YouTube as part of this Marijuana Market Update bonus episode. Click here or the thumbnail below to watch it now.

Suggested Stories: Buy This Strong Bullish Utilities Stock Before the Summer Heat Wave Canopy Growth Earnings May Reveal a Troubling Trend

| America's $51 trillion green boom will be of unheard magnitude. Only it's not from anything Biden is doing. Or from any big corporation. Instead, one pioneering company is at the forefront. You won't believe what it's battery tech can do. It's 25X more powerful than a Tesla EV. | |

Chart of the Day

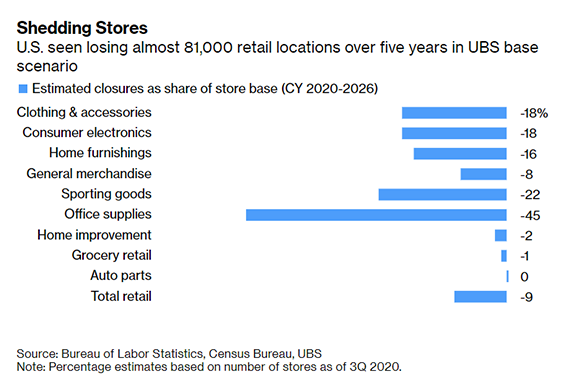

Bull markets climb a wall of worry, according to a popular Wall Street saying. This applies to broad market averages and individual sectors — and for now, the most worrisome is the retail sector. Online sales are a concern for brick-and-mortar retailers. In fact, many retailers and investors worry traditional stores may not survive this threat. Analysts with UBS recently confirmed those fears. You can see some of that analysis in the chart below. But that might be bullish for some retailers. Here’s why.

Suggested Stories: The Fed Wanted Inflation — It May Get Stagflation Instead Spot Bearish Moments With One Inflation Trend

|

1851: Prohibition began as Maine became the first state to ban alcohol. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2021 Money & Markets. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Tidak ada komentar:

Posting Komentar