| Consider Coca-Cola (KO). Buffett began loading up on Coke in 1988. At that time, he noted, among other things, that the company is able to raise the cost of its product to beat inflation without losing consumers (a term he calls “economic goodwill”). Take a look at how KO, priced in gold, has performed relative to the broader stock market priced in gold and you’ll see the effect of this “economic goodwill in action. Even with KO falling when priced in gold since 1999, it’s still outperforming the broader market by a wide margin.

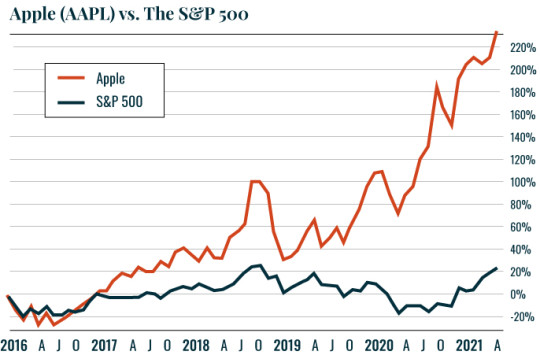

Let’s take a look at another, more rapid-growth company that Buffett recently bought: Apple (AAPL). After famously avoiding tech stocks for most of his career, Buffett began loading up on AAPL in 2016. The chart below shows what he is looking at:

You get the general idea. The idea is to find high quality companies that are rapidly growing with products that have what Buffett calls “economic goodwill” (the ability to raise their prices to account for inflation). Best Regards,

Graham Summers

Editor, Money & Crisis P.S. Finding stocks with this kind of “economic goodwill” in order to beat inflation’s impact on the market can be a challenge. But… one asset class we know is impervious to the ravages of inflation is precious metals. Gold is always good to own during inflationary times, but today SILVER is probably even better because it tends to outperform gold in bull markets. If you’re interested in adding some silver to your portfolio, check out Hard Assets Alliance. They’re a great platform for buying, selling, and storing all your bullion. (We liked them so much, we bought a small stake in the company!) And there’s no cost to set up an account. You can get all the details about them here… |

Tidak ada komentar:

Posting Komentar